The next transformative technology?

The next transformative technology?

Artificial Intelligence (AI): what was once just a buzzword, is now reshaping industries and creating an environment ripe with investment opportunities. This transformative force is driving efficiency and innovation across industries and sectors, including real estate.

We think AI has the potential to enhance investment processes and add diversity to investment strategies. Asset managers who strategically integrate AI into their operations can gain a competitive edge, and risk falling behind if they don’t.

A technology with great potential

A technology with great potential

AI has the potential to reshape the real estate sector. It can improve the investment process and enhance the asset and property management functions. We also expect AI to create attractive real estate investment opportunities and allow investors to access new markets. In this report we will focus on AI’s potential impact on investment, but also look at some of its other impacts on the real estate sector.

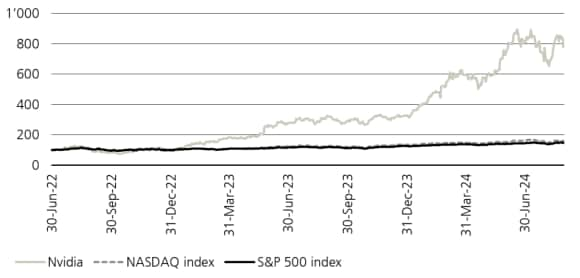

AI may be the next transformative technology, and although its potential has been increasing for years, the more recent expansion of accessible tools such as ChatGPT have made it mainstream. The potential for AI has helped push equity valuations higher. For example, Nvidia, a US chipmaker, reached a USD 3 trillion valuation in June 2024, jostling with Apple and Microsoft to be the most valuable company in the world. The company more than tripled in value in a year and has far outpaced the wider market (see Figure 1). However, since then, the shares plunged by 23% in six weeks from 18 June 2024, clipping USD 784 billion from the company’s market value and moving it into third place among the largest firms. The pullback reflected fears over the US economy and weaker earnings results from the large tech companies, with traders seeking to cash in on some gains. Even accounting for the decline, Nvidia shares had still more than doubled since the start of 2024.

Figure 1: Nvidia, NASDAQ, S&P 500 (price indices, to 31 Aug 2024, 30 Jun 2022 = 100, USD)

The performance of Nvidia is an indication of just how much growth potential the market thinks AI has. The scope to use AI chips in home PCs has further boosted expectations and the AI boom has fueled global stock market gains. More recently, there has been market anxiety and concerns over AI’s impact and its ability to deliver the widespread gains predicted. However, we still think that AI has the potential to have a significant and wide-ranging impact, though there is uncertainty over the exact quantum and nature of this.

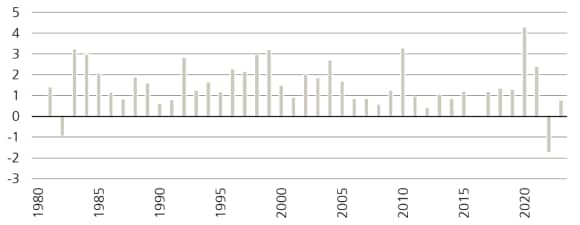

In the broad sense, AI refers to the use of machine learning and deep learning algorithms to study data to predict future behavior or trends, mimicking some human cognitive functions. The breakthrough in generative AI algorithms is that they can now learn from patterns in existing data to generate new content, designs and solutions. It is hoped that AI will have a major impact on the economy as its further integration into the jobs market will help to enhance overall productivity. It could mirror the period running up to the millennium when more widespread use of computing saw strong productivity growth (see Figure 2).

In the US, Oxford Economics expects the use of generative AI to assist and automate workplace tasks and boost annual GDP 2.9% by 2032. The productivity of the overall US workforce is expected to rise by more than 10% over the same time period. Hence, generative AI has the potential to significantly raise the outlook for GDP growth in the US and other countries too. However, it will also likely result in some workers being displaced.

Figure 2: US productivity growth (Productivity growth, % YoY)

Despite the prediction that AI will help enhance productivity, the key questions are which jobs are at risk of being displaced and which ones will be enhanced by AI.1 This has important implications for the real estate sector. On the one hand, productivity enhancing AI can boost overall job numbers if innovation spurs a sector and causes demand to grow in excess of the productivity gains delivered by AI. On the other hand, if output is static, productivity advances can see the same amount of output produced with fewer hours from people required.

According to the IMF, about 40% of jobs globally are exposed to AI. The advanced economies are at greatest risk, with 60% of their jobs exposed due to a prevalence of cognitive, task-oriented roles. In addition, the OECD predicts that across its member states, 28% of jobs are in occupations at high risk of automation.2 AI also has the potential to work with robotics and can improve manufacturing processes.

Companies may utilize algorithms to complete tasks, resulting in a lack of human touch behind the work. This could also have a knock-on effect in the future if the workload of junior staff becomes more automated and they lack the training and development needed to progress into senior roles, creating a widening skills gap.

However, we currently see many AI service providers making the more conscious decision to explore a human-centric approach assisted by AI ‘co-pilot’ products, rather than ‘auto-pilot’ products which aim to entirely replace human roles. For example, Microsoft reported that more than 27,000 organizations are incorporating its Microsoft GitHub Copilot AI platform into their businesses to increase the productivity of software developers.3

Technological advances can have a non-disruptive impact on the economy and generate employment rather than displace jobs. For example, a recent MIT study found that 60% of today’s jobs did not exist in 1940 and were brought about by technological advances. For example, jobs in the aviation industry.4

Hence AI is likely to augment jobs rather than replace human workers, and can often enhance their jobs. Simple process-driven elements of roles have the greatest scope to be automated, leaving workers to focus on higher value-add activities and boosting overall productivity.

To summarize, there are three main impacts that AI could have on jobs: disrupt, augment or create. The disruption includes roles that could be fully or partially automated. Augment allows tasks to add new capabilities and efficiencies to existing roles. And AI can create jobs such as developing, implementing and servicing AI.

AI as a technology is still in its early phases and will likely impact the economy in ways not yet envisaged. The wide range of outcomes means there is significant uncertainty about the future of AI and its impact on the labor market. The downside is greater structural unemployment due to job displacement, while the upside is net job creation and productivity enhancements. The overall impact will vary by sector, however, the office sector will likely be impacted most. We will discuss this in more detail later.

Want more insights?

Want more insights?

Subscribe to receive the latest private markets perspectives and insights across all sectors directly to your inbox.