The strategic and tactical case for loans

Floating-rate loans can offer attractive yields, low duration risk, and diversification benefits, making them a compelling option in today’s market

![]()

header.search.error

Floating-rate loans can offer attractive yields, low duration risk, and diversification benefits, making them a compelling option in today’s market

In an evolving interest rate environment, loans continue to hold strong appeal for investors. Their floating rate nature, historical resilience, and potential for attractive risk-adjusted returns and high income generation make them a compelling component of diversified portfolios. Chris Kempton explores why they have both immediate and long-term appeal.

The strategic case

Loans have long been a core component of institutional fixed income portfolios, offering diversification benefits and a relatively stable return profile. Several key factors underpin their strategic attractiveness:

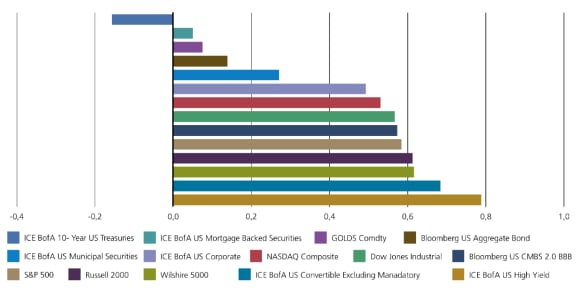

Unlike traditional bonds, which have fixed coupons and can suffer price declines when interest rates rise, loans are typically floating rate instruments, meaning their coupons adjust with prevailing interest rates. This reduces their interest rate sensitivity and low correlations versus other parts of the fixed income market.

Historical data highlights the consistency of loan returns. Over the past 32 years, the leveraged loan market has seen only three negative calendar years – an impressive track record compared to many other fixed income asset classes. Even in volatile periods, loans have demonstrated resilience, underpinned by their senior secured status, which ensures they are among the first to be repaid in the event of corporate distress.

Another advantage of loans is the presence of collateral backing. Unlike unsecured debt, loans are typically secured by specific assets providing an additional layer of investor protection. Furthermore, a significant portion of the investor base consists of institutional buyers, such as banks, pension funds, and insurance companies. This institutional participation helps stabilize the market, even during periods of heightened volatility.

In addition to their strategic role within fixed income portfolios, loans provide broader diversification benefits across asset classes. Senior loans have historically exhibited low correlation with equities and traditional fixed income helping to reduce overall portfolio volatility.

The tactical case – why now?

While the strategic case for loans is well established, the tactical case is equally compelling.

Historically, loans have been favored by investors when interest rates are rising, as their floating rate nature means higher income as rates increase. However, with rate cuts, some investors question the continued relevance of loans.

The answer lies in their appeal beyond rate cycles. Even in a declining rate environment, loans continue to attract institutional investors due to their yield and credit spread advantages. The loan market has historically grown even in post-tightening periods, demonstrating its resilience and demand sustainability.

While absolute yields have risen across fixed income, spreads remain the key metric for assessing value. Spread levels represent the risk premium investors earn over risk-free rates, and despite overall higher yields, spreads in the loan market are only slightly tighter than their 15-year average. This is compared to other parts of the credit market, which are at long term lows in terms of the spreads currently being offered.

Given the spread compression across broader credit market, the premium available in loans remains attractive.

Senior loans and collateralized loan obligations (CLOs) have characteristics that help them withstand market volatility. In the event of default, leveraged loans have historically fared better than high yield bonds, reducing investor losses. Post-bankruptcy recoveries over the last 10 years for senior loan holders have averaged around 55 cents on the dollar, while the average for high yield bond holders has been around 37 cents on the dollar.

CLOs in particular, act as structural buffers in the market. These actively managed vehicles pool senior loans and create tranches with varying levels of risk and return. This structure provides flexibility, allowing managers to adapt portfolios dynamically while maintaining stability even in downturns.

Thoughtful implementation

Despite changing market conditions, loans continue to offer a compelling mix of strategic stability and tactical opportunity.

In a world where macroeconomic uncertainty persists, loans remain a key tool for investors seeking both income and risk-adjusted returns.

Key risk factors to consider

While senior loans offer compelling features, investors should be aware of potential risks, including:

However, institutional participation and CLO structures help mitigate these risks, reinforcing market stability.

Want more insights?

Subscribe to receive the latest private markets perspectives and insights across all sectors directly to your inbox.