Investing in India’s ambition

Explore the long-term themes that endorse the country’s extraordinary growth story in the first installment of our India series

![]()

header.search.error

Explore the long-term themes that endorse the country’s extraordinary growth story in the first installment of our India series

Key takeaways

India’s mammoth general elections spanning over six weeks are now past the midway point, with more than 900 million people eligible to vote at a million plus polling stations across the expansive country. The magnitude of the world’s largest elections befits a population estimated to be over 1.4 billion people, as India passed China last year as the most populous country. What is more, these superlatives are matched by India’s ambition to become a global economic powerhouse.

Prime Minister Narendra Modi is bidding for a third consecutive term, pledging to finish what he and the ruling Bharatiya Janata Party (BJP) have started: moving the fast-growing economy to the third largest position after the US and China in the next five years and making “Viksit Bharat 2047” – elevating India to a developed country a century after it gained independence. A recent Morning Consult poll ranked Modi as the world’s most popular global leader, with an approval rating of 76% at home.

2047 is far away but there is no denying that India is rising as a geopolitical and economic superpower. Many elements contribute to the rise, and these same elements also make India an attractive long-term investment case, going beyond headlines of the moment.

Great growth potential, long-term themes

India’s economy grew 7.6% in the last fiscal year (ended March 31) and is forecast to grow by 7% in the current fiscal year, according to the Reserve Bank of India (RBI).1 Strengthening rural demand, improving employment conditions, moderating inflation pressures and a sustained pick-up in the manufacturing and services sectors should boost consumer demand that has been weak following the pandemic. Longer term, a rising middle class expected to almost triple to nearly 1.2 billion in 2030 from 400 million in 2022 should provide support to consumption and economic growth. These consumers are also likely to spend more on premium and discretionary products.

Middle income population – India (millions)

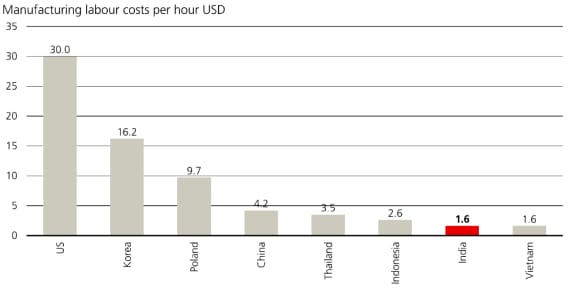

Another ongoing theme underwriting India’s growth is the global reconfiguration of manufacturing and supply chains. For example, as Apple relocates part of its supply chain and opens retail stores in India, Tesla is rumored to have plans to open a factory and enter the world’s third-largest car market after successfully lobbying for significantly lowered import taxes on electric vehicles (EVs). EVs made up a small portion of India’s total car sales in 2023, representing a huge opportunity for carmakers like Tesla. American friend-shoring will likely continue, with the US importing more and more manufacturing goods from countries like India.

Proportion of manufactured goods imported into the US from low-cost countries or regions in Asia

That said, India has been working hard on improving its export competitiveness. The government over the years has implemented tax reforms including goods and services tax (GST) collections and tackled structural issues such as high logistics costs, rising inflation and inadequate scale of production and operations and made meaningful progress. It is focused on developing niche and complex manufacturing sectors such as IT hardware, medical devices and telecommunications, as well as building out infrastructure to support these sectors. To better capitalize on the advantage in resources and skills will help India climb higher on the manufacturing value chain, taking the country one step closer to Viksit Bharat 2047.

Complementing these pro-growth fiscal measures is a steady monetary policy guiding hand. Although core inflation has fallen sharply in recent months to below 4%, food price volatility remains a concern for the RBI.1 The central bank has maintained a disinflationary stance, keeping its key interest rate unchanged at 6.5% since early 2023.1 It is unlikely to ease policy before summer as the economy maintains a healthy growth momentum.

An emerging market option

By now, many are recognizing India’s strong growth potential makes it an attractive market for global investors, particularly those who are looking to invest in the emerging market universe. Not only is capital inflow from international sources significant, domestic flow and interests have reached fever pitch.

The Indian mutual fund industry is experiencing massive growth, recording a 35% increase in total assets over the latest fiscal year, according to the Association of Mutual Funds in India.2 Not to mention, the number of mutual fund investors have jumped from 9.6 million in March 2014 to 41 million in October 2023, as stated by the Securities and Exchange Board of India.3

Increased retail investor participation as well as strong local and global interest in investing in India create an environment positive for alpha opportunities. Selectivity is key in a rapidly growing emerging market, and it is important to have on-the-ground presence to take advantage of market inefficiencies and identify alpha.

India might be one of the brightest emerging markets, but it is not without risks. While Modi is a frontrunner and BJP is projected to lead in its parliamentary race, a victory – let alone an overwhelming one – for the National Democratic Alliance is not guaranteed. The odds of a surprise here is low. However, an upset would introduce a high level of uncertainty and could have a significant impact on investor sentiment.

Higher oil prices could also pose a problem for India given its dependence on imported oil, especially in a rising geopolitical tensions scenario. That said, the country is pivoting towards green energy, making significant investments in solar power manufacturing and focusing on EV adoption. Oil dependence may decline over time.

In addition, India’s rural economy has not recovered after the pandemic, still reeling from high inflation, intense monsoons in recent years and weak employment prospects. Because the rural population is younger than the urban population, rural joblessness at least partly translates into higher youth employment overall.

For the 20 to 24 age group, the jobless rate stands at 44% for the quarter ended December 2023.4 For the 25 to 29 age group, it is at 14% for the same period.4 With a young population, seven to eight million youths enter the working age every year. Should job creation fail to keep pace with the growing workforce, India’s economic growth and ultimately social stability could be put at risk.

Lastly, stock valuations also appear pricey, with price-to-earning ratio much higher than its emerging-market counterparts and just above the S&P 500.

The risks and recent hype notwithstanding, we like India’s growth story. The country’s ambition goes beyond the short term and presents a large set of attractive alpha opportunities. Investing in India on its path to become a global economic superpower could prove rewarding for global investors in the long run.