The Year Ahead

What’s the outlook for rates and yields?

Key questions

![]()

header.search.error

The Year Ahead

Key questions

We expect central banks to commence rate-cutting cycles in 2024. In our view, government bond markets are overpricing the risk that high interest rates will represent the new normal, and we expect yields to fall in 2024.

Inflation and rates

Back to normal. Inflation made progress toward central bank targets in 2023, and in 2024 we believe that journey will continue. In our base case, we expect US and Eurozone core consumer price inflation to end 2024 in the 2–2.5% range. Key drivers include falling homeowner-related inflation, weaker consumer demand, and slower wage growth.

Expect lower rates. We believe that the combination of lower growth and lower inflation should lead to interest rate cuts in 2024. Although inflation will likely remain above the 2% targets through most, or all, of the year ahead, we believe policymakers will be sufficiently confident by midyear that inflation is falling sustainably toward target. Our base case is for the ECB and Bank of England each to cut rates by 75bps in 2024, while we expect the Fed and Swiss National Bank to ease by 50bps next year.

Yields

Markets pricing higher-for-a-lot-longer. Markets are implying that the Fed will not cut rates below 4.2% over the next five years. While it is possible that interest rates could stay higher for longer than we expect, we consider it highly unlikely that the Fed will not need to cut rates below 4%, or otherwise intervene in markets, within the next half-decade. Over that time frame, at least one recession, period of low inflation, or financial turbulence should be considered likely. Political decisions to engage in large and unfunded fiscal spending create risks to this view.

Expect bond yields to fall. We expect slower economic growth in 2024 to lower interest rate expectations, both over the short and longer term. Commensurate to this, we expect the 10-year US Treasury yield to fall to 3.5% by the end of next year. We estimate the equilibrium 10-year yield to be 3.5% (based on a combination of inflation of 2–2.5%, a neutral real interest rate of 0.5–1%, and a term premium of 0.5%).

Investment implications

Manage liquidity. With interest rates and rate expectations set to fall, we believe investors should ensure they don’t hold too much cash, and look to optimize potential returns. For more, see Manage liquidity.

Buy quality bonds. We believe that quality bonds have attractive yields and the potential for capital appreciation if markets start to price lower expectations for interest rates in 2024. For more, see Buy quality.

What does history suggest about the path for rates and yields?

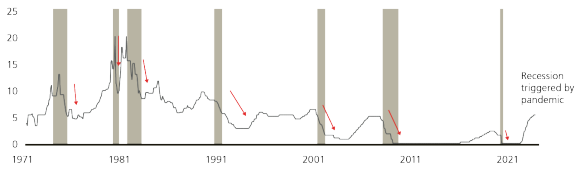

Peak rates don’t last long. In the 10 instances of Fed rate-hike cycles since 1970, interest rates stayed at the peak for a median of three months. The shortest “hold” was just one month, and the longest 15.

Cuts can be sharp. When the Fed started cutting rates, it cut by an average of 260bps in the first 12 months (excluding 1987 and 2006, when rates rose again after a pause) and 410bps within the first 24 months. Today, markets are pricing 150bps of easing within the next two years.

Yields come back to earth. While the recent rise in 10-year US Treasury yields has been swift, it is not without precedent: Since 1962, there have been 16 episodes in which the long yield has climbed by more than 100bps over six months. All but one of them (1979–80) were followed by a decline in yields over the following 12 months. We believe this time will be no exception.

Rate cuts can be sharp

Federal funds rate, in %, with US recession periods shaded

Other chapters

This report has been prepared by UBS AG, UBS AG London Branch, UBS Switzerland AG, UBS Financial Services Inc. (UBS FS), UBS AG Singapore Branch, UBS AG Hong Kong Branch, and UBS SuMi TRUST Wealth Management Co., Ltd..