The 4Ds megatrends: Decarbonization

Are we underestimating the clean energy backlash?

![]()

header.search.error

Are we underestimating the clean energy backlash?

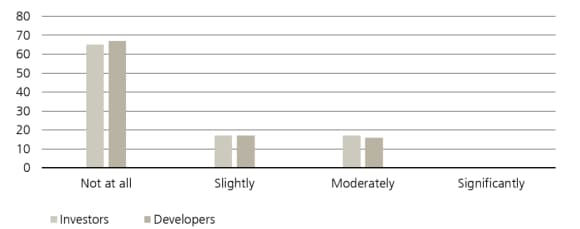

The decarbonization investment theme receives widespread support. However, we are seeing more negative headlines this past year about the pushback against green energy. Most renewable investors and developers remain unfazed. But skeptics are questioning whether we are underestimating the risk from the backlash.

Alex Leung, Head of Infrastructure Research & Strategy

Emerging decarbonization investments beyond renewables

Clean energy is a staple investment across the portfolios of many infrastructure funds. The industry benefits from technological improvements, political support, and stable economics. There are also emerging decarbonization investments beyond renewables, especially in sectors such as industrial, transport and buildings, which we highlighted in a recent insight on emerging energy transition in infrastructure

The decarbonization investment theme receives widespread support. However, we are seeing more negative headlines this past year about the pushback against green energy. Most renewable investors and developers remain unfazed based on a recent industry survey. But skeptics are questioning whether we are underestimating the risk from the backlash.

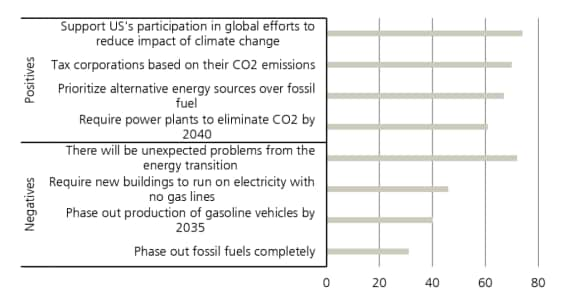

Some of these fears are understandable since 2024 is an important election year in the US and Europe (followed by the UK in early 2025). For example, Former President Donald Trump has already vowed to repeal the IRA if he is elected again, despite the IRA mainly benefitting more conservative “red states”. Similar rhetoric will almost certainly increase in the next few months.

Local politics are also becoming more contentious. Recently, voters in Texas approved the establishment of a USD 10 billion Texas Energy Fund that subsidizes new gas-fired power stations, eroding the project economics of renewables. Earlier in May, state politicians also attempted to pass a bill that imposes (ironically) more stringent environmental permitting rules on wind and solar projects.

This backlash is also happening in progressive “blue states”. There are grassroot protests against offshore wind projects in New Jersey and Maryland citing issues such as ecological impact and visual pollution. High profile cost overruns and project cancellations also add to the public distrust, as they validate negative preconceived notions.

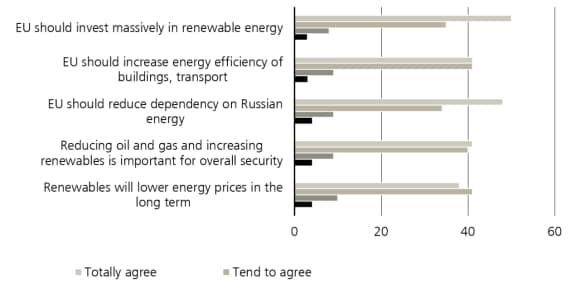

Europe is not immune to these negative headlines either, especially on the back of a cost of living crisis and renewable project cost inflation. In the UK, Prime Minister Rishi Sunak announced in September 2023 that he plans to roll back the UK’s climate commitments. Germany and Italy are also pushing back on energy efficiency initiatives.

In our view, investors need to focus on the big picture. The evolution of clean energy has never been linear, and we have always faced various uncertainties. Despite the recent headlines, IEA forecasts USD 1.7 trillion of global green energy investments in 2023. In many markets, renewables are still cheaper than other traditional forms of electricity generation. Like any industry, it is up to managers to separate the good investments from the bad ones.

Optimism on the decarbonization trend

We therefore remain optimistic on the decarbonization trend. In addition, there are some powerful mitigants that offsets some of these headline risks:

Want more insights?

Subscribe to receive the latest private markets perspectives and insights across all sectors directly to your inbox.