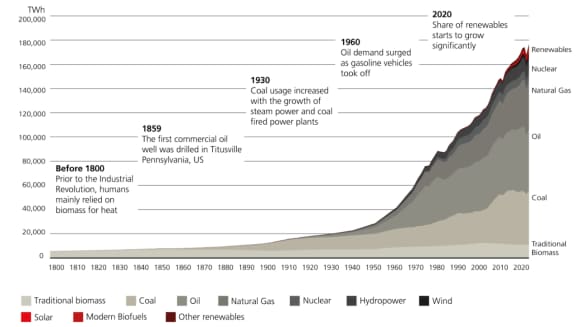

Energy evolution: the transition from gray to green

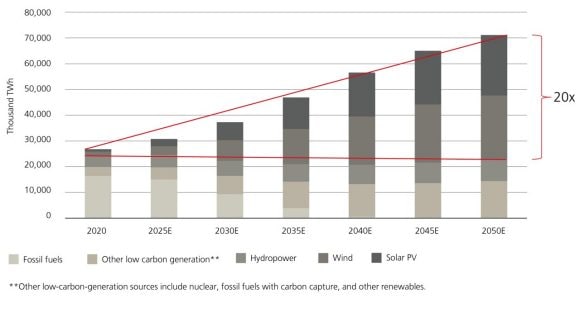

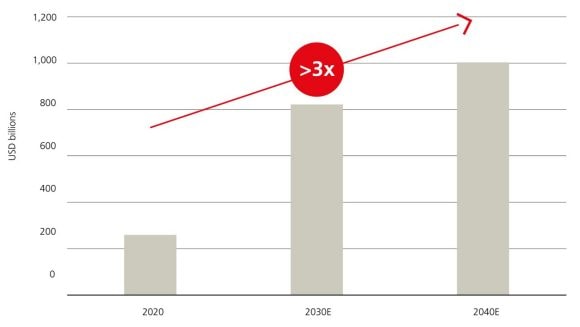

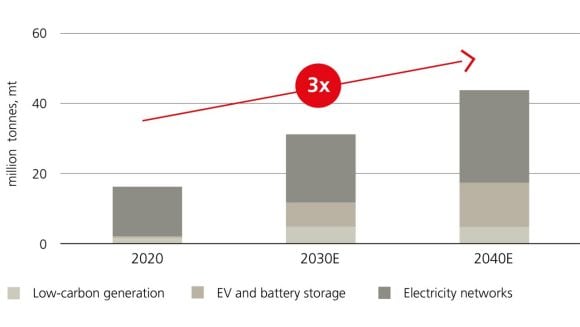

Renewable energy is currently the most economical way to mitigate climate change and ensure energy security. Electrification, networks, and critical minerals for the energy transition are likely to benefit from increased spending.