The Red Thread

Diversifying the diversifier

Challenges for multi-manager alternatives in portfolios

![]()

header.search.error

The Red Thread

Challenges for multi-manager alternatives in portfolios

Alternatives play a key role as a diversifier in portfolios. Daniel Edelman and Edoardo Rulli look at the challenges and benefits of using multi-managers to broaden access and capture distinctive market traits.

A desk, some pads, a pencil, and a large basket – to hold all of my mistakes.

Albert Einstein

I wish I had an answer to that because I'm tired of answering that question.

Yogi Berra

The word diversification is about as ambiguous as is the word risk. When told “don't put all your eggs in one basket,” we quick-wittedly reply “What kind of eggs? How many baskets? What kinds of baskets? Which eggs in which baskets?”

We label this the problem of the three ‘R's’ – replication, risk reduction, and representation. Diversification has multiple dimensions, and the term is frequently used imprecisely to mean only one of its several facets.

The importance of diversification is even more pronounced in alternatives, particularly in the segment for multi-managed portfolios such as hedge funds and real estate. Diversify too little, and your portfolio misses attractive opportunities while suffering a painful drawdown.

Diversify too much, and your portfolio becomes an unmanageable, index-like vehicle with no alpha. Yet diversification as a concept is in a state of ever-changing evolution. New asset classes, new investor dynamics, and changing world financial markets all point to a different quality for diversification today than in the past. It is time for a rethink on the topic, a ’Diversification 2.0’, a new prototype managing the three Rs in the post-COVID world. Our views combine both recent academic as well as practitioner experience related to multi-manager, multi-asset alternative investments.

Diversification challenges for multi-managed portfolios

The appeal of non-traditional investments is straightforward. Real estate, hedge funds and other alternatives offer the potential for returns uncorrelated to equities and bonds, thereby reducing overall portfolio risk while isolating potential sources of alpha.

Funds of hedge funds (FoHF) and multi-manager real estate programs (MMRE) offer investors additional benefits including potential exposure to otherwise inaccessible managers, markets and strategies. FoHFs endeavor to secure capacity with the most successful traders and build portfolios spanning disparate directional and arbitrage strategies. MMREs take pride in potentially providing unique inflation protection (as rental income typically grows in line with price appreciation), new sources of income (through rents paid by occupants leasing properties) and capital appreciation (via active management).

As pooled investment vehicles, both MMREs and FoHFs seek to negotiate preferential fees, terms, transparency and investment conditions for their clients; design both commingled and bespoke offerings; hand-craft desired outcomes through aggressive side-letter negotiation; offer potentially favorable terms as cornerstone investors in new launches; and opportunistically join in co-investment opportunities with their network of submanagers. With these capabilities, MMREs and FoHFs endeavor to address the three R's of diversification by reducing risk, broadening access, and capturing market traits.

Yet markets and economies evolve over time, as does the nebulous concept of diversification. Long gone are the days when one could simply throw money at a handful of asset classes and geographies to create a diversified product. FoHF and MMRE specialists must grapple with changing geopolitical and financial market regimes to access alpha and reduce risk.

Indeed, the era of low interest rates, low inflation, low regulation, low global market volatility and negative correlation between bonds and equities are gone: the COVID crisis marks the turning point.1 Climate change has had significant impact on real estate investments and MMREs.2 In addition, the rise of passive investing (including rules-based)3 has also increased pressure on hedge funds and FoHFs.

FoHFs have also seen increased competition from multi-platform firms that combine different strategies run by in-house portfolio managers. Such multi-strategy shops can offer comparable diversification while reducing overall fees.

Consolidation has occurred as investors have reallocated to single-manager funds or else withdrawn entirely from these alternatives. According to Hedge Fund Research, the FoHF industry has experienced net outflows every year since 2008, totaling nearly USD 340 billion (see Figure 1). One might conclude that investors may have sacrificed some multi-manager diversification in favor of a different set of single-manager risks, ostensibly to improve performance.

With Intelligence Limited puts out a semiannual “Billion Dollar Club” survey of FoHFs with over USD 1 billion in assets. In the past few years, the number of FoHFs making the cut has dropped from 65 to 58, and the “Super League” (FoHFs with over USD 10 billion in assets) similarly has reduced from eighteen to fourteen. Consolidation has resulted in market share of the top ten largest FoHFs in this survey growing from 54% to 61% (see Figure 2).

Multi-managed portfolio teams fight back

It is our opinion that in the era leading up to and following COVID, sophisticated institutional MMREs and FoHFs have fought back in several ways to regain alpha and expand the benefits of diversification.

First, MMREs have broadened their reach into new market structures. For example, we believe the most successful MMREs have found ways of connecting retail clients with private market allocations – long the province of only institutional investors due to scale, access and informational asymmetries. Such private market opportunities offer higher return potential, lower correlation with public equity markets, inflation protection and exposure to harder-to-access markets and strategies. As transparency and the availability of data in these semi-liquid structures have improved, regulators have allowed greater access to non-institutional investors, which MMREs have facilitated.

Second, we have observed that leading MMREs have expanded their holdings to include those that would be difficult or impossible to replicate in the open market. For instance, providing unlisted real estate solutions means that non-institutional investors can benefit from the MMRE's network. Portfolios can be constructed via multiple routes, such as unlisted funds, co-investments, recapitalizations, and secondaries that are selected by an MMRE and actively positioned within guidelines agreed with the clients. Diversification is amplified as investors do not face the risk of individual funds or managers.

Third, FoHFs have embraced new sources of diversification and alpha in the form of alternative risk premia, ESG, generative AI, digital assets and other niche opportunities. Moreover, we have seen how leading FoHFs have morphed into ’solution providers’ and blurred the boundary between internal and external trading. Most notably, some FoHFs now include a range of tactical co-investment opportunities where the FoHF teams up with individual hedge funds in their network to pursue tactical ideas.

Multi-managers look at many facets of diversification

Any standalone investor can compute a basic ’benefit of diversification’: calculate the portfolio’s overall expected variance using returns, variances and covariances of the underlying holdings. Now compute the same but assume all holdings have a correlation of one to each other. Subtract the latter from the former and presto… the wonders of diversification.

While this all looks pretty on paper, it ignores some irksome questions. What if all correlations go to one? Is portfolio variance the correct measure of risk? Why only consider a single point in time? In our opinion, risk managers in a FoHF can delve deeply into the three Rs by exploring a much broader concept of diversification measures.

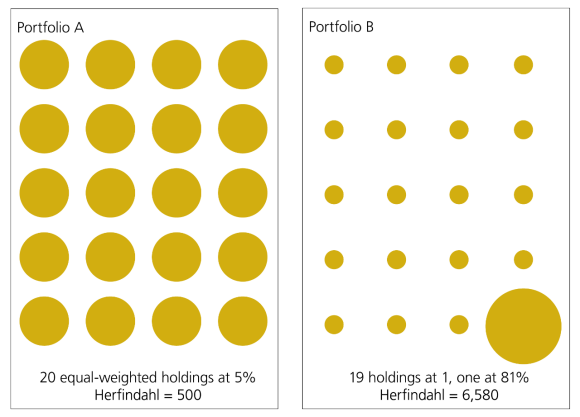

Name diversification: Academics tend to focus on risk diversification whereas practitioners are usually more concerned about holdings diversification, i.e., the number of unique line items in a portfolio.4 For bonds, this could suggest either issue- or issuer-related groupings; for equities, individual company names; for FoHFs, number of underlying funds and firms. Holdings diversification suggests protection against outliers or concentration risk, even reputation risk. A basic measure of name diversification is the Herfindahl Index (HI), which measures diversification on a scale of zero to 10,000. The higher the number, the greater the concentration risk and risk of single-name failure.5

Tail-risk diversification: Alternatives differ from traditional investments in countless ways. They often exhibit properties of skewness (asymmetry between wins and losses) and kurtosis (excessive performance in the tails and center of the distribution). In the traditional case, mean-variance models are concerned with covariances, i.e., the behavior of pairs of assets. To improve diversification in the presence of skewness, one must look not only at each individual holding and each pair of holdings, but also every triplet of holdings. Diversification accounting for kurtosis requires examination also of every quartet of holdings. We humans are not wired to think in such higher dimensions.

Liquidity diversification: Sophisticated risk management plans can be designed for market crises where liquidity dries up, causing potential asset-liability mismatches. For mutual funds, this could lead to regulatory risk. For hedge funds and other alternatives, illiquid situations may result in reputational risk, compelling managers to institute gates, withhold redemptions or make inglorious payments-in-kind of non-tradeable assets. Liquidity diversification also encompasses the deeper topic of mismatches between contractual liquidity terms and the underlying liquidity of one's subadvisors.

Capacity diversification: FoHF allocators compete with one another for scare capacity. A newly launched hedge fund, or a veteran who is accepting new money, will only entertain a fixed amount of capital inflows. Similarly, rookie managers who may be the superstars of tomorrow may take on early investors and close their shop permanently to new subscribers. Capacity diversification involves game theory: how much capacity is needed now to diversify our portfolios in the future?

Too few cooks in the alternatives kitchen

Academics and practitioners have debated endlessly the question concerning the optimal number of holdings needed to diversify a portfolio adequately. The controversy stems back to the dawn of modern portfolio theory. In this ivory tower world, investors live in a mean-variance world of normal distributions where they face neither transaction costs nor liquidity constraints. Authorities including Evans & Archer (1968), Fama (1976), Elton & Gruber (1977), and Reilly (1985) mandated that a mere 10-20 stocks are sufficient to eliminate 95% of the variability in an equity portfolio. This view has unfortunately spread and influenced beliefs about other non-traditional asset classes.

We know that hedge funds, real estate and other alternatives investments are different. Besides skewness and kurtosis, these asset classes often report serial correlation, meaning present returns are not random but may be influenced by the past. Many such funds are much less liquid than theory allows: some may suspend payouts, suffer blowups, fraud or other unfavorable ’headline’ risks. Most critically, certain alternatives do not lend themselves well to standard benchmarks: they are considered ’absolute return’ vehicles.6

A litany of early scholarly articles concerning FoHFs argued that a compact portfolio of 10-20 funds was more than sufficient to meet the needs of diversification. However, time and experience have revealed that these studies were misguided and flawed. We have issues with their methodology, data problems, biased historical time frame and an inadequate definition of risk. These researchers fell into the trap of the three Rs, as they confused diversification with only replication, ignoring the dimensions of risk reduction and representation.7

Figure 4 illustrates a Monte-Carlo study in which we created equal-weighted portfolios consisting of one through 80 hedge funds. Each portfolio was the average of 2,500 simulations sampled from a universe of 10,000 time series.

We first assumed returns were normally distributed. The results suggest that only fifteen hedge funds can diversify away most portfolio volatility: further, the marginal benefit of reducing a potential drawdown is limited after 20-25 funds. However, when we reran the study assuming fat-tailed returns, the results were strikingly different. The speed of risk reduction was slower, and absolute losses were severe for portfolios with small numbers of holdings. Under certain crisis circumstances, it may be desirable to have 60 or more funds in a broad-mandate portfolio to mitigate the potential for a substantial drawdown.8

Diversifying the diversifier

Recent academic research disputes a key tenet of modern portfolio theory apropos diversification; namely, we have been wrong all along to forecast risk using a static correlation matrix. Experience and analysis show this leads to trouble when faced with a major upheaval such as seen in 2008 or COVID in 2020: correlations tend to rise in the left tail of a distribution and fall in the right tail. As such, diversification is less effective in a risk-off tape, while conversely, investors sacrifice some upside due to diversification in a risk-on environment.9

In an example of an approach to address the issue of changing correlations, Vatanen (2024) proposes a multi-asset framework for asset allocation including listed equities, private assets, diversifiers and tail hedges.10 This framework, though comprehensive, seems expensive to implement.

Instead, we believe savvy MMRE and FoHF managers already do the work for the investor, by incorporating both bottom-up and top-down analysis into portfolio construction. This suggests that multi-manager solutions are not bound by fixed schemes for investing across strategies but rather may move in and out tactically as the situation demands. For the complete investor, a well-designed asset management firm that offers various products, including both traditional and alternative, single-manager and multi-manager, can guide an overall portfolio into different fund vehicles. This will effectively diversify the diversifier and satisfy the requirement of the three Rs: replication, risk reduction, and representation.

The three Rs for multi-manager alternatives

For many market participants, diversification works until it does not. This is partly the result of an inadequate appreciation of the multiple facets of diversification: replication, risk reduction and representation.

MMREs and FoHFs offer opportunities for alpha and uncorrelated returns in normal markets but must adapt in the post-COVID era. This includes building portfolios that address many other forms of diversification; incorporating new strategies and asset classes; and evolving from static allocators to dynamic, tactical and opportunistic fund management. In this way, shrewd multi-manager alternative programs can embrace Diversification 2.0 and prosper in the uncertain times ahead.

The art of understanding asset correlations