Our solutions, we address all dimensions of your wealth

Explore our solutions and services

At UBS, our goal is to address all dimensions of your wealth so we can deliver individual wealth management solutions that serve your financial needs today, tomorrow and for generations to come.

Explore our latest publications

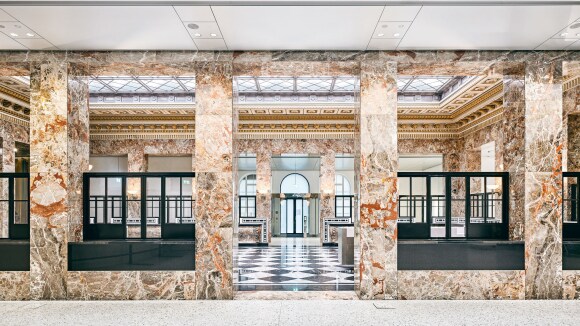

Banking is our craft

We’re committed to understanding what wealth means for you. Because it means something different to all of us.

UBS Wealth Way

Financial planning for your life projects.

We’re committed to understanding what wealth means for you. Because it means something different to all of us.

Our advisory approach to your financial needs. During a consultation, we jointly determine three strategies – liquidity, longevity and legacy – and tailor them to your short- and long-term goals in life.

Access to our financial insights

Looking for the intelligence you need to power your wealth management goals?

Benefit from the insights of our award-winning Chief Investment Office wherever you are.*

About us

With UBS, you’ll benefit from over 160 years of experi¬ence helping our clients pursue what matters most to them – in life and in business.

Our history in Brazil begins in 1953, with the opening of the first UBS office in São Paulo. Today, we have more than 1,200 employees distributed between São Paulo, Rio de Janeiro, Curitiba and Recife.

Wealth Management UBS Brazil

We have changed our name, but our commitment remains the same: to offer personalized services to assist you in managing and protecting your wealth.

On June 12, 2023, Credit Suisse Group AG was acquired by UBS Group AG. As part of this process, we have migrated our documents and legal information to the new UBS platform in Brazil (in Portuguese only).

Why UBS is your right partner

* "Best Chief Investment Office in Private Banking," PWM/ The Banker Global Private Banking Awards 2025

1 "Best Global Private Bank," PWM/ The Banker Global Private Banking Awards 2025

2 Based on publicly available data.

3 UBS AG. See information on our latest ratings here

The price, the value of investments, and the profit derived from them may both decrease and increase. You may not recover the amount originally invested.

UBS does not provide legal or tax advice. Before making any investment or deciding not to do so, seek guidance from an independent advisor of your choice for specific advice.