With 24-hour coverage of major asset classes from 12 key financial hubs around the globe, our Chief Investment Office experts identify the latest investment opportunities and market risks for you. Get fresh perspectives on the topics that matter most to you and your investment goals.

Investing under Trump 2.0

House View

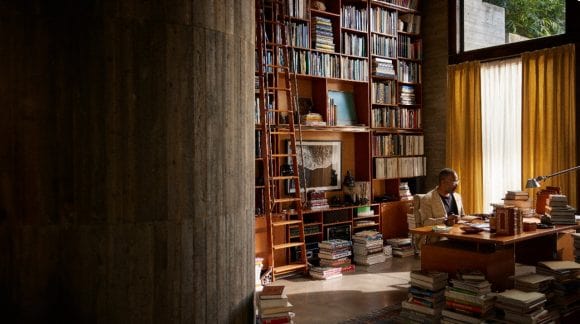

Paul Donovan: economics without jargon

I tend to think of myself as a political economist, not a mathematical economist. Diversity, inflation, education, trade, inequality, sustainability and social change are some of the topics I am very enthusiastic about.

Daily

Weekly

Wealth Intelligence

Stay ahead with the inside view on every segment and dimension of global wealth with our premier suite of wealth intelligence reports, enriched by further curated strategic perspectives from our CIO.

Let's talk

From planning your finances to providing individual solutions, we focus on helping you get more out of life and your wealth.