In this unprecedented period of wealth transfer, investors are not just looking at how best to pass on their assets in a smooth and tax-efficient way. They also want to make sure their family’s values, history and life lessons are conveyed to the next generation.

Having shared values within a family is clearly important, as it indicates what matters most to each family member.

We found that the top values include looking out for family, taking accountability for your actions and being grateful for what you have.

91%

Ensuring your family remains secure

89%

Taking accountability for your actions

88%

Gratitude for what you have

85%

Remaining practical in how you live

84%

Instilling a work ethic for the next generation

Investors also see values through the lens of what’s most important to their families. This is especially true when considering which values a family sees as most important to pass on.

For example, both benefactors and heirs said it is highly important to carry on the family work ethic, culture and traditions.

Which values are specific to the family

Which values are specific to the family

% Highly important to carry on

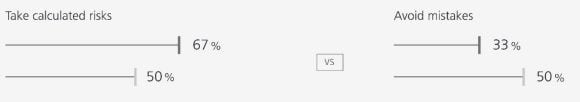

Benefactors and their heirs generally agree on what values are most important. Yet how to consistently instill these values in life isn’t so clear-cut.

Benefactors’ messages around values don’t always hit the mark

Benefactors’ messages around values don’t always hit the mark

Benefactor % values would like to instill in heirs

Inheritor % values parents instilled in me

For many families, passing on values is as important as passing on assets. Yet, talking to loved ones and heirs about values and money can be difficult.

A framework for defining the purpose of a family’s wealth and engaging with future generations can help foster the connections necessary to collaboratively develop family governance, promote accountability and renew family bonds.

Families aren’t talking

Families aren’t talking

6 in 10

A framework to help with legacy planning: UBS Wealth Way

A framework to help with legacy planning: UBS Wealth Way

Understanding the bigger picture is the first step to helping you pursue your financial goals today, tomorrow and for generations to come. UBS Wealth Way1 is designed to help you on that journey.

Get to the heart of your values and passions

Get to the heart of your values and passions

- What excites you about the future?

- Who are the people who matter most to you?

- What impact would you like to have on your loved ones and community?

- What keeps you up at night?

- How do you plan to achieve your life’s vision?

Organize your financial life around three key strategies

Organize your financial life around three key strategies

To help provide cash flow for short-term expenses—to help maintain your lifestyle

For longer term needs—to help improve your lifestyle

For needs that go beyond your own—to help you improve the lives of others

Why it matters

Helps take the emotion out of investing with a plan for your needs

Why it matters

Allows you to focus on your long-term financial goals

Why it matters

Helps you plan to make a difference for the people and causes you care about