Put business expenses to work with our suite of business credit cards. These cards are loaded with flexible perks and a selection of rewards—plus, valuable expense management tools and controls, enhanced purchase and travel protections, and more. And as our UBS client, the card comes with the insights and support of your UBS Financial Advisor.

Designed to help manage your cards easily

Track expenses, capture receipts with your mobile phone and create customized reports

Set spending limits and temporarily turn cards on/off remotely

Get up to 24 authorized users on your account so you can manage all your business expenses on one statement

Get real-time alerts to help you monitor UBS card activity, including “card not present” transactions and large purchase transactions

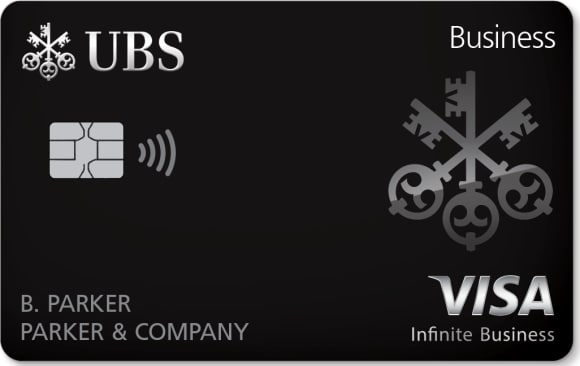

An experience built to your standards

A card designed for business, with elite travel privileges, exceptional rewards, specialized services, and valuable expense reporting and controls—all for a $650 annual fee*.

Learn more about the UBS Visa Infinite Business card.

Call +1-888-762 1232 or contact your UBS Financial Advisor.

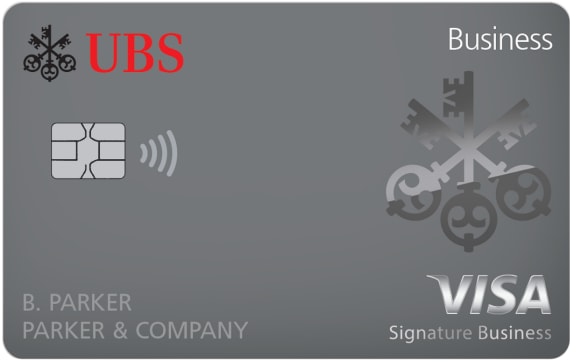

Built for the way you do business

Enjoy access to the UBS Concierge, financial controls, selection of rewards and travel privileges—with no annual fee.*

Learn more about the UBS Visa Signature Business card.

Call +1-800-762 1000 or contact your UBS Financial Advisor.

Built for a better bottom line

Build your bottom line with cash rewards, plus enhanced financial control, and protections, with a $150 annual fee.*

Learn more about the UBS Cash Rewards Visa Business card.

Call +1-833-709 1790 or contact your UBS Financial Advisor.