Invest in China’s new economy

Wealth is shifting to China’s new economy. It is moving away from manufacturing towards a services-led growth model

Wealth is shifting to China’s new economy

Wealth is shifting to China’s new economy

The government is re-designing China’s economy. It is moving away from manufacturing towards a services-led growth model.

This change means that the new economy sectors like consumer, healthcare, education and IT are likely to grow faster that the rest of China.

China’s services sector still has ample room for growth. Services as a share of GDP (~52%) is still well below developed countries like the US (~87%).

Services sector in China is now a large part of the economy

Contribution to GDP

Look beyond GDP growth in China

Bin explains why it GDP growth does not matter as much as China transitions to a new economy

3 themes in China’s new economy

3 themes in China’s new economy

1. Potential for healthcare to grow in future

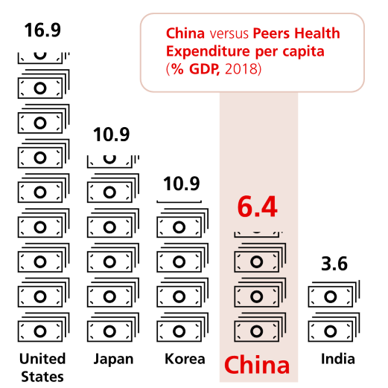

While China is the second largest economy in the world, healthcare expenditure is still comparatively low.

Expected increase in government and public spending on healthcare, together with China’s rapidly aging population will drive the long-term growth of the healthcare industry. This has brought about a broad range of opportunities to the healthcare sector in China - pharmaceutical, contract research organization, internet healthcare, and med-tech.

China healthcare has potential for long-term growth (% GDP)

2. Data is China’s new gold

China is the biggest producer of data globally and churns out about 9 to 10 zettabytes of data1.

However, data in itself is meaningless unless companies can turn it into valuable insights.

China is running ahead when it comes to employing big data technology and artificial intelligence to take advantage of the data available. In the long-run, the ability to analyze massive amount of data will still be important and China will continue to be a first mover in many new technologies.

3. Consumers in China are upgrading

Consumers in China are trading up – accepting higher prices and buying premium, value-added, products across a whole range of categories. This trend, also called premiumisation, is driven by a. income growth, b. urbanisation and c. demographic change.

Chinese consumers prefer premium liquor

Sale of high-end baijiu vs total sales

Baijiu: world's most popular spirit

Be part of China's new economy

Be part of China's new economy

Click on the links to learn more

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.