Our award-winning, multi-asset class global research team's primary goal is to support you in analyzing the pivotal questions that drive your investment decisions. As a market-leading investment bank research house, we bring you differentiated content on global financial markets and securities with coverage of ~3,800 stocks in over 50 different countries.

Our award-winning, multi-asset class global research team's primary goal is to support you in analyzing the pivotal questions that drive your investment decisions. As a market-leading investment bank research house, we bring you differentiated content on global financial markets and securities with coverage of ~3,800 stocks in over 50 different countries.

- 0Analysts, strategists and economists

UBS internal data

- 0Company stocks

- 0Markets

Featured topics

Our capabilities

Latest research insights

Market insights and commentary from our global thought leaders

UBS Global Research Pod Hub

Tune in to our episodes for insights on the topics that matter from our global economics, strategy and industry thought leaders at UBS

Research podcasts

13:50

APAC Data Centers: Understanding the current market and investment implications

David Vogt, IT Hardware analyst, John Lam, Head of APAC property research and Phil Campbell, TMT analyst, all from UBS Investment Bank, discuss the APAC data center market. Amongst the surge in AI and accelerating cloud migration, they delve into the dynamics of capacity additions vs demand growth, the potential challenges of power supply constraints and what these trends mean for investors. *(This information is subject to a disclaimer at the end of this podcast. Please ensure that you listen to the disclaimer and go to www.ubs.com for further information about UBS).

21:17

Deep Speak: How can AI analyse the tone and sentiment of central banks?

In this episode, Arend Kapteyn, UBS Chief Economist and Elena Amoruso, UBS European Rates Strategist, discuss Deep Speak, a new AI-based tool that assesses the thematic trends across central banks. They explore how this new model works, why Elena and her team decided to build Deep Speak, and discuss the evolution of sentiment tracking over the last 20 years and its wider implications across the market. *(This information is subject to a disclaimer at the end of this podcast. Please ensure that you listen to the disclaimer and go to www.ubs.com for further information about UBS).

13:38

Unlocking tomorrow: Highlights from the AIC 2025

How can adaptability and resilience drive innovation, and help us seize opportunities? William Vanderpump, Product Manager, Asia Research and Sunil Tirumalai, Head of Emerging Markets & Asia Equity Strategy, share highlights from this year’s UBS Asia Investment Conference. They discuss the global economic and trade outlook, the new normal in geopolitics, and the transformation of AI and its implications for the future of humanity. *(This information is subject to a disclaimer at the end of this podcast. Please ensure that you listen to the disclaimer and go to www.ubs.com for further information about UBS).

31:42

One Month On: Assessing the Impact of Trump’s Tariffs

It’s been over a month since the Trump administration introduced tariffs, sending ripples through global markets. What has been the investor response? Where does inflation go from here? What happens next from a US policy point of view? Will de-globalisation compromise AI productivity? Join us for an analysis of where markets stand, and what might come next. Featuring Arend Kapteyn, Chief Global Economist, Jonathan Pingle, Chief US Economist, and Bhanu Baweja, Chief Strategist, from UBS Investment Bank. *(This information is subject to a disclaimer at the end of this podcast. Please ensure that you listen to the disclaimer and go to www.ubs.com for further information about UBS).

15:39

Global Investment Returns Yearbook 2025 – Now with 125 years of data

How can investors make better decisions? By understanding the past. This year’s edition of the Global Investment Returns Yearbook (GIRY) explores how 125 years of historical data can offer key insights for the future. At the core of the Yearbook is the long-run DMS database, which provides long-run annual returns on stocks, bonds, bills, inflation, and currencies for 35 markets. The unrivalled breadth and quality of its underlying data make the GIRY the global authority on long-run asset performance. Hosted by Tim Ramskill, Global Head of Product Management, UBS Investment Bank, with Professor Paul Marsh, London Business School. *(This information is subject to a disclaimer at the end of this podcast. Please ensure that you listen to the disclaimer and go to www.ubs.com for further information about UBS).

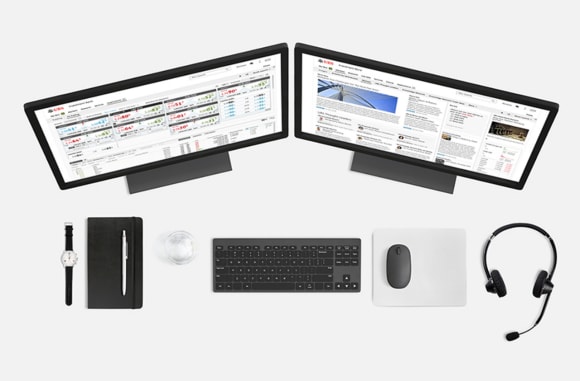

Access via UBS Neo

Your access to informed macro and local market insights direct from our economists, analysts and strategists available across regions, companies and asset classes.