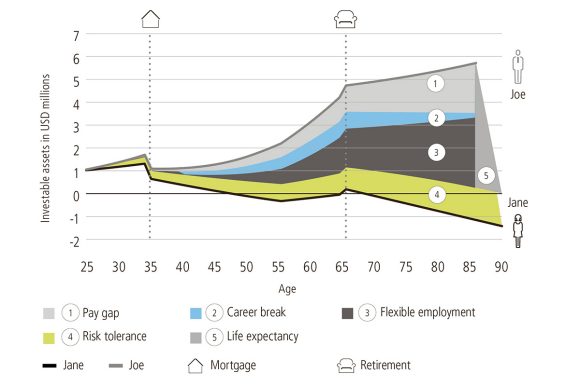

Learn how women face a different financial life journey to men and how to ensure the outcome towards the end of their lives is not negatively impacted as a result. By managing investments wisely women can narrow the gender wealth gap that can persist towards the end of their lives.

How much of a gap do gender differences create in women’s finances?

UBS advisory approach

Financial planning for your life projects.

We’re committed to understanding what wealth means for you. Because it means something different to all of us.

Our advisory approach to your financial needs. During a consultation, we jointly determine three strategies – liquidity, longevity and legacy – and tailor them to your short- and long-term goals in life.

Recommended to you

Risk considerations

Risk considerations

The price and value of investments and income derived from them can go down as well as up. You may not get back the amount originally invested. Currency and interest rate changes can significantly reduce expected returns and asset values. If the value of your securities against which a loan is secured falls below a certain limit, you may be asked by UBS to furnish additional collateral or to repay the loan in part or in full. If you are unable to meet this obligation UBS may liquidate some or all of the investments used to secure the loan.