Infrastructure valuations

Is the recent resilient performance too good to be true?

![]()

header.search.error

Is the recent resilient performance too good to be true?

Critics argue that under the current interest rate pressures, infrastructure discount rates should also adjust upward, which means valuations should come down. Yet recent performance remains positive, and the asset class has not seen widespread write-downs.

Alex Leung, Head of Infrastructure Research & Strategy

Longer term interest rates more relevant for infrastructure

Private infrastructure equity was up ~10% in 2022, and is currently up ~4% in 1H23, according to both MSCI and Burgiss. However, the resilient performance has only attracted some skepticism around valuations.

Critics argue that under the current interest rate pressures, infrastructure discount rates should also adjust upward, which means valuations should come down. Yet recent performance remains positive, and the asset class has not seen widespread write-downs.

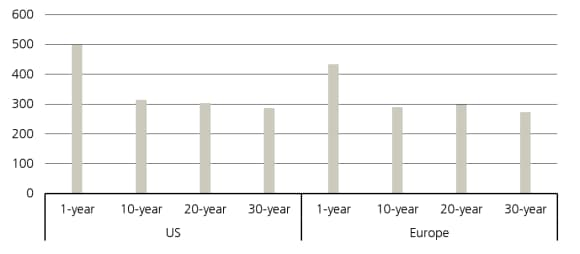

In our view, investors are currently too focused on the dramatic increase in the front end of the yield curve. For example, they often point out that 12-month US treasury yields have widened by 500bps.

However, infrastructure assets are long-term investments, with stable cash flows, and useful lives of 20 years or more. This means longer-term rates are more relevant to Infrastructure assets as a gauge on cost of capital, and these term rates have not increased as dramatically as short-term rates.

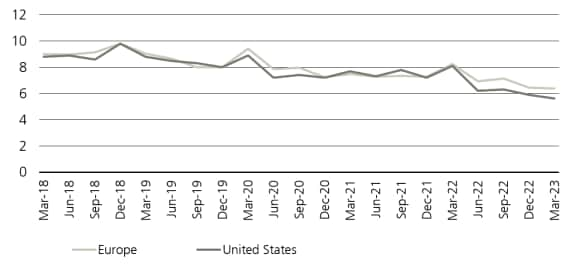

Equity risk premiums are falling

Base rates are only one part of the discount rate equation. The other piece is the equity risk premium (Cost of equity = risk free rate + equity risk premium). Using public markets as a proxy, implied equity risk premiums have actually trended lower even in public markets, according to UBS Global Research’s fundamental analytics team. This helps lower an all-in cost of equity despite rate hikes.

Public markets equity risk premium (%)

A natural question is, why have public market equity risk premiums declined? The answer generally revolves around low earnings volatility, markets stability and general strength of underlying fundamentals – factors that would resonate with infrastructure investors.

Skeptics may argue that the decline in public market equity risk premiums are not warranted, but that debate is beyond the scope of this article. We are simply highlighting what is currently being priced into public markets, and using that as a read across for private infrastructure.

Overall, given long term rates have increased by ~300bps (see the first Figure) and equity risk premiums have declined by about ~200bps (see the second Figure), we would expect ~100bps increase in cost of equity.

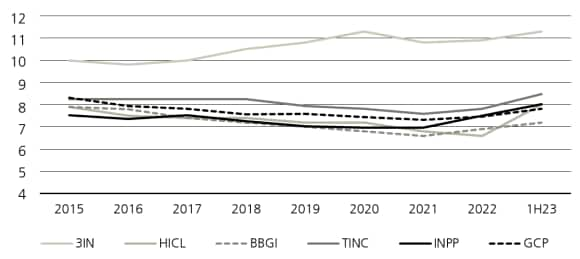

This is consistent with what we can observe in the markets. Although private infrastructure funds typically do not disclose their hurdle rates, discount rates published by listed infrastructure investment trusts1 have only increased by ~50-100bps since 2021. Regulations require these investment trusts to disclose their discount rates, which they use to calculate Net Asset Values (NAVs) in their period financial statements.

Public infrastructure investment trust reported discount rates (%)

Stronger fundamentals and cash flows offset higher discount rates

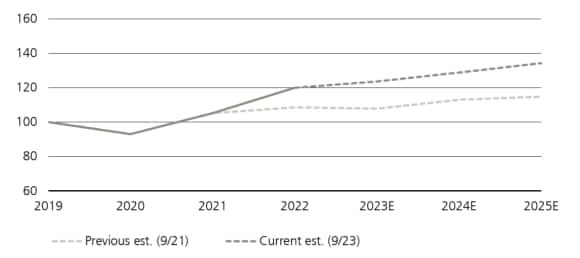

When looking at asset valuations, discount rates only tell one part of the story. The other part is free cash flows, and that is where infrastructure has shined. Infrastructure fundamentals remain healthy, due to robust post-pandemic recovery, strong inflation passthrough, policy support, and the fact that most infrastructure investments are unique assets that provide essential services and have pricing power.

Looking at the consensus estimates of over 100 listed infrastructure companies as proxy, 2023-2025 revenue estimates have been revised upward by an average of ~15% in the last two years. Higher discount rates do not impact valuations much when the underlying assets are also making more money.

However, every investment is different, and it is important to go back to basic business fundamentals; this means focusing on barriers-to-entry, pricing power, growth plans, capital structures, and management teams. Active asset management also increases the resiliency of infrastructure assets, as operational and financial levers can be adjusted under different economic environments to maximize value.

Want more insights?

Subscribe to receive the latest private markets perspectives and insights across all sectors directly to your inbox.