Q2 equity market outlook

What can markets expect amid high energy prices and ongoing inflation concerns?

Market volatility – energy prices, inflation and growth

Market volatility – energy prices, inflation and growth

- The Russia-Ukraine conflict resulted in a large spike in oil prices due to supply crunch fears

- As a result, we think that the fall in inflation will happen later than initially expected

- These will likely negatively impact economic growth and result in reduced activity in the medium term

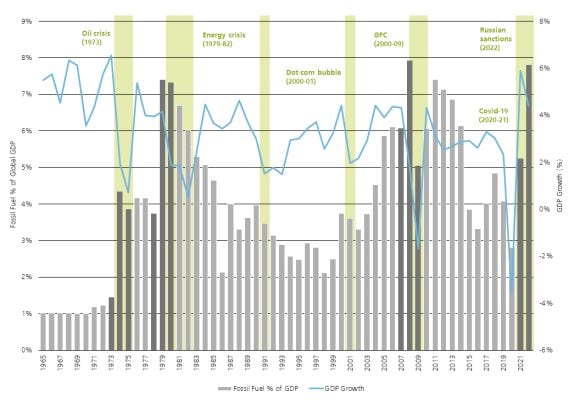

Historically, economic shocks have been preceded by sharp rises in energy prices

Historically, economic shocks have been preceded by sharp rises in energy prices

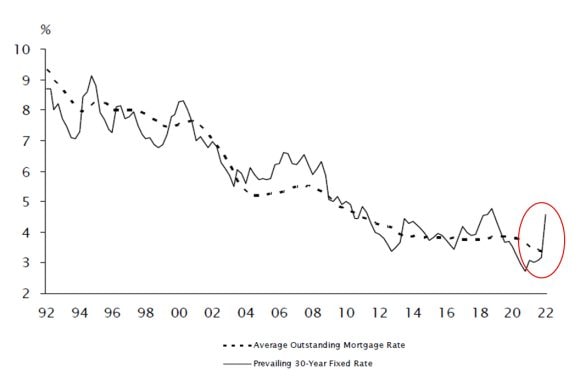

Not much room left for long term interest rates to rise

Not much room left for long term interest rates to rise

- Markets are pricing in more interest rate hikes by the Fed in 2022

- This will likely cause long term bond yields to rise and, in turn, the financing costs to increase

- The long-term fixed mortgage rate has already exceeded the new mortgage rate, indicating a potential slowdown in US housing market and economic activity

Limited room for interest rates to rise

Limited room for interest rates to rise

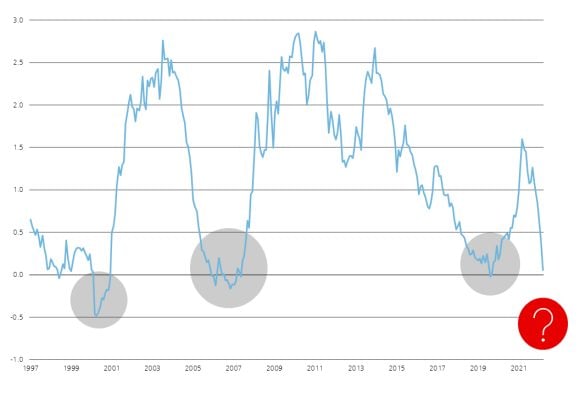

10-year to 2-year US Treasury spreads are signaling global weakness

10-year to 2-year US Treasury spreads are signaling global weakness

- Historically, a close to zero 10Y-2Y Treasury yield spread has been followed by economic slowdowns

- Therefore, the recent sharp fall in bond yield spreads would suggest a slowdown

- One of the biggest risks we face is too much liquidity tightening and interest rate increases at the same time

10-Year Treasury constant maturity minus 2-Year Treasury constant maturity

10-Year Treasury constant maturity minus 2-Year Treasury constant maturity

Nicole Lim, Concentrated Alpha Equity Specialist

Nicole Lim, Concentrated Alpha Equity Specialist

Q1 2022 Global Market Review

The Concentrated Alpha equity team looks at the impact of high oil prices on economic activity.

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Whether you have a question or a request, we will be happy to get in touch with you.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.