The climate tech funding chain. (UBS) - For illustrative purposes only.

While the decarbonization challenge may seem daunting, studies suggest that we actually already have the technology to achieve our goals (or at least where to find them). A 2023 McKinsey report suggests that 90% of man-made greenhouse gas emissions can be reduced with existing climate technologies.

Knowing what technology is needed, however, is not the same as having them in the right quantities, at the right price, for sustainable and scalable deployment. The same study suggests that only 10% of these climate technologies are today fully commercially mature, for example onshore wind and solar in regions with good grid connections. Another 45% are commercial, but need further support to be competitive, which includes renewable energy projects elsewhere, as well as electric vehicles, heat pumps, and hydrogen.

These technologies have also reached commercial scale and no longer bear any technological risk. The challenge is, in fact, not finding enough buyers and achieving scale economics, or in systemic/infrastructure bottlenecks as individual renewable power plants or electric vehicles fail to get on grid or charging infrastructure.

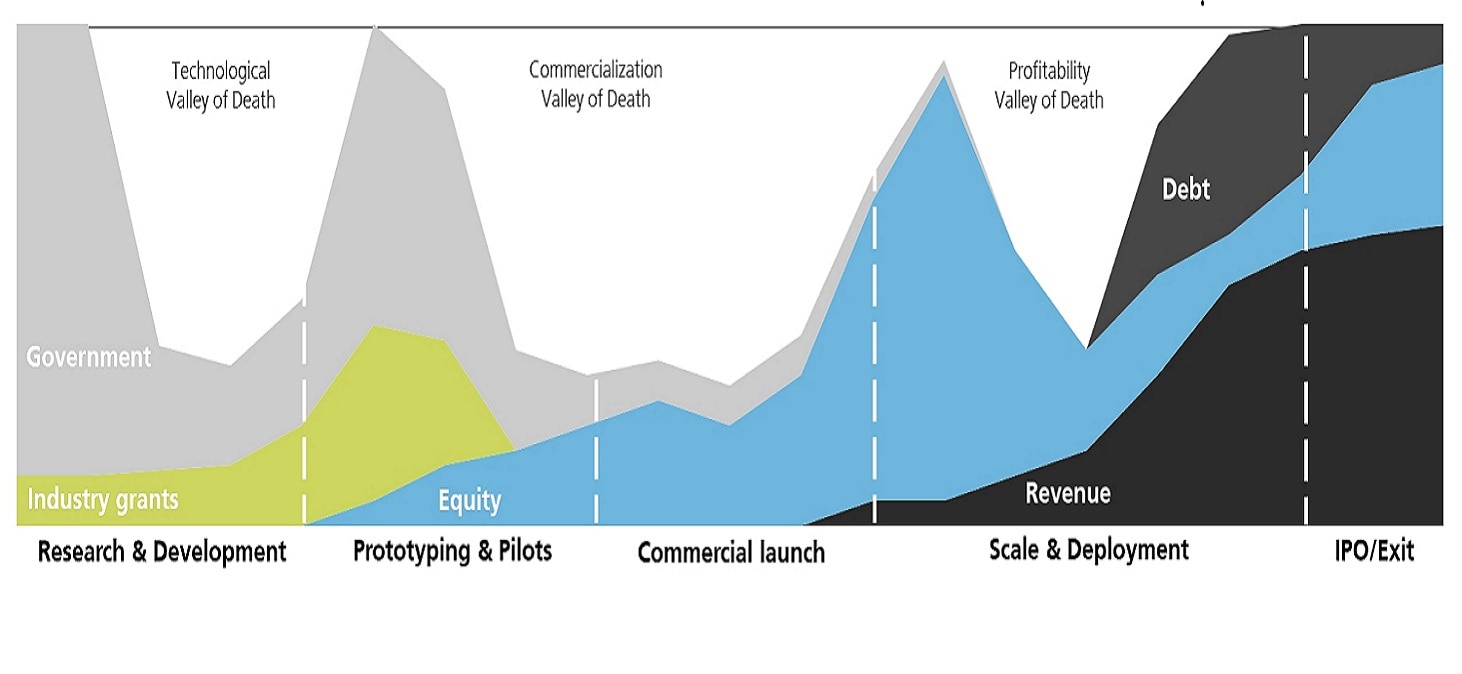

The final 45% of climate technologies are early-stage solutions that are still in proof of concept or prototype stages, that are still stuck in the technological or commercialization valley of death (see image). These include solutions such as small modular nuclear reactors, carbon capture, utilization and storage, and e-fuels.

This illustrates that, apart from scale, consistency is also key. The climate investment cycle suffers from disjointedness that also stems from the fact that, unlike the software and SaaS technologies that have shaped venture-to-public value chains over the past decades, most climate tech is hardware with a much longer development and commercialization cycle, as well as higher capital intensity.

According to Sightline Climate, climate tech investments totaled USD 11.3 billion in 1H24, representing a 20% year-over-year and 41% half-over-half drop. Within this, growth funding saw the most significant contraction of 33% year over year, versus a 12% decline in early-stage investments. Notably, the average period of time between Series A and Series B has more than doubled compared to 2021.

Part of this weakness reflects broader private market trends, and with the dawn of the rate cut cycle we may see a recovery in flows. Encouragingly, 1H24 also saw some high profile first-of-a-kind transactions that suggest risk appetite remains.

But beyond market cycles, a big takeaway in our view is the importance of "full-stack" investing, i.e., participating in every development stage, including in enabling areas such as green bonds, which increases funding for commercial buyers of climate tech.

Taking this full-stack view opens up myriad opportunities for investors to support either directly or indirectly in this segment of the climate value chain, create diversified portfolios, and generate market-rate risk/returns while maintaining clear alignment to climate impact. These range from early-stage venture investments, to infrastructure investments, green and transition bonds, and even ESG thematic funds which may become ultimate buyers of companies that manage to exit via IPO.

Main contributors: Stephanie Choi, Amanda Gu, Sebastian van Winkel

Original Report: Sustainable InSIghts: The COP29 issue