How to turn Chinese consumption around

What is limiting Chinese spending and what is Beijing doing about it?

![]()

header.search.error

What is limiting Chinese spending and what is Beijing doing about it?

Beijing sent clear signals to revive consumer and business confidence. It could be more powerful than any policy stimulus, argue Denise Cheung and Morris Wu.

Cautious Chinese consumers are not spending money, and this stagnation is having a large effect on an already slowing economy. Domestic demand is stuck in a low trajectory after the anticipated post-pandemic recovery has not fully materialized, and consumer prices stayed nearly flat and retail sales weak for most of last year. More recently, the consumer price index fell 0.7% in February, the first negative reading in a year.1

A combination of factors, both immediate and legacy, led to this point: a protracted property slump and job insecurity depressed household sentiment, while a conservative culture prefers saving over spending to begin with and thrift is ingrained in individuals and government.

Last year policymakers had set an optimistic tone and declared their intentions to “vigorously” boost consumption in 2025 and expand domestic demand “in all directions”. Consumption was elevated to be among the top priorities at the annual National People’s Congress (NPC) meeting in March, as policymakers vowed greater efforts to strengthen consumption in order to support overall economic growth.

Weak consumption

The Chinese New Year holidays late January are a peak season for spending, but early, high frequency data are not particularly encouraging – suggesting 2024’s lackluster trend could continue.

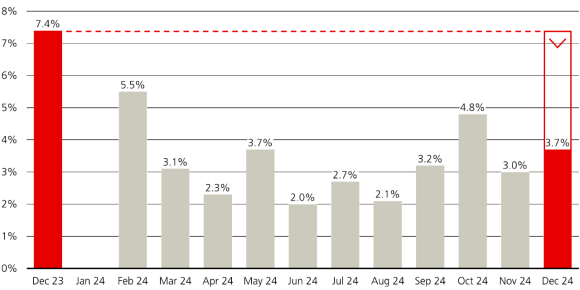

Retail sales sputtered last year and grew just 3.7% in December, a significant decline from 7.4% of the same month a year ago.1 At the same time, consumer prices only went up 0.2% for the year, well below the official target, against persistent deflationary pressure.1

Pressure on income

Overall Chinese consumers have accumulated sizable wealth in the decades of fast economic growth, but middle-income households, more specifically migrant workers with relatively high-paying jobs in Tier-1 and Tier-2 cities, are pessimistic on their economic outlook, according to a McKinsey survey. Many have lost their jobs due to a slowing economy and regulatory actions that affected companies in property, gaming, after-school education, healthcare and finance in recent years.

Young people are also having a hard time. Although the unemployment rate for 16-to-24-year olds is coming down from a peak, jobs are still hard to come by, not to mention pay rises, prompting some to set extreme monthly savings targets.

Pressure on income growth will not let up with a surplus in labor, and reducing savings will not necessarily give consumption a boost. Weakness in spending will likely continue with no government intervention.

What can be done?

In the short term, direct consumption vouchers could make a big difference. We believe stronger and more targeted financial support could shake consumers out of their risk averse behavior and catalyze spending. This is especially the case for lower-income households, which are a lot more likely to spend the windfall than wealthy households. This could have a more immediate impact on spending.

For instance, the rollout of "trade-in" policies since 2024 is an effective lever. The number of household appliances owned by Chinese families were estimated to exceed three billion units. The program has led to a significant increase in the sales of key consumer products, such as automobiles, home appliances, home decoration goods and equipment. The campaign led to 920 billion yuan in automobile sales and 240 billion yuan in home appliance sales, according to Li Gang, an official from China’s Ministry of Commerce.

Longer term, restoring confidence among consumers and businesses is even more important. President Xi has been very clear that the state is supportive: “The new era and new journey have broad prospects for the development of the private economy and great potential,” he said at a rare appearance at a business symposium, according to state media Xinhua. “It is time for private enterprises and private entrepreneurs to show their talents,” which is interpreted as the state’s commitment to work with businesses and revive confidence. Improved confidence could lead to improvement in investment, employment and income expectations. We are hopeful that consumers could grow more optimistic and spend more.

A mid-course policy shift is a mammoth undertaking, but we believe the government’s incremental measures will pay off in the long run, not only in lifting consumption but also ushering in more sustainable and high quality growth for China. That would clearly be positive for investing in China.