Textbook economics suggests that lower rates should drive equities higher. And yet, the performance in recent days has been heterogeneous. (UBS)

What has changed—in a nutshell—is that the looming Fed pivot appears now more of a certainty than a few weeks ago. In our view, the June CPI report was the trigger, with better-than-expected data on services and shelter items indicating further disinflation ahead.

Unsurprisingly, recent Fedspeak has shown a marked shift, with policymakers starting to hint that we are inching closer to the first cut. The market is clearly heeding the changing tides, with the rates curve now pricing 65bps of rate cuts by year-end, a much more dovish take than a few months ago when some were still arguing that the Fed might not be able to ease at all this year.

Looser financial conditions might benefit equities in different ways

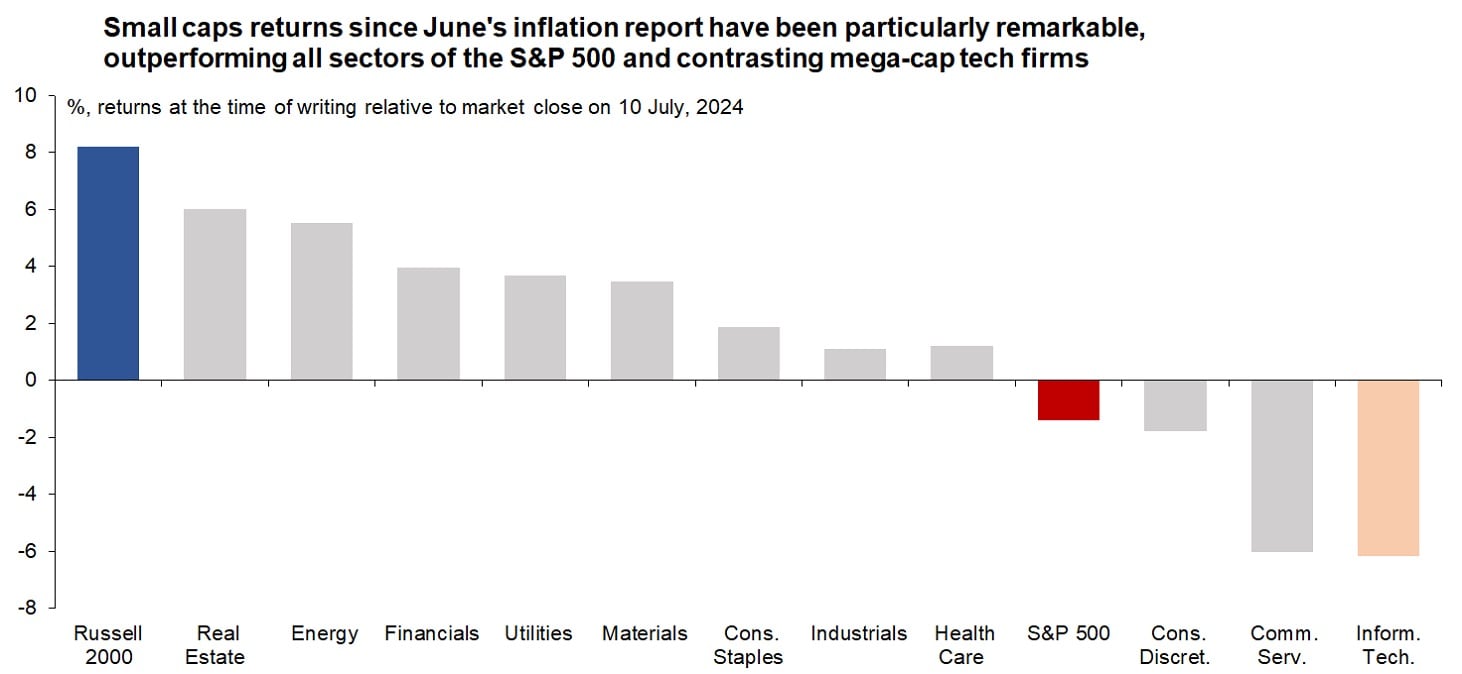

Textbook economics suggests that lower rates should drive equities higher. And yet, the performance in recent days has been heterogeneous across sectors. It’s as if the anticipation of monetary easing is causing market participants to reposition allocations; what is generally referred to as “market rotation”. Seemingly, investors are taking profits in high-earners, and allotting some of those gains in sectors whose performance has been capped by the high interest rate environment. Perhaps going forward returns might be fueled by new actors.

In a broadening rally, the best course of action is diversification

At this point, we are confident that the equities rally is likely to broaden over the coming months, amid lower rates, improving earnings, and still healthy economic growth. As a reminder, we have long argued that easier financial conditions should benefit small caps, whose capital structures are largely dependent in short-term variable interest rate financing.

Having said this, we underline that we are neutral in US equities in terms of size. This implies that we do not favor large-caps, nor small-caps. But rather, that we think the most prudent strategy, in the months ahead, is to have a diversified allocation in terms of equity size. Maintaining exposure across firms with diverse market capitalizations appears to us as the best way to capture risk-adjusted returns.

For more details, please see our recent report: US equity size and style

Main contributor: Alberto Rojas, Investment Communications Writer — CIO Americas