In online shops with 3D Secure, UBS credit card holders must confirm their payment via the UBS Access App. This provides an additional security element alongside card details and enhances payment security. The UBS Access App is required, even without a UBS account.

How to use 3D Secure with the UBS Access App for your credit card:

Important: Why is an E-Banking contract necessary?

The process activates your card to enable 3D Secure transactions with your phone, even without a UBS banking relationship.

Tip: With the UBS Mobile Banking app, you can manage your cards conveniently while on the move and stay up to date with push notifications.

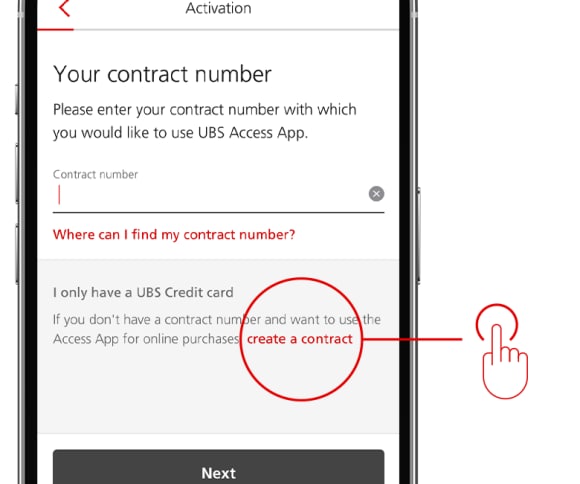

I don’t have E-Banking or Mobile Banking

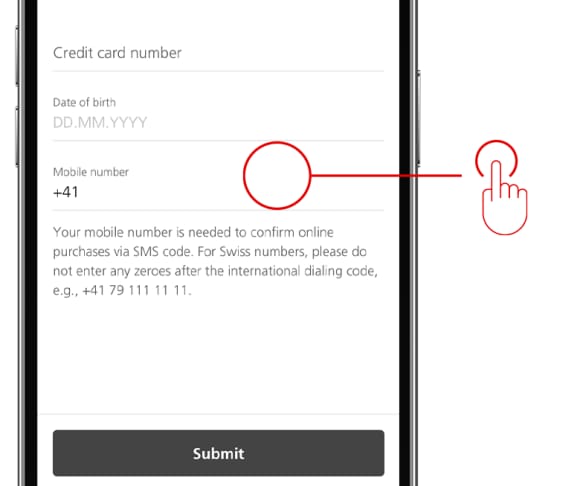

3. Register your card for E-Banking or Mobile Banking by filling out all the details and tapping Submit .

Tip: In step 3, an error message may appear requiring you to register your phone number separately. In this case, please call us at the number provided in the error message so we can assist you. For security reasons, you , as cardholder, must make the call yourself. Please have your card number and phone number ready.

Your card will now be registered for 3D Secure, E-Banking and Mobile Banking.

Important: You’ll receive your new E-Banking contract number and your activation PIN by letter within a few working days. Once you’ve received them, continue with part 2.

You’ll receive an activation letter if you’ve received

- a private card linked to your own account.

- a partner card linked to the account of the relevant family member.

- a corporate card from your employer.

Continue with the details you received by letter.

Part 2 of 3: I’ve already received an activation letter

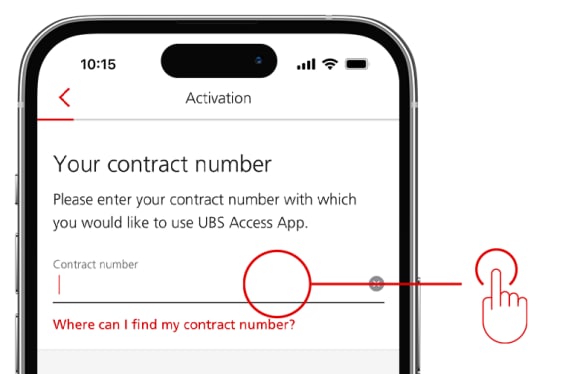

4. Open the Access App again and enter the contract number in your letter.

Tip: You must fulfill the following requirements before you can use the Access App:

Your mobile number must be registered with UBS.

Your new device must meet the requirements of the Access App.

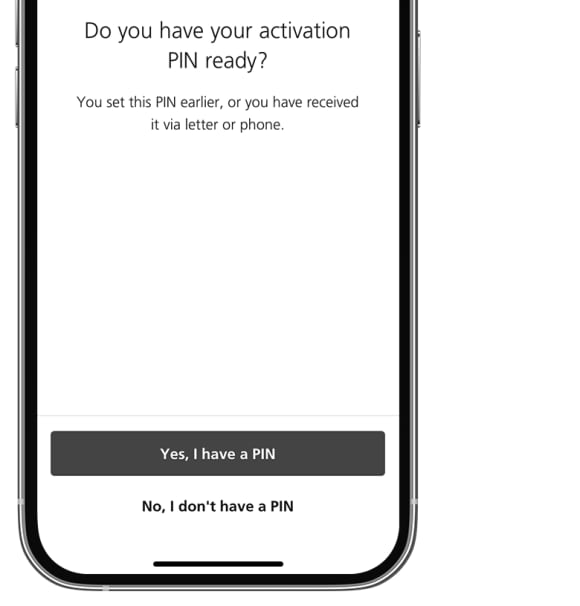

5. Click Yes, I have a PIN.

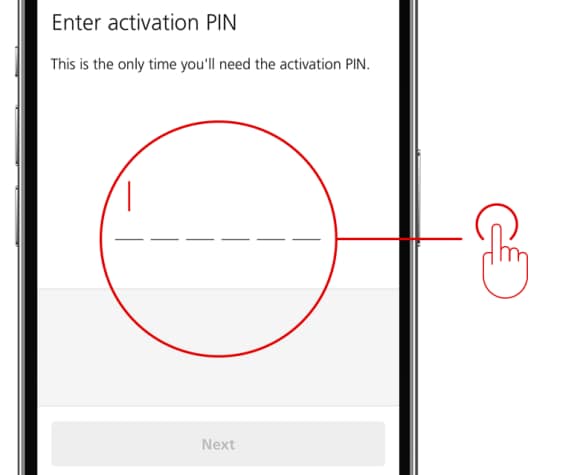

6. Enter the activation PIN from the activation letter and click on Next.

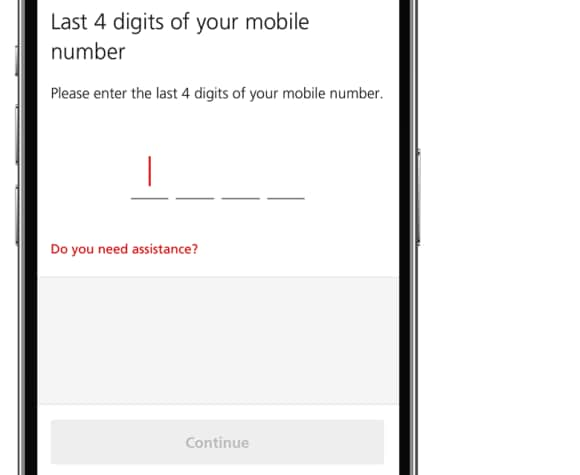

7. Please enter the last 4 digits of your mobile number.

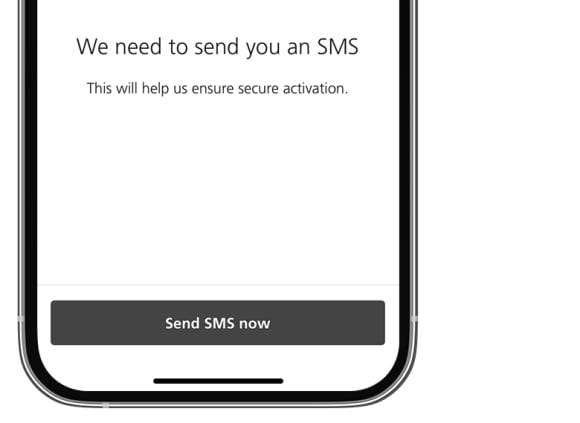

8. Tap on Send SMS now.

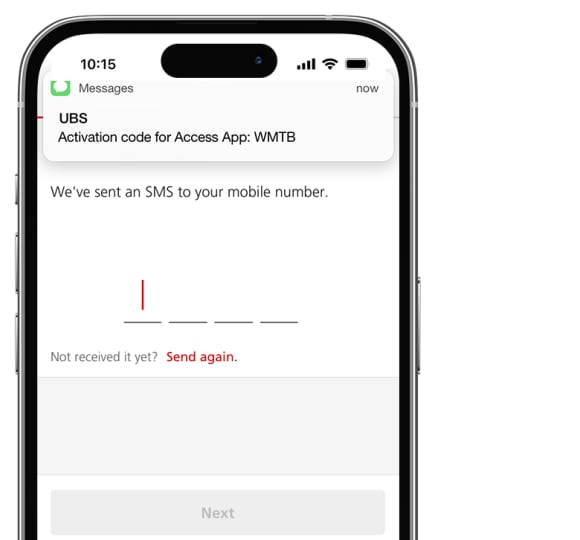

9. Enter the SMS code.

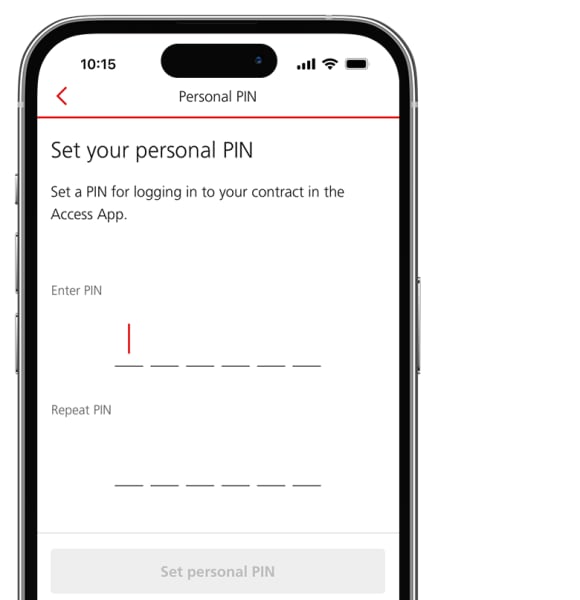

10. Specify your personal PIN for the Access App and confirm it.

Your details are now confirmed. Continue with part 3.

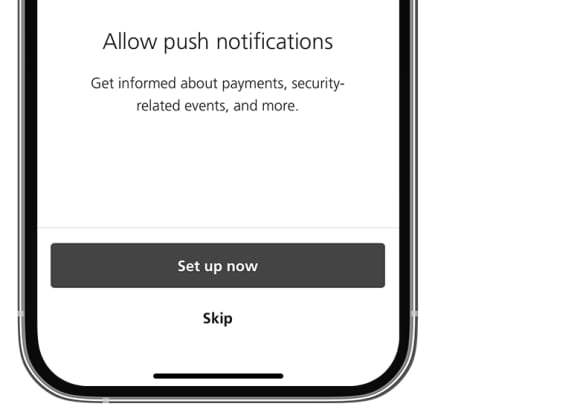

Part 3 of 3: Activate push notifications

11. Receive important push notifications about your card to approve transactions directly or receive instant fraud prevention notifications.

You can also access your bills, transactions and card limits at any time in E-Banking or Mobile Banking.

Other help topics

Shop online with a debit card

You can just as easily link a debit card to your E-Banking or Mobile Banking and use the Access App to confirm your online purchases. All you need do is activate the option for online shopping.

Other help topics

I have E-Banking or Mobile Banking and would like to add another card

If your card is not visible in E-Banking, add it

Part 1 of 2: Launch the registration process

1. Log in to E-Banking on your computer

2. Click on Settings followed by Manage my cards

3. Scroll to the Credit cards section and click on Manage cards

4. Then click on Add card

5. Enter your new card number and your date of birth and then click on Register

You will receive a letter with a PIN. This takes a few days. Once you have received the PIN, continue with the registration process below.

Part 2 of 2: Finish your registration

6. Go back to Manage cards (see step 03)

7. Enter the PIN contained in the letter

8. Click on Activate to confirm registration

3DS is now activated for your credit card and you can shop securely online. You can also access your bills, transactions and card limit at any time in E-Banking or Mobile Banking.

Was this page helpful?

Please enable javascript in your browser and retry.

The feedback component cannot be displayed.