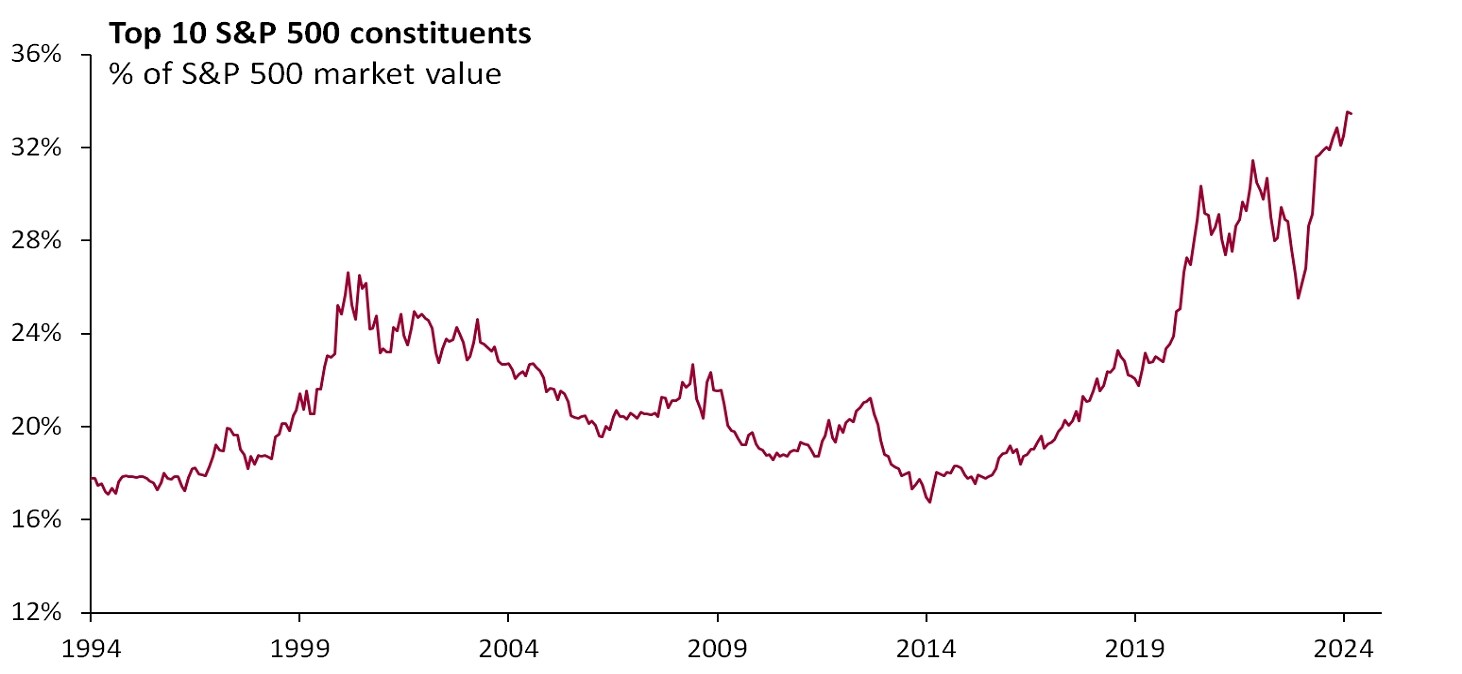

The US equity market is the biggest in the world. Yet, rising US market concentration is a good reminder about the importance of portfolio diversification. (Bloomberg, UBS)

The chart above shows that the top 10 firms in the S&P 500 represent nearly 33% of the market's total capitalization. This is the result of the surge of mega-cap companies (e.g., the Magnificent-7 [1]). This higher-than-normal concentration, makes the US equity market more sensitive to the performance of a select few. This is not necessarily negative, but it does mean that S&P 500 returns may be more volatile than they have been in the past.

In this context, we think it behooves investors to set aside any home biases. According to Bloomberg, ex-US equity markets have a capitalization of nearly USD 62 trillion, roughly 10% higher than that of the US. Meanwhile, as per MSCI ACWI [2], firms outside the US are about 40% of global market capitalization. As such, it is clear that there are more than enough products, across sectors and regions, to add foreign exposure.

The bottom line

While the US equity market is key for any investor, higher-than-normal concentration suggests that exposure to an index like the S&P 500 may offer less diversification benefits than it has in the past few decades. Hence, we think is worthwhile to remind investors that putting money to work in foreign equities may be a good way to enhance risk-adjusted returns. Remember, there's more to equities than just American ones.

Main contributor: Alberto Rojas, Investment Communications Writer – CIO Americas

[1] These are Apple, Alphabet, Amazon, Meta, Microsoft, Nvidia and Tesla.

[2] The MSCI ACWI captures large and mid-cap representation across 23 Developed Markets (DM) and 24 Emerging Markets (EM) countries. With 2,841 constituents, the index covers approximately 85% of the global investable equity opportunity set.