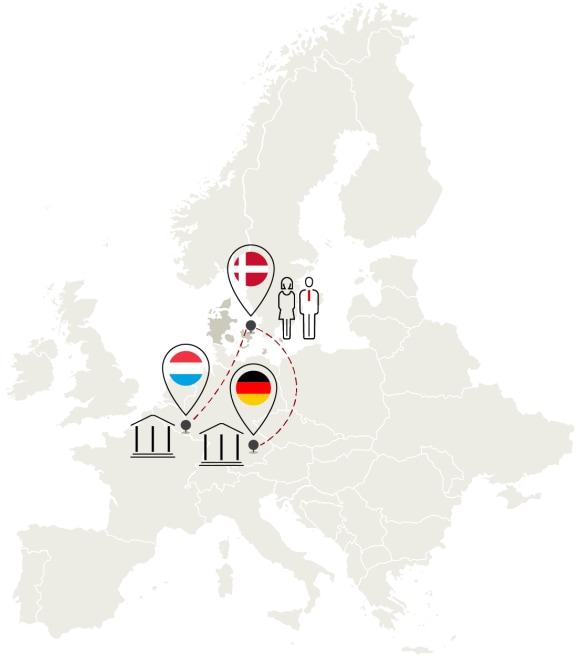

At UBS, we pride ourselves on offering a unique business model that combines local expertise with global solutions. Our approach ensures that clients in the Nordic region, particularly in Denmark, receive personalized and proximate advisory services while benefiting from the robust infrastructure and solutions provided by renowned financial centers like Germany and Luxembourg.

How we work with you

This business model ensures that our clients in the Nordic region receive the best of both worlds: the personalized service and local expertise of our Danish advisors, combined with the global solutions and infrastructure of UBS.

Your advantages:

Our UBS Office in Denmark

UBS Europe SE, Denmark Branch, filial of UBS Europe SE

Sankt Annae Plads 13

1250 Copenhagen

+ 45-33-18 14 00

Access to our financial insights

Looking for the intelligence you need to power your wealth management goals?

Benefit from the insights of our award-winning Chief Investment Office wherever you are.*

UBS recognized again as a leading and truly global wealth manager.

UBS recognized again as a leading and truly global wealth manager.

The Euromoney award for World's Best Bank 2024 is a recognition of the breadth and quality of our bank's overall offer and services.

* "Best Chief Investment Office in Private Banking," PWM/ The Banker Global Private Banking Awards 2025