China and net zero: An existential sustainability issue

It will be impossible to reach net zero without China. Western investors therefore need to put certain ideological differences to one side and seek to understand China in its fullest context, argues Lucy Thomas.

First, an analogy. The concept of transition investing has grown in popularity in recent years. Climate transition strategies typically contain two investment sleeves: solutions providers and improvers. The latter often include companies that are not yet sustainable from a net-zero perspective. Such investments are included on the basis they will improve and because they are critical to transitioning away from fossil fuels. After all, decarbonizing your portfolio is not the same as decarbonizing the economy – and while divesting may clear one’s conscience, it is unlikely to help green the global economy.

As with transition investing, thinking about China’s global role in reaching net zero requires nuance. And the logic is a little circular.

Climate change presents a systemic risk for investors which cannot be addressed through one portfolio alone. Instead, it requires real-world decarbonization. This means all countries and regions in the world need to reach net zero .

This means all countries and regions in the world need to reach net zero.

Capital allocators must therefore consider how their global investment decisions influence the real economy trajectory of emissions, even as they consider the impact on their portfolios and future returns by the success or failure of that journey. Of course, companies and policymakers in China need to do their part, but investors need to speak with their capital, make their views on China’s role in net zero clear, and provide support for progress with the investment decisions in their portfolios.

Let us look at the facts.

Finding a path forward

Finding a path forward

China’s president Xi Jinping has pledged to reach net zero by 2060. Perhaps more importantly though, China also committed to a peak in CO2 emissions by 2030, as their emissions have continued to rise steadily – though a recent report from Carbon Brief showed some encouraging signs on this front.1 This underscores the magnitude of shorter-term climate commitments they are making, that may not seem apparent given the 2060 goal. To get there, local governments have mobilized to create decarbonization strategies and plans for the short term (e.g., price-based market mechanisms, green bonds) and the long term (e.g., climate tech R&D). Progress is being made across key sectors, such as transport and power, as well as in hard-to-abate sectors like industrial manufacturing. The effects are rippling across global markets.

Much is made of China’s continued reliance on coal in its power supply. Given peak load capacity, domestic power outages and rising energy security concerns, China appears to be taking a pragmatic approach to keeping its proverbial lights on. But their long-term goal of carbon neutrality remains clear. The delicate balancing act will come in meeting interim targets; after all, climate and ecological tipping points are deaf to domestic challenges and geopolitical excuses.

In most instances, market-based tools would play a critical role in decarbonization. It is a little different for China. Its emissions trading scheme (ETS) remains embryonic in part because China is less about short-term actions such as price-based market mechanisms. Instead, its eye is on the long term; the state’s transition policies have already prompted primary industries to invest in R&D including transition technologies that are not yet economically viable (i.e., CCS, hydrogen).

In many ways, energy security and hence the development of decarbonization technologies take priority over transitioning away from coal for China. The building of ultra-efficient coal plants is intended to help the country reach peak emissions by replacing old ones, yet the replacement rate is not catching up fast enough. It is a risky strategy, but pivoting entirely away from coal is unfortunately not a priority.

A renewables and clean energy leader

More positively, it is no secret that China is a clear leader in many aspects of green technology. And, while commercial and geopolitical reasoning may underpin some of the underlying motive, it still reflects a strategic commitment to decarbonize.

Its success here is undeniable. Having captured 80% of the supply chain for solar panels2 and recently become the world’s largest manufacturer of electric vehicles3, much of the rest of world looks on in envy and is frantically trying to either emulate or at least ensure the global supply of renewables is more diversified. Meanwhile, China has effectively been an exporter of renewable deflation to other parts of the world by running down the costs of rare earth equipment. Prices for rare earths sank to their lowest since late 2020 as soft demand from green energy companies and the automotive sector combined with rising supply from China.4

Yet although China’s global position is dominant, it remains an economy in transition.

As the EIA conclude, “China’s innovation system will need to be harnessed appropriately to stimulate the wide range of low-carbon energy technologies needed.” Commenting on the latest Five-Year Plan, they go on to state, “Current Chinese policy incentives are better suited to large-scale technologies like CCUS and biorefining than network infrastructure and consumer-facing products, which are China’s current manufacturing strengths.”5

Climate finance

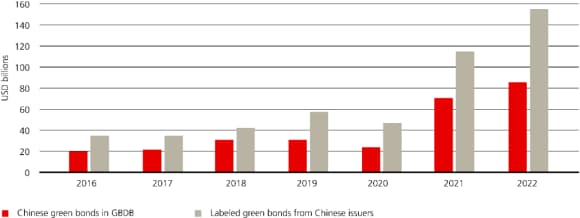

A major part of transitioning to net zero is financing it. Green bonds have seen explosive growth in China as the country seeks to embed itself as a climate finance leader. Indeed, it recorded USD 85.4bn (RMB 575.2 billion) in the Climate Bonds Initiative green bond database (GBDB) – the largest of any country.

“China has seen incredible growth in green finance over the past few years, reflecting rapid progress in clean energy, low-carbon transport and other areas,” says Sean Kidney of the Climate Bonds Initiative. He goes on, “There is a huge amount still to do, especially in the transition of energy and industrial sectors; green and transition bonds will help drive that change.”6

Chart 5: China’s green bond issuance continued to expand in 2022

As Kidney notes, there is still more to be done as the proportion of labelled green bonds vs. China’s overall debt issuance remains below 2% in the onshore market. However, as the market scales so will the diversity of issuers and investors.

While China’s change to SOE's have been dominant in thematic debt issuance, we expect this to expand to public and private organisations, and for both domestic and international investors to participate.

China has seen incredible growth in green finance over the last few years, reflecting rapid progress in clean energy, low-carbon transport and other areas.

China’s large-scale transition will undoubtedly create opportunities for all types of investors.

Policy certainty and finding common ground

Tensions within ESG are nothing new. In the US, for example, ESG and sustainable investing has become a hot potato tossed back and forth between conservative Republicans and more liberal Democrats. Equally, the ideological gap between the West and China is extreme and has the capacity to impact Western investment in China’s energy transition.

It feels like we need some tangible common ground.

Barely a day goes by without another call from the (Western) sustainable investment community for greater levels of policy certainty and commitment to net zero. Yet I rarely sense any hint of self-reflection or irony as they scorn inefficient decision-making and policy paralysis.

It is worth remembering that achieving carbon neutrality is essential to China’s long-term growth and prosperity. And according to the World Bank Group, the country is well positioned to meet its climate commitments and transition to a carbon-neutral economy while still continuing to grow its economy.7 So for all its perceived faults, China’s political model has the ability to mobilize quickly and to chart a long-term course with a high degree of policy certainty.

The entrepreneurial and socially conscious side of Chinese citizens should not be ignored either. Take pollution. As a result of increasing awareness and frustration with urban pollution levels, a series of policy interventions has led to a rapid decline in particulate matter levels since 2014. Indeed, the hugely successful Blue Map App – which allows users to track air quality and was an Earthshot Prize finalist in 2021 – is a prime example of the intricate positive feedback loop between innovation and civic engagement. As the Earthshot official website states, “Blue Map App demonstrates the power of transparency and accountability. It also teaches the world a lesson — that clever innovation, combined with public participation, is a recipe for progress.”

To some in the West though, China and sustainability will never belong in the same sentence. Yet as Dr. Keyu Jin puts it, “Recognizing that there is some wisdom to China’s approach doesn’t mean endorsing all of it”8 And in The Party’s own words, “moving forward with the times” (yu shi ju jin) is critical.

China’s future, like everyone’s, is not yet set in stone. Addressing climate risk for large asset owners (universal owners), and for the global environment, therefore requires investors to look through a more nuanced lens. For if China fails, we all do.

For if China fails, we all do.

About the author

Lucy Thomas

Head of Sustainable Investing and Impact

Lucy Thomas, Head of Sustainable Investing and Impact for UBS Asset Management since January 2022. Previously Head of Investment Stewardship at TCorp, developing a sustainable investing framework and overseeing AUD110bn as a member of the Management Investment Committee. Former Global Head of Sustainable Investment at Willis Towers Watson (2014-2018). Lucy is a member of TCFD and the Investor Advisory Group of IFRS International Sustainability Standards Board. She holds the Chartered Financial Analyst (CFA) Charterholder designation.

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Whether you have a question or a request, we will be happy to get in touch with you.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.