How do electric vehicles affect global oil demand?

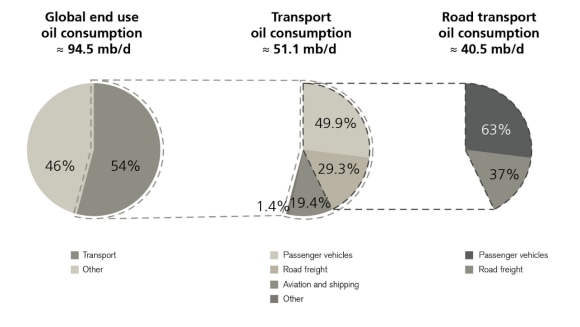

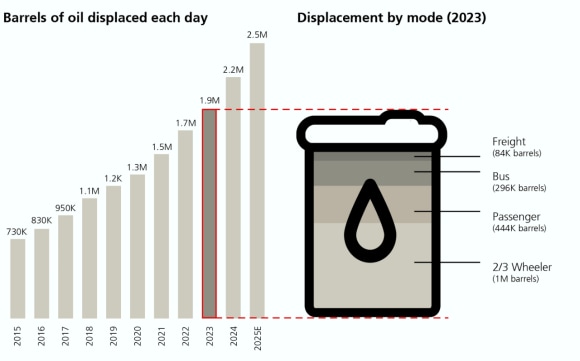

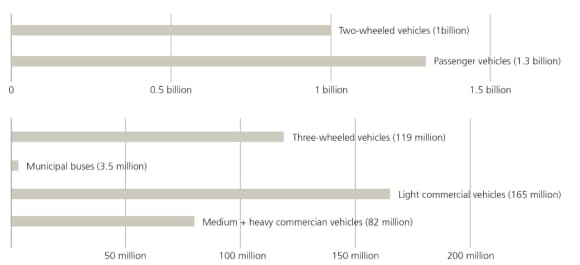

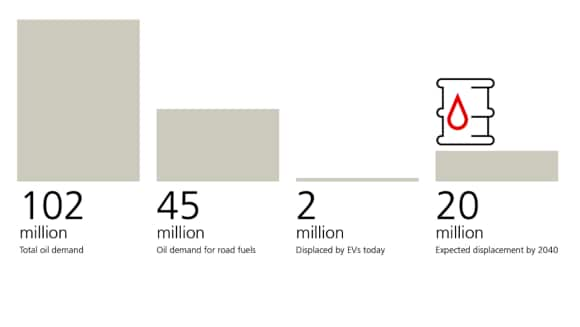

With the penetration of electric vehicles in new car sales skyrocketing in several countries, peak oil demand – the point in time when the highest level of global crude demand is reached – is now forecast to occur at the end of this decade.