Signaling improvement

Signaling improvement

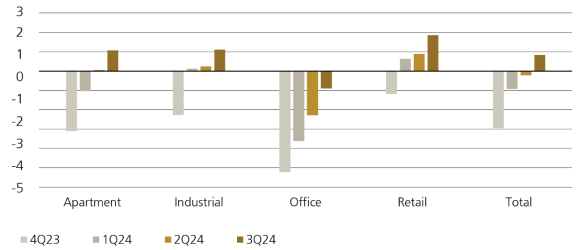

Leading indicators signal continued improvement in US real estate markets, and recovery has begun. Interest rates are volatile, but as of early November 2024, rates across the yield curve remain below their Spring 2024 highs. As competition for high-quality investments increases, lenders are charging lower spreads than earlier in the year. Transaction volume is poised to grow, and quarterly returns turned positive for all but the troubled office sector (see Figure 1).

Figure 1: Quarterly total returns (%)

Still, the downturn is not completely over for private real estate investors. The unlevered NCREIF Property Index declined for seven consecutive quarters from 4Q22 to 2Q24 but posted a positive total return of 0.8% in 3Q24. Income return of 1.2% offset mild depreciation of -0.4% to lift the index into positive territory. Throughout this recent downturn, net operating income growth remained positive for all but the office sector, which softened the negative effect of higher interest rates and rising cap rates. It’s likely that income growth will continue to carry the day during much of the recovery.

In November 2024, the US held a pivotal election where the balance of power shifted firmly to the conservative party. We cannot know with certainty what policies will be enacted in the coming years. Relative to a pre-election forecast, expectations are that taxes, regulation, and immigration will be lower; while tariffs, inflation and interest rates will increase. Higher interest rates – fueled by inflation and deficit spending – would weigh on the private real estate sector, but the drag would be more than offset by lower taxes, less regulation and rental rate gains. Ultimately, the results of the US election should boost the real estate sector in the near-term, and recovery should remain intact.

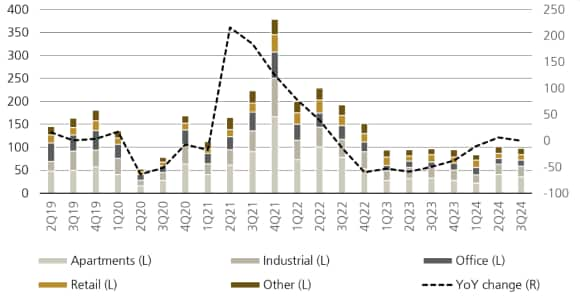

The Fed’s decision to begin lowering rates signals a turning point for commercial real estate, but for a true bull market to take effect, transaction volume must increase substantially, creating comparable sales and building pricing confidence. During 3Q24, transaction volume was flat compared to a year earlier at USD 97 billion. Property owners can resist the discounted prices demanded by buyers as net operating income continues to grow across most sectors.

Figure 2: US transactions (USD billion, % change YoY)

Primary sectors

Primary sectors

Figure 3: October US real estate return expectations

Total return (%) | Total return (%) | 2021 | 2021 | 2022 | 2022 | 2023 | 2023 | 2024 forecast | 2024 forecast | 3-year forecast | 3-year forecast |

|---|---|---|---|---|---|---|---|---|---|---|---|

Total return (%) | Apartment | 2021 | 6.9 | 2022 | (3.2) | 2023 | (3.1) | 2024 forecast | 0.4 | 3-year forecast | 6.4 |

Total return (%) | Industrial | 2021 | 13.3 | 2022 | (3.6) | 2023 | (2.3) | 2024 forecast | 1.8) | 3-year forecast | 6.5 |

Total return (%) | Office | 2021 | 1.8 | 2022 | (4.6) | 2023 | (5.2) | 2024 forecast | (8.7) | 3-year forecast | 2.3 |

Total return (%) | Retail | 2021 | 2.2 | 2022 | (1.6) | 2023 | (1.2) | 2024 forecast | 3.5 | 3-year forecast | 6.9 |

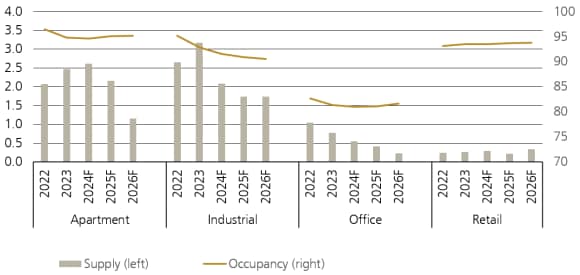

Apartments

The US apartment sector continues to stabilize as low unemployment and moderating inflation support tenant demand for rental units. Outpacing new supply, growth in demand pushed the national vacancy rate down to 5.3%. Rents increased marginally by 0.3% year over year (YoY). Values are down, and buyers are taking advantage of the possibility of buying at discounts. Apartment transactions totaled USD 35.8 billion during 3Q24, an increase of 9% YoY that followed a 27% annual increase the prior quarter. Nationally, the ODCE NPI apartment sector delivered an annual total unlevered return of –3.3% in the year ending September 2024. Values during 3Q24 remained unchanged, a welcome turnaround after seven quarters of depreciation. As supply rates decrease over the next three years, apartment returns should improve (see Figure 3).

Industrial

Even as demand is contesting with the tail-end of a wave of new supply, total returns for industrial remain positive. New deliveries pushed the availability rate up by 10bps over the quarter and 180bps over the year to 8.3%, the highest national availability rate in eight years, and industrial rents rose by just 1.6% YoY. However, new leases are being signed at rent levels that have increased 25% over the past three years. Transaction volumes picked up slightly during the quarter, down 2% from a year ago and compared to a decline of 6% during the previous quarter. For the first time in seven quarters industrial values rose for ODCE NPI industrial, increasing by 0.025%. Over the past year, total returns declined by –0.8% but momentum is positive. Year-to-date 2024, industrial returns are up 1.3%.

Office

The US office market is a long way from stabilization, but there was one spot of good news during 3Q24 when vacancy rates held steady at 19.0%. Leasing demand was weak but positive for class A properties in both Suburban and Downtown locations; while lower-quality office buildings struggled with tenants giving back space and low leasing velocity. Risk premiums available in the capital market are not yet high enough to entice buyers or encourage lenders to become more active. Office transactions totaled USD 57 billion in the year ended September 2024, compared to USD 153 billion in the year ended September 2022, before the one-two punch of increased work-from-home and higher interest rates. ODCE NPI office delivered a total unlevered return of –13.3% in the year ending 3Q24, which was less negative than last quarter’s performance. The extreme depth of the downturn may have passed for the office sector, but recovery back to pre-pandemic occupancy and values is expected to take many years.

Retail

US retail investments are well into recovery after three consecutive quarters of positive total return. During 3Q24, NPI retail returned 1.9%, including an appreciation return of 0.5% during the quarter. Solid demand for retail space, combined with minimal new development, kept occupancy at a record high. As shown in Figure 4, occupancy remained unchanged over the quarter at 93.5% in 3Q24 and was 10bps higher than a year ago. Buyers are not yet responding to retail’s strong fundamentals; though lower interest rates should help increase transactions over the next few quarters. Retail transactions totaled USD 11.6 billion during 3Q24, which is down 27% compared to a year earlier. For the year ended September 2024, NPI retail increased 2.2%, the only major commercial real estate sector to boast positive performance over the full year.

Figure 4: Sector fundamentals (Completion rate, %)

Source: CBRE-Econometric Advisors, September 2024. Note: Completion rates shown are the total supply delivered within the year as a percentage of inventory. Past performance is not a guarantee for future results.

Light at the end of the tunnel

Light at the end of the tunnel

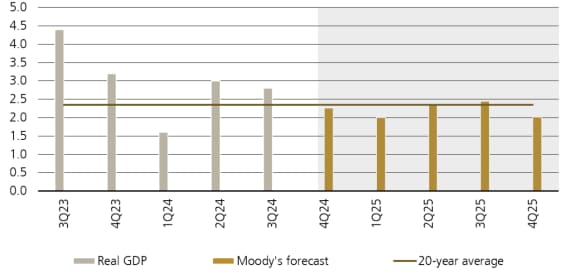

Economic viewpoint

Recovery is beginning for private real estate as the transaction market finds its footing and total returns turn positive, supported by an outlook for continued growth in the economy and lower borrowing costs. After several quarters of guessing and mixed economic results, the labor market and inflation cooled enough to allow the Federal Reserve to begin cutting rates. US economic growth remained strong as GDP increased by an annualized 2.8% during the third quarter of 2024 (see Figure 5). US GDP is growing at or near potential, which helps maintain positive momentum in real estate space markets and net operating income growth.

Consumption typically accounts for two-thirds of the US economy. During the year ended September 2024, consumers remained the key driver of growth with spending coming in above consensus expectations at 3.7%. Nonfarm payrolls also remained robust during September with an increase of 254,000 jobs, well above expectations. During the same period, the unemployment rate decreased slightly to 4.1% and wage growth accelerated, rising by 4.0% YoY.

Figure 5: Real GDP quarterly annualized forecast (%)

Current consensus is for approximately one Federal Funds Rate cut per meeting until mid-2025. If consumer spending and labor market conditions remain strong, the Federal Reserve has room to slow the pace of rate cuts somewhat. However, many datapoints still show a cooling labor market, which would entice more easing, especially with inflation nearing target.

While not yet at its 2% target, inflation is trending lower. During September, the US economy recorded a 2.1% YoY increase in the Fed’s preferred inflation metric, the core personal-consumption expenditures index, which excludes food and energy. Further rate cuts anticipated this year and in 2025 would continue to support economic growth, real estate revenue and investor optimism.

If policy changes cause tariffs to increase and taxes to decrease, inflation may reverse course and move higher. Higher inflation would likely prompt the Fed to pause rate cuts or even move the Federal Funds Rate up to slow the pace of inflation. In fact, the market is already pricing in higher inflation expectations which has caused interest rates in longer-dated bonds to increase. Thus far, those increases have not been enough to alter our view that strong income growth with tailwinds from decreasing supply creates more than enough momentum to sustain improvements in commercial real estate markets. The Fed should continue to lower rates on the short end of the curve, which will help control the cost of debt. As a result, the recovery in US private real estate markets remains on track.

The Red Thread – Private Markets

Our semi-annual insights into private markets

Our semi-annual insights into private markets