Seeking future stock winners

Stock markets tend to react negatively to uncertain market environments, such as the one we are facing now. Selling stocks is a common and very human reaction during such times.

![]()

header.search.error

Stock markets tend to react negatively to uncertain market environments, such as the one we are facing now. Selling stocks is a common and very human reaction during such times.

Panic reactions are not always helpful, since they often come too late, that is after the market has fallen and the negative news priced in. Rather than realizing the loss, investors should stay cool, start to look forward, and consider investing in the future.

Invest in stocks for the long term

Predicting short-term market movements and sentiment is extremely difficult to achieve with any consistency. Many try, and while some get lucky, most fail. Generally, investing for the long-term is somewhat simpler. Stock markets have trended upwards over the long term, interspersed with a number of sharp downward corrections, and a few more prolonged periods of decline. With this in mind, it appears logical to own stocks for the long term and simply increase one’s holding during the market dips and reduce after the market has performed well. If we are to own stocks for the long term, then it also makes sense to identify investment themes that are supported by powerful long-term secular growth drivers, which will be relevant in the years to come.

Identify the winners for the next 10 years

Passively managed funds, which track the performance of an index, are in a sense investing in the most successful companies in the world today. However, from a different perspective, we can also say that these are the winners of yesterday. Actively managed funds might logically follow a different path. Rather than investing in companies that have already won – the large benchmark index stocks – fund managers can use their knowledge to identify the winners for the next 10 years. These are often rather small companies, not members of any major index – they tend to be companies that have not appeared on most people’s radar. That said, and given the current market uncertainty, most stocks have declined. Overpriced stocks have fallen, but so too have the stocks of some very promising and high-quality smaller companies. Many of these companies are now trading at attractive valuations, so it is a very interesting opportunity for savvy investors with a long-term investment horizon.

ESG will become more relevant despite challenges

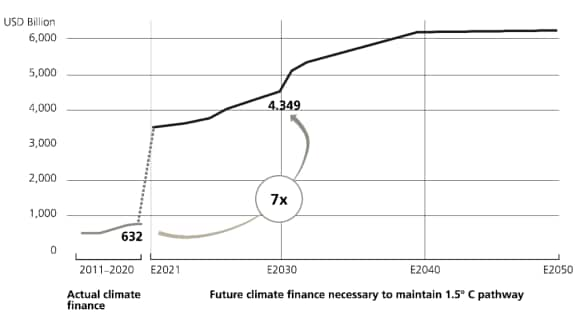

We consider technology, innovation and ESG among the major trends that will shape tomorrow’s economy. COVID-19 and the war in the Ukraine have challenged the “E” in ESG. When economies slow down and our security is threatened, priorities can change and sustainability could start to feel like a luxury for some people. However, most are convinced that the way we have operated over the last 50 years is not sustainable. As consumers and investors start to demand a different approach and regulations start to enforce new rules, ESG issues will steadily become increasingly more relevant. The extreme weather over the last few years is a clear signal to everyone that we need to change our way of life and invest in companies that provide solutions to mitigate climate change and other ESG topics. By 2030, the estimated required investment in climate solutions to meet the 1.5 °C target will grow by a factor of seven, according to the Climate Policy Initiative (see Figure 1).

Technology and innovation expand the investment opportunities in many sectors

Apart from environmental considerations, technology and innovation will continue to shape our economy. Automation, robotics and AI can make various aspects of life less wasteful and less resource intensive while also improving the quality of life. For sectors like healthcare, technology can enable earlier stage disease diagnosis and delivery of novel treatments in a very short space of time. The mRNA technology used for COVID-19 vaccinations is a recent example. For sectors like education, technology has the potential to give greater access to quality education to a broad spectrum of people worldwide. Technology can thus help improve the social dimension of ESG. While technology makes life more convenient, it also exposes us to security risks which were previously not here.

Seek a pure exposure to investment themes

When investing in long-term themes such as environmental impact, robotics and automation, digital health, education technology or security and safety, it is important to find a strategy that provides a high level of exposure to the selected theme. This is a concept known as “purity”. We suggest that a pure-play approach where portfolio companies have at least 50% of revenues from the respective theme is sensible. This also tends to lead to a greater focus on smaller companies, which may prove to be the winners of the future.

In our view, investors should seek future-looking investment themes supported by powerful long-term drivers that will shape the world and society for decades to come. A well-diversified and balanced portfolio approach can help balance out market turbulence and provide investors with risk-adjusted returns over the long-term.