2024 Fixed Income Default Study

An examination of our bottom-up default outlook and total return forecasts for 2024

![]()

header.search.error

An examination of our bottom-up default outlook and total return forecasts for 2024

This paper examines our bottom-up default outlook and total return forecasts for 2024 within Global high yield, Asia and emerging markets. The fixed income default study is based on a proprietary, bond by bond analysis conducted by our dedicated team of career credit analysts. The team utilizes reference indices to form a comprehensive, bottom-up estimate of defaults and distressed exchanges by industry.

Expected default | Expected default | Rate 2024 | Rate 2024 |

|---|---|---|---|

Expected default | EUR HY | Rate 2024 | 3.00% |

Expected default | US HY | Rate 2024 | 3.40% |

Expected default | EMD corporates | Rate 2024 | 1.50% |

Expected default | EMD HY corporates | Rate 2024 | 3.60% |

Expected default | Asia ex-Japan | Rate 2024 | 1.80% |

Expected default | Asia ex-Japan HY | Rate 2024 | 11.0% |

These projections translate into the following total return forecasts (also taking into account our rates and spreads forecast):

Our forecast for EUR high yield is for defaults to be lower than 2023 and remain below historical long-term averages as large idiosyncratic events played out in 2023 and issuers have been able to refinance outstanding maturities. We expect fundamentals to remain under pressure amid general macroeconomic weakness, with credit metrics continuing to deteriorate as refinancing comes in at notably higher coupons. However, many corporate issuers took advantage of suppressed rates in recent years to extend maturity schedules and defaults should therefore remain below long-term averages. Looking beyond next year – although defaults are likely to rise, we do not believe the maturity wall presents a substantial hurdle given its skew towards higher-quality issuers. For context, 80% of 2025 maturities and 56% of 2026 maturities are BB-rated.

Similar to 2023, key negative outliers are the retail and real estate sectors, both of which are heavily influenced by single issuers with large and complex debt structures. However, the current macroeconomic backdrop has had a material impact on real estate and retail is a purely idiosyncratic situation.

Our expectations for US default rates are to remain broadly unchanged from last year. As with the European forecast, credit fundamentals are skewed to the downside. However, issuers have been reasonably proactive in terms of terming out 2025 maturities, while there has been ample evidence of sponsor support and private credit investment.

The key negative outliers are the healthcare and telecommunications sectors: the healthcare sector is influenced by a single sizeable constituent, while telecommunications generally reflects intensified competition and significant growth challenges in the context of heavily leveraged capital structures.

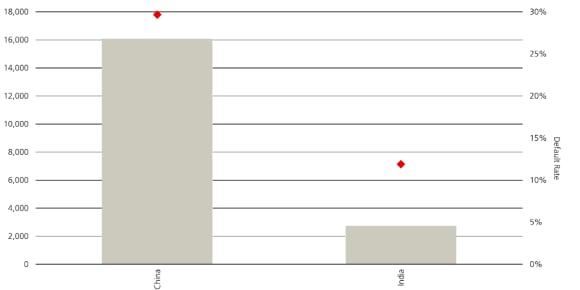

Within Asia ex-Japan high yield, our forecast is marginally higher than last year. The key difference from last year is our more conservative estimate for Chinese real estate as there are three large issuers on the cusp of our comfort level for default/exchange. Our probability of a default/exchange is on the lower side at 33%, but given the ongoing pressure the sector is facing we felt it prudent to take a conservative stance and include these three issuers as a default/restricting candidates. If those three issuers were not to default/restructure in 2024 the default rate would drop materially to below 6%. The Chinese government has announced new policy initiatives in the sector over the past several weeks, but again we choose to be conservative in our estimate.

We expect an improvement in the default rate compared to 2023. Note our forecast is below those of several sell-side strategists; this reflects our view that several stressed issuers (CCC+ and below rated) with no maturities in 2024 will muddle through the year.

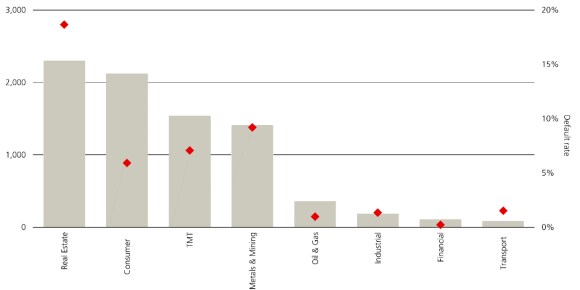

On a sector basis, Chinese real estate remains the largest contributor to these numbers, representing 28% of face value outstanding of default candidates. Outside real estate, we see default risk in the consumer sector driven by several Ukrainian issuers that could face stress in light of the continued conflict, as well as in TMT with certain LATAM countries experiencing difficulties.

Our fixed income team is broadly constructive on high yield and emerging markets overall, and we forecast expected total returns to be positive for these sectors even in a downside scenario in 2024.

Returns should be driven by elevated carry with downside risks coming from potential spread widening given where spreads finished at the end of 2023. Our base case is for US high yield and EUR high yield to have attractive carry driven returns between 4.5-8.5% and 5-7% respectively. We expect EM corporates to return between 6.5-9%. Based on the default forecast, Asia high yield looks attractive between 11-20%, albeit with high volatility and dispersion potential amid lingering uncertainty around Chinese property.