The inflection point

Technology and customization will shape the future of asset management

![]()

header.search.error

Technology and customization will shape the future of asset management

Asset management stands at a critical juncture. Megatrends like the rise of indexing and alternatives will continue to disrupt and – ultimately – drive the industry forward. However, Barry Gill argues that technology and increasing customization will be defining trends of the next ten years.

To really understand strategic inflection points, you must first realize that they have almost always been gestating for a while. As Hemingway’s character, Mike Campbell, answered when asked how he went bankrupt, “Gradually, then suddenly.”

In other words, the threats to our business model are already upon us and we cannot rely on approaches that have worked for us in the past doing so in future. We need to spot the signals that offer inklings to where we are all headed and act accordingly. In my mind, this means fully embracing technology in ways that asset managers have not previously been accustomed to – using it to create efficiencies, scale operations to allow for mass customization, and also enhance the investment process.

Part of this involves taking more notice of what retail clients are doing. They are increasingly complex – with tax, reporting and client service demands that extend far beyond general performance outcomes and the liability matching requirements of defined benefit pension and insurance mandates.

Allied to this, the democratization of alternatives has, been driven by wealth management clients and defined contribution pension pots. The resulting trend towards liquid alternatives reflects an almost insatiable demand from private investors to access the somewhat mythical illiquidity premium.

And with fee compression, rising costs and increasing client demands rippling through the industry, there isn’t long to course correct. While extraordinary market performance used to more than offset this fee pressure on revenue growth, those days have long since passed.

People don’t want a quarter inch drill, they want a quarter inch hole.

We need to recalibrate our attention, and a good place to start is with truly understanding clients’ needs. “People don’t want a quarter inch drill, they want a quarter inch hole.” In a 1960 article entitled ‘Marketing Myopia’, Theodore Levitt, the late Harvard Business School marketing professor, correctly identified that companies spend too much time thinking about producing goods or services and not enough time thinking about what the customer actually wants. He “encouraged executives to switch from a production orientation to a consumer orientation.”

Levitt’s insight still holds. Put a slightly different way, and to paraphrase Peter Drucker, ‘clients never buy what you think you sold them’. To understand and unlock what this really means, asset managers need to look at the world the way our clients do. This means recognizing that no one ever wakes up in the morning and says, “I want to buy a mutual fund.” It simply doesn’t happen. They want value, not vehicles. They want exposure to themes, asset classes, and differentiated investment strategies; and, increasingly, they want cutting-edge digital client service, customization, and tax management.

Whether you serve all this up to them in a mutual fund, an ETF, or a separately managed account (SMA) is almost irrelevant. The vehicle only matters insofar as it either constrains or enhances your ability to deliver value.

For example, a mutual fund is just a wrapper that solves for fixed cost delivery of investment performance. They have proved to be extremely efficient for asset managers, but have actually catalyzed little to no innovation in terms of delivering value to the end client.

ETFs, on the other hand, have added a new dimension to all parts of the investment value chain. They are essentially a technology offering cost-effective access to specific indexes, themes and investment returns. However, ETFs are to funds what electric vehicles (EVs) are to internal combustion vehicles. To use Clayton Christensen’s lexicon, they are ‘sustaining innovations’ as, while the auto industry is being disrupted, our driving experience really isn’t (i.e., EVs are still just a box on four wheels with a steering wheel).

Yet SMAs are genuinely innovative from a client’s perspective – which, after all, is the only one that matters. They constitute a genuinely ‘disruptive innovation’ akin to autonomous driving; a total game-changer. And while yet to take off in Europe and Asia, the US ‘pilot’ has proven impressive levels of portfolio customization, as well as tax management and client reporting benefits.

If built on the solid foundations of technology and indexing capability, it is possible to scale the platform (and assets) and dramatically drive down the breakeven production point of SMAs.

Forecasts from Cerulli support the above hypothesis, too. ETF assets are projected to grow at 9.5% per annum from 2021–2026 and SMA assets by 7.2% over the same period. Meanwhile, mutual fund assets are predicted to decrease by 2.0% annually.1

We are all suckers for a good story – and as markets are driven by people, narratives play out clearly in financial form. The elephant in the room here is the narrative around alpha which, while no longer the be all and end all, is still what many clients pay for and expect. In short, the rise of indexing and in many ways the rise of alternatives are in no small part due to the inability of active managers to reliably generate alpha and price it accordingly.

Indexing and alternatives have stronger stories behind them.

Index funds provide a solution for investors comfortable exchanging alpha, which at times is costly, for more affordable market returns that are ‘just good enough’. By focusing on delivering market returns in the most precise and cost-effective way, indexing has essentially created a reputation for being the most reliable tool for investors. Where active has failed, indexing has stepped in and captured market share in the process.

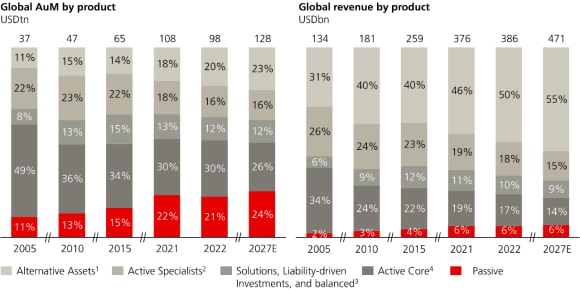

Similarly, the alternatives industry has capitalized on the opportunity by selling a story of highly prized and exclusive alpha. You can see below the impressive job private markets have done, with a near doubling of assets since 2005. More impressively, they now account for over 50% of global asset management revenue, despite representing less than a quarter of the assets.

However (and as with any trade), the more money that piles in, the more the available alpha pool gets dispersed. In private markets, the elusive and hard to value illiquidity premium is undoubtedly lower now that more private capital is chasing fewer opportunities. This is finance 101.

According to BCG, a consultancy, the overall fee share of the AUM pool was broadly flat between 2004 and 2022.2 Therefore, despite the disruption of indexing, clients are essentially saying they will pay a lot for alpha but only believe it exists in private markets.

Regardless, all active managers – both public and private – must be self-critical of how they price their offerings and ensure their investment approach is structured in a way that not only delivers value efficiently, but also prices each layer of value (including alpha generation) appropriately. And while I see indexing becoming an organizational bedrock, this should not be confused with a dogmatic argument for the efficiency of markets.

Technology is key to underpinning, underwriting, and ultimately creating a successful and future-proofed asset manager. Serving as an efficiency tool, it can improve the implementation portfolio ideas and trades more efficiently. It is working its way up the value chain and already starting to seep into the investment process as investment teams strive to find the crucial edge. Artificial intelligence – the latest edge case of technological progress – can clearly help with the ‘thinking’ activities of research analysis, problem solving and portfolio management and needs to be applied in a way that frees up more blocks of quiet, uninterrupted time. This is when the magic happens in active management.

The transformative potential of technology to automate, simplify, and scale our many operational processes is undeniable. Once a platform is put in place it creates the opportunity for material margin improvement as the asset base scales. Over time, as you attract more and more assets onto a common platform you can operate on a fundamentally different cost paradigm than other companies, thereby delivering a compelling value proposition for clients seeking alpha in low-cost solutions.

Client needs are increasingly varied and an asset manager’s ability to deliver on them will be dependent on a common infrastructure with shared processes capable of delivering on a greater need set. By creating a unified technology infrastructure that underpins this heterogeneity of activities, a flexible business model can be created. From here, the innovation flywheel accelerates and the platform can continuously be redefined to solve for an increasingly complex and unique set of client needs.

Any management thinker worth their salt will tell you that business strategy can be boiled down to two fundamental questions: where to play?, and how to win? To be successful in delivering for clients, asset managers will need to make difficult decisions about where to prioritize and focus. As Steve Jobs famously said, “I’m as proud of many of the things we haven’t done as the things we have done. Innovation is saying no to a thousand things.”

This essentially means identifying the true relationship between price, cost and value. If done well, relationships, loyalty and trust can be built with clients. These are the crucial factors that drive the long-term success of any business. However, even if firms manage to answer the above exam questions with flying colors, implementation will be meaningless unless they continue to cultivate a culture capable of radical collaboration and teamwork. Not all parts of the business will be able to move at the same time, and at the same pace.

Disruption is something all leaders and organizations need to be actively thinking about all the time. Who could steal our lunch and what is the best business model and operating structure to deliver value to our clients? To survive and prosper, we need to be laser focused on where each marginal dollar of investment is directed. And if it isn’t going towards technology or improving customization, then we could have a problem.

Investing through change

An exploration of disruptive and innovative forces shaping economies and markets.