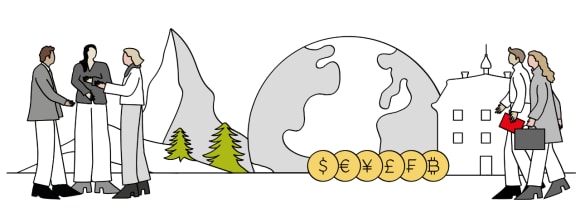

Reserve Management Seminar

2022 Event Highlights

For the 28th consecutive year, UBS hosted one of the most successful and longest running events in the industry. Over the years it has developed into one of the leading events addressing recent trends in reserve management from areas of asset allocation to (geo)-political, macro economic and megatrends featuring around 35 institutions from 28 different countries across the globe.

Event Days

Event Days