Highlights

Highlights

- Volatility spiked in July, with popular positions taking a hit. We believe fundamentals acted as a catalyst, but the magnitude of moves was primarily driven by technical factors. We think political developments have had a limited impact on broad markets.

- We still think the combination of strong growth and the start of an easing cycle justifies an overweight stance on equities, and recent improvements in market breadth can continue.

- As technicals may remain challenging through August and September, we take some chips off the table with reduced overweight positions across our portfolios.

Large market gyrations during the summer months have become increasingly common, and July did not disappoint with sharp movements across a wide array of assets. Some of the most popularly held positions, such as in US mega cap tech or Japanese yen-funded carry trades, suffered abrupt drawdowns.

Investors are questioning whether recent volatility has been driven more by fundamentals, politics or technicals. While fundamentals have played a role in triggering moves, subsequent price action has been exaggerated by technical factors. We argue US political developments were not a primary driver of markets in July.

As such our overall constructive stance on markets, which is rooted in a still strong fundamental outlook, is unchanged. However, we think a small reduction in risk is warranted as technicals may remain challenging through the rest of summer (see Asset Allocation).

Exhibit 1: Large market rotations

Exhibit 1: Large market rotations

Fundamental triggers and technical extensions.

Fundamental triggers and technical extensions.

The initial trigger for July’s volatility came from positive news: US core CPI for June printed 0.1pp below expectations for a second consecutive month. Together with Fed Chair Powell shifting his assessment of the labor market from “tight” to “balanced,” the market received confirmation of an imminent easing cycle, which challenged the higher-for-longer theme.

Market pricing for rate cuts for the remainder of the year moved closer to three 25bp cuts and US 2y yields saw their sharpest monthly decline year-to-date. The prospect of a longer cycle and easier funding conditions supported companies with weaker balance sheets, leading to a rotation into small caps and initiating a sequence of corrections to well-held positions.

Exhibit 2: Major asset performance since CPI, July 10th

Exhibit 2: Major asset performance since CPI, July 10th

Remarkably, the Russell 2000 outperformed the Magnificent 7 by 25% in the two weeks following the CPI release. While mega cap tech earnings expectations for Q2 set a high bar to beat, we believe the sheer speed and magnitude of the rotation was due to lopsided positioning. CFTC data shows that before the CPI release leveraged funds were short small caps, while all investor types were quite long the Nasdaq.

A second trigger came when Japanese public officials intervened in the FX market and importantly, called on the Bank of Japan to normalize policy. This, combined with lower US yields, led to JPY rising near 5% vs. the USD in two weeks, which is a 2.3 standard deviation since the beginning of this cycle. Similarly, the size of the move was greater than justified by the news, given that JPY shorts had reached a decade high, according to CFTC.

Similar dynamics occurred in various markets. Other funding currencies (CHF and CNH) with stretched short positioning benefited from an unwind of popular positive carry trades. Copper prices fell 10% in 10 days with long positioning in futures having reached a three-year high.

Politics overstated as a market driver

Politics overstated as a market driver

The rise in betting odds of a second Trump presidency in the first two weeks of July added to the perception of disruptive rotation trades. However, we note small cap outperformance sustained through the month, even as betting odds reset to show a tighter presidential race in the latter half of July.

Further distinguishing market behavior from political factors, the US Treasury curve bull steepened through July, consistent with the market preparing for a rate-cutting cycle. Had politics been the driver, a bear steepening associated with looser fiscal policy would have been more appropriate.

As of now, we are electing not to pre-position for the US election for two reasons: First, the race is too hard-to-call, with the Democrats uniting behind Vice President Harris and the recent surge in Democrats’ fundraising. Second, we think the net impact of Trump’s policies on the economy and market are more uncertain than in his first term. The latter being due to wide-ranging proposals on trade, immigration, taxes, energy, deregulation and the dollar in an economic environment of more elevated inflation and higher deficits.

Monetary policy and technical factors were the key drivers in July and will likely remain more important than political risk over the rest of the summer.

Exhibit 3: Russell/Nasdaq vs. Trump PredictIt odds

Exhibit 3: Russell/Nasdaq vs. Trump PredictIt odds

Focus on fundamentals

Focus on fundamentals

We caution against inferring overly negative signals from recent market behavior as we believe technicals have played a larger than usual role. In fact, the underlying price action represents a healthy broadening of the equity market, even if the speed of the move was jarring. Improving breadth beyond a narrow group of tech stocks is more consistent with investor faith in an extension of the economic cycle.

Overall, hard data still points to a healthy cyclical outlook in the US, with real GDP growth tracking at an annualized rate of 2.8% in Q2, supported by robust personal spending. Real incomes continue to grow healthily, as do corporate earnings. Expected monetary easing should relieve pressure on interest rate sensitive sectors like housing and manufacturing.

We acknowledge that the labor market is cooling, and this is our primary focus in monitoring risks to the view. We are also attentive to downside risk to growth outside of the US, particularly following disappointing growth-related data in Europe and China. However, falling core inflation is also allowing respective central banks inside and outside of the US to loosen policy, cushioning downside risks and brightening the forward outlook.

With the Fed likely to begin a measured cutting cycle in September – supported by a more benign inflation path – we will soon enter into a period of synchronized global easing (ex. Japan). This should create a supportive backdrop for risk assets, as investors gain confidence that central banks will provide foam under the runway should economies cool further.

Exhibit 4: Moving into an increasingly synchronized global cutting cycle

Exhibit 4: Moving into an increasingly synchronized global cutting cycle

Despite the solid macro backdrop, we still see challenging technical conditions in the immediate future. First, while there have been adjustments in prices, we have not seen a large shift in positioning. Speculative positioning remains very long US tech and short various funding currencies.

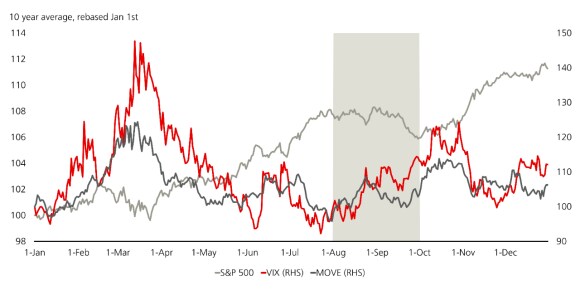

Second, on an index level, we are mindful of seasonal patterns which show weaker risk asset performance and higher volatility in August and September. Given lingering concerns about the state of the global economy and a tight political race, volatility can easily increase during the coming illiquid period.

Exhibit 5: Weaker seasonality through August and September

Exhibit 5: Weaker seasonality through August and September

Asset allocation

Asset allocation

We think the combination of still strong growth and the start of an easing cycle justifies an overweight stance on equities. We see room for ongoing improvements in market breadth and a cleaner backdrop for active equity managers as the market becomes less concentrated. In the very short term, we acknowledge more fragility in the technical environment and take some chips off the table with a reduced overweight position in equities across our portfolios.

We are neutral on duration given how much easing is already priced in, assuming a soft-landing scenario. However, duration continues to play an important role in balanced portfolios to hedge against negative economic scenarios, especially as the risks of weaker growth and higher inflation are now more balanced. We still view bonds as the best hedge against downside surprises in the labor market.

Similarly, we think JPY can benefit from more hawkish domestic monetary policy and any weakness in the macro environment. We remain neutral credit, as all-in yields remain attractive in an environment where our base case is continued economic resilience.

Asset class views

Asset class views

The chart below shows the views of our Asset Allocation team on overall asset class attractiveness as of 29 July 2024. The colored circles provide our overall signal for global equities, rates, and credit. The rest of the ratings pertain to the relative attractiveness of certain regions within the asset classes of equities, bonds, credit and currencies. Because the Asset Class Views table does not include all asset classes, the net overall signal may be somewhat negative or positive.

Asset Class | Asset Class | Overall / relative signal | Overall / relative signal | UBS Asset Management's viewpoint | UBS Asset Management's viewpoint |

|---|---|---|---|---|---|

Asset Class | Global Equities | Overall / relative signal | Overweight | UBS Asset Management's viewpoint | Constructive macro and earnings backdrop amid central bank easing, but have taken chips off the table due to technicals, seasonals. |

Asset Class | US | Overall / relative signal | Overweight | UBS Asset Management's viewpoint | Expect further broadening of equity market performance as Fed extends the cycle. |

Asset Class | Europe | Overall / relative signal | Neutral | UBS Asset Management's viewpoint | Downgraded to neutral on disappointing economic and earnings data. |

Asset Class | Japan | Overall / relative signal | Neutral | UBS Asset Management's viewpoint | Ongoing corporate reform, solid earnings countered by renewed JPY strength. |

Asset Class | Emerging Markets | Overall / relative signal | Neutral | UBS Asset Management's viewpoint | Skeptical EM can outperform ahead of US election especially with ongoing China growth malaise. |

Asset Class | Global Government Bonds | Overall / relative signal | Neutral | UBS Asset Management's viewpoint | Bonds more attractive with clearer evidence of a growth/inflation stepdown. Still prefer equities. |

Asset Class | US Treasuries | Overall / relative signal | Neutral | UBS Asset Management's viewpoint | Gradual growth and inflation moderation improves hedging properties but don’t expect significant outperformance versus what is priced. |

Asset Class | Bunds | Overall / relative signal | Neutral | UBS Asset Management's viewpoint | ECB to ease policy amidst cooling inflation, but tight labor markets and improving growth limit degree of easing. |

Asset Class | Gilts | Overall / relative signal | Neutral | UBS Asset Management's viewpoint | BoE eager to cut rates as employment has slowed, but sticky services inflation curtails ability to ease significantly. |

Asset Class | Global credit | Overall / relative signal | Neutral | UBS Asset Management's viewpoint | Credit spreads are tight but not irrational as default rates remain low. Most attractive carry in Euro HY and Asia. |

Asset Class | Investment Grade Credit | Overall / relative signal | Neutral | UBS Asset Management's viewpoint | Spreads are around usual cycle tights, while corporate fundamentals remain supportive. Returns likely driven by carry. |

Asset Class | High Yield Credit | Overall / relative signal | Neutral | UBS Asset Management's viewpoint | Further price upside is limited with spreads around 3%. But all-in yields remain attractive. Prefer Euro HY over US. |

Asset Class | EMD Hard Currency | Overall / relative signal | Neutral | UBS Asset Management's viewpoint | Good restructuring news has been largely priced in in recent months. Carry-driven returns look likely from here. |

Asset Class | FX | Overall / relative signal | - | UBS Asset Management's viewpoint | - |

Asset Class | USD | Overall / relative signal | Overweight | UBS Asset Management's viewpoint | Bullish against G10 with more Fed easing priced in relative to other G10. USD offers a carry-positive hedge against adverse scenarios. |

Asset Class | EUR | Overall / relative signal | Underweight | UBS Asset Management's viewpoint | Expect rate differentials to shift back in US’ favor due to more subdued European growth outlook. |

Asset Class | JPY | Overall / relative signal | Overweight | UBS Asset Management's viewpoint | Increasing pressure on the Bank of Japan to normalize policy means narrowing of rate differentials. |

Asset Class | EM FX | Overall / relative signal | Neutral | UBS Asset Management's viewpoint | Bumpier environment for EMFX carry as volatility rises. |

Asset Class | Commodities | Overall / relative signal | Neutral | UBS Asset Management's viewpoint | Brent crude oil in the middle of a USD 75 to USD 90 range. |