Macro Monthly Telegraphed taper no threat to the expansion

Investors are bracing for an inflection point in Federal Reserve policy, from adding monetary stimulus to gradually paring it back.

Highlights

Highlights

- For equities, continued earnings growth is likely to outweigh any negative effects of a Fed taper.

- We believe that investors are underestimating the strength of the expansion, which is providing opportunities in procyclical positions.

- There are welcome signs of a shift to a healthier nominal growth environment ahead, with more real activity and ebbing inflationary pressures.

- In our view, a still slow-moving Fed and cyclical acceleration favors higher long-term bond yields and outperformance for pro-cyclical sectors and regions.

Investors are bracing for an inflection point in Federal Reserve policy, from adding monetary stimulus to gradually paring it back. This is not the 2013 taper tantrum, but a telegraphed taper.

A withdrawal of central bank stimulus is a natural, welcome consequence of a global economic recovery that continues apace – even as the Delta variant prevents a full normalization of activity. However, the low level of longer-term bond yields and equity market internals currently imply that that the economy is ill-equipped to handle even modest adjustments to this highly accommodative policy setting.

We believe this view is misguided. On its own, the nascent withdrawal of US monetary stimulus is not a threat to the economic expansion, as activity is likely to stay well above trend in 2022. As such, it is not a threat to the earnings growth that underpins the equity bull market.

A higher bar for hikes

A higher bar for hikes

The recent slowdown in US job growth should prevent any imminent hawkish Fed surprises, like an announcement on tapering at its September meeting or a particularly swift reduction in bond buying. However, the cumulative progress on inflation and employment since the depths of the pandemic have laid the groundwork for the Fed to begin reducing its asset purchases before the year is out.

Over a five-year horizon, PCE inflation has averaged above 2% – arguably aligned with the Fed’s loosely-defined flexible average inflation targeting framework. What is important to remember is that on its own, that is not enough to get the central bank to hike rates. The bar for that is significantly higher. The Fed’s forward guidance is three-fold: it states that the policy rate will stay at zero until (1) inflation has risen to 2%, (2) is on track to run moderately above that level for some time, and (3) the labor market has reached maximum employment. In his Jackson Hole virtual address, Fed Chair Jerome Powell stressed that that the criteria for tapering are quite different than what is required for rate liftoff, and that inflation is not the sole consideration.

At present, the US labor market is well short of its pre-pandemic state, and serves as the constraint on a more aggressive withdrawal of monetary stimulus. The central bank has yet to systematize any definition for full employment, and we would not expect one to be forthcoming. Rather, we expect that realized inflation outcomes will help to determine the central bank’s view of what constitutes maximum employment – within reason. In our view, the Fed is unlikely to lift rates until the unemployment rate is below 4%, at a minimum, at a time when the inflation criteria listed above are also being met

We believe that tapering will be announced near the end of this year and be carried out over 8 to 12 months. By the end of this period, we expect inflation will have cooled – particularly for core PCE inflation – as the reversal in idiosyncratic and reopening categories outweighs a continued rise in shelter inflation. After tapering runs its course, low inflation may prove a barrier to rate hikes, keeping monetary policy easier for longer.

Heathier nominal growth

Heathier nominal growth

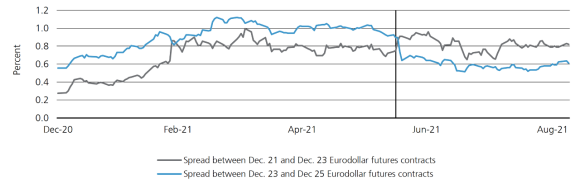

The Fed’s June meeting showed several officials were more sensitive to the surprisingly high price pressures associated with economic reopening and supply chain stresses than investors had previously thought. Soon thereafter, markets began to price more policy tightening in 2022 through 2023 than 2024 through 2025, and yield curves flattened aggressively.

A summary of the market’s view is as follows: inflation that the Fed has to react to sooner rather than later is enough to undermine the economic expansion. Such a sequence of events is unlikely to be realized, in our view.

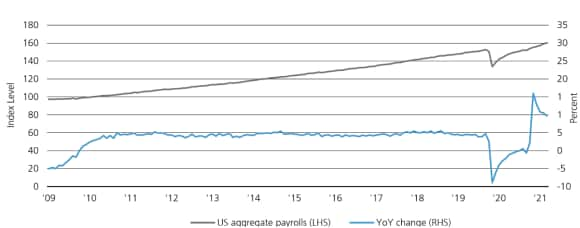

Exhibit 1: Growth in labor income to underpin consumption

We are cognizant that after last cycle’s relatively sluggish expansion, the burden of proof is high for those espousing economic optimism. But investors do not appear to appreciate how the runway for strong activity is longer this cycle than in the aftermath of the 2007-08 global financial crisis. The US aggregate national paycheck is rising at nearly a 10% pace year-on-year, and has nearly eclipsed its pre-pandemic trend. The US consumer, the engine of global activity, is further bolstered by excess savings from previous income support measures. Businesses are running very lean inventories, which they have a need and desire to replenish. Continued supply disruptions, partially a function of this strong demand backdrop, will need to be durably remedied by investment that increases productive capacity.

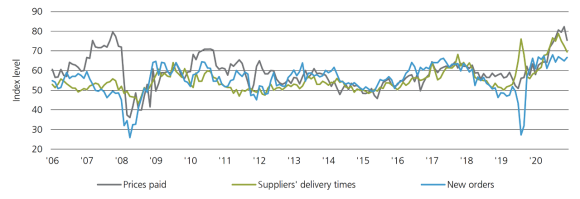

Elevated inflation would probably be a function of continued supply chain stress and strong demand that persists amid modest tightening. On the other hand, a shift to a more favorable composition of nominal growth – more real activity and less inflation – would allow for continued central bank patience on policy rates. We have seen encouraging signs on this front recently: the number of commodities reported to be in short supply at US manufacturers has decreased, as has the ISM prices paid index and suppliers’ delivery times index. New orders, meanwhile, continue to expand at a robust clip. However, because of the ongoing pandemic, this progress may occasionally suffer setbacks.

Exhibit 2: Investors price sooner but less Fed tightening after June meeting

Exhibit 3: Details of US ISM manufacturing report hint at better composition of nominal growth

Watch expectations

Watch expectations

We believe that the most likely reason the Federal Reserve would turn hawkish is due to concern that its dual mandate goals are temporarily incompatible. For example, if above-target inflationary pressures were deemed to be more persistent than transitory, the central bank may take action to rein in inflation even if the labor market remained short of maximum employment.

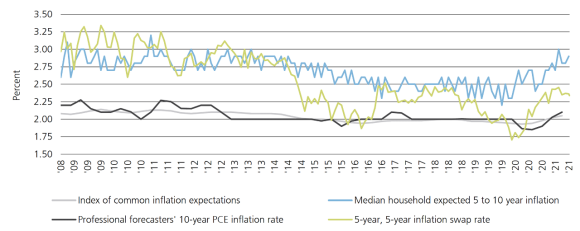

A significant rise in longer-term inflation expectations is the key risk to gauge whether such an outcome would come to pass. Fed Chair Jerome Powell recently outlined an inflation expectations dashboard. This array of metrics is broadly in line with the Fed’s price stability view, he said. If rising inflation expectations do become worrisome, we believe the central bank’s guidance on the conditions required for rate hikes would be meaningfully altered well ahead of any change to monetary policy.

In our view, the deeply negative levels of US real yields, which protect the holder from CPI inflation, are inconsistent with the likely vigor of the global economic expansion, and are likely to move higher over time. Any adjustment in real rates would likely be more abrupt, meaningful, and disruptive to risk assets – and particularly secular growth stocks – if inflation expectations were at risk of becoming unhinged to the upside.

Conclusion

Conclusion

Investors are underappreciating the likely strength of economic growth, in our view, which is unlikely to be derailed by central banks tip-toeing away from the extraordinary easing policies.

By exhibiting patience on the removal of stimulus in the near term even as headline inflation remains elevated, the US central bank is accommodating an economic upswing. Over the course of the cycle, this may allow for more rate hikes than if Fed officials acted aggressively and preemptively. As such, this policy setting should contribute to higher bond yields over time.

Exhibit 4: Inflation expectations remain well anchored

Asset class attractiveness (ACA)

Asset class attractiveness (ACA)

The chart below shows the views of our Asset Allocation team on overall asset class attractiveness, as well as the relative attractiveness within equities, fixed income and currencies, as of 10 September 2021.

Asset Class | Asset Class | Overall signal | Overall signal | UBS Asset Management’s viewpoint | UBS Asset Management’s viewpoint |

|---|---|---|---|---|---|

Asset Class | Global Equities | Overall signal | Light green | UBS Asset Management’s viewpoint |

|

Asset Class | US Equities | Overall signal | Neutral | UBS Asset Management’s viewpoint |

|

Asset Class | Ex-US Developed market Equities | Overall signal | Light green | UBS Asset Management’s viewpoint |

|

Asset Class | Emerging Markets (EM) Equities(ex. China) | Overall signal | Neutral | UBS Asset Management’s viewpoint |

|

Asset Class | China Equities | Overall signal | Neutral | UBS Asset Management’s viewpoint |

|

Asset Class | Global Duration | Overall signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | US Bonds | Overall signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | Ex-US Developed-market Bonds | Overall signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | US Investment Grade (IG) Corporate Debt | Overall signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | US High Yield Bonds | Overall signal | Light green | UBS Asset Management’s viewpoint |

|

Asset Class | Emerging Markets Debt - US dollar / Local currency | Overall signal | Neutral / Light green | UBS Asset Management’s viewpoint |

|

Asset Class | Chinese Bonds | Overall signal | Dark green | UBS Asset Management’s viewpoint |

|

Asset Class | Currency | Overall signal |

| UBS Asset Management’s viewpoint |

|

A comprehensive solutions provider

A comprehensive solutions provider

UBS Asset Management Investment Solutions manages USD 167.9 billion (as of 30 June 2021). Our 100+ Investment Solutions professionals leverage the depth and breadth of UBS's global investment resources across regions and asset classes to develop solutions that are designed to meet client investment challenges. Investment Solutions' macro-economic and asset allocation views are developed with input from portfolio managers globally and across asset classes.

For more information, contact your UBS Asset Management representative or your financial advisor.