Weight loss drugs – hope or hype?

As obesity rates rise worldwide, popular glucagon-like peptide-1 drugs are increasingly attracting investor attention.

![]()

header.search.error

As obesity rates rise worldwide, popular glucagon-like peptide-1 drugs are increasingly attracting investor attention.

Obesity has been one of major health hazards for modern societies, increasing the risk of numerous chronic diseases such as cardiovascular diseases, type 2 diabetes, musculoskeletal disorders and even certain types of cancer.1 As new weight-loss medications become available, can they really reverse the upward trend for chronic diseases, which costs lives and money?

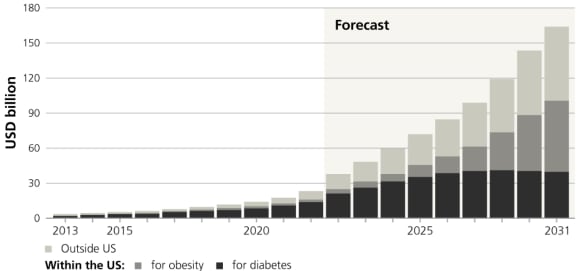

Used to treat type 2 diabetes, glucagon-like peptide-1 (GLP-1) receptor agonists are a newer class of medications, which have gained a lot of attention in recent years due to their impressive weight-loss results – in some cases reaching as much as 20% of a person’s body weight.2 Although the rollout of the new class of anti-obesity treatments is still in a relatively early stage, the global market size for GLP-1 receptor agonists drugs alone is expected to surpass USD 160 billion by 2031 (chart 1).

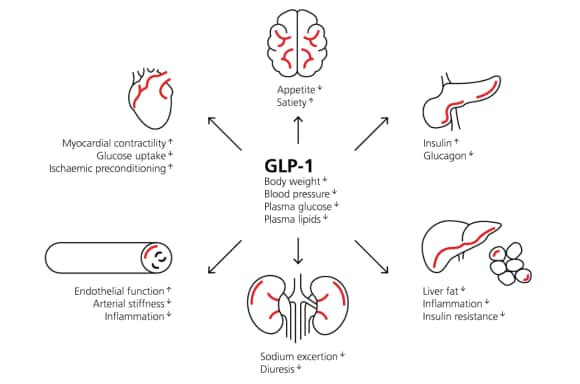

GLP-1 drugs mimic the GLP-1 hormone that is naturally produced in the small intestine in response to eating and serves many functions: it triggers insulin release from the pancreas, helping manage glucose levels, slows digestion, and increases satiety.3 The medications most commonly come in the form of an injection.

While GLP-1 agonists such as semaglutide have made headlines for their ability to help people lose weight, they are used to treat health issues that extend far beyond simply shedding pounds. These medications hold significant potential in addressing the whole spectrum of metabolic and systemic conditions, ranging from the already mentioned type 2 diabetes, through cardiovascular risks, high blood pressure, poor lipid profile, to non-alcoholic fatty liver disease, polycystic ovary syndrome (PCOS) and neurological disorders.4 GLP-1s have also been found to significantly reduce sleep apnea in adult patients.5

Despite all the potential benefits, GLP-1 agonists do not yet seem to be a silver bullet. Reported side effects include gastrointestinal issues, dizziness, mild tachycardia and excessive muscle mass loss, to name a few.6 These coupled with high costs of obesity medications and their limited availability could also be the reason for patients’ suboptimal long-term compliance to their treatment. When these issues are properly addressed, the share of GLP-1 drugs in the global anti-obesity drugs market, which is projected to grow at a staggering compound annual growth rate (CAGR) of 5.53% from 2024 to 2034,7 is likely to increase further. Enhancing GLP-1 compounds and combining different mechanisms to alleviate side effects of the drugs is one of the avenues innovation leaders, that want to explore opportunities the fast-growing market offers, are following.

Metabolic syndrome components, including abdominal obesity, have been associated with higher healthcare costs, which tend to increase with age. What’s more, the rising incidence of childhood and morbid obesity further necessitate solutions to reverse this trend. Despite the current shortcomings of GLP-1 medications, the demand is significant.

More and more innovative companies are offering products treating chronic health conditions that the obesity medications aim to address. The combination of the GLP-1 medication with proven therapies for chronic conditions is a major step forward towards eliminating them: however, this is not likely to happen soon. With numerous competitors in the market, we believe that smaller, specialized companies could be the winners of tomorrow, by offering improvements to the yet-imperfect solutions currently available.

CFA, Senior portfolio manager, Thematic Equities

Thomas Amrein (MSc, CFA), Director, is a Senior Portfolio Manager and Lead Manager of the Digital Health Equity strategy. Before that, he focused on the US healthcare sector, managing the USA Growth Opportunities Equity strategy. He became Lead Portfolio Manager of the Credit Suisse Global Biotech Innovators Equity strategy in 2016. Thomas joined Credit Suisse Asset Management, now part of UBS Group, in 1996. He has covered the healthcare and other sectors for over 20 years. Thomas holds a master’s degree in Business Administration from the University of St. Gallen and is a CFA charterholder. He also attended postgraduate courses in biotechnology at the University of Basel and ETH Zurich.