Sustainability and private equity

ESG integration vs. impact funds and the rise of SFDR funds

![]()

header.search.error

ESG integration vs. impact funds and the rise of SFDR funds

As sustainability continues to gain prominence in financial markets, institutional investors are increasingly compelled to rethink their investment strategies. With frameworks like the Sustainable Finance Disclosure Regulation (SFDR) reshaping fund classifications in Europe, investors now have to navigate a new landscape of ESG-integrating and impact-focused funds. However, for institutional investors like pension funds, this presents a challenge when allocating capital, considering the level of ESG friendliness, investment universe and financial performance. In this article, we explore the key distinctions between these fund categories, performance trends, and how the evolving regulatory environment might influence investment choices.

ESG vs. impact investing – key differences

Understanding the distinctions between ESG integration and impact investing is crucial for institutional investors. As per Preqin’s methodology, for the purposes of this article we differentiate the two types of funds under the following:

IRR and TVPI – A closer look

To understand the implications of different fund types, it’s important to look at their historical performance. For the purposes of this article, we have used Preqin’s definition of what constitutes ESG-integrating and impact funds. The data we analyzed indicates a noticeable gap in internal rate of return (IRR) and total value to paid-in (TVPI) between non-ESG funds, ESG-integrating funds, and impact funds. However, we need to take these results with caution given the small sample size of ESG-integration and impact funds that have registered their performance in the database, in addition the potential self-reporting bias of such a database.

Quartile ranking | Quartile ranking | Non-ESG funds | Non-ESG funds | ESG-integration funds | ESG-integration funds | Impact funds | Impact funds |

|---|---|---|---|---|---|---|---|

Quartile ranking | 1st Quartile | Non-ESG funds | 21.60 | ESG-integration funds | 21.03 | Impact funds | 18.40 |

Quartile ranking | Median | Non-ESG funds | 13.60 | ESG-integration funds | 15.30 | Impact funds | 9.30 |

Quartile ranking | 3rd Quartile | Non-ESG funds | 5.60 | ESG-integration funds | 7.30 | Impact funds | -2.10 |

Quartile ranking | Quartile ranking | Non-ESG funds | Non-ESG funds | ESG-Integration funds | ESG-Integration funds | Impact funds | Impact funds |

|---|---|---|---|---|---|---|---|

Quartile ranking | 1st Quartile | Non-ESG funds | 2.09x | ESG-Integration funds | 1.66x | Impact funds | 1.43x |

Quartile ranking | Median | Non-ESG funds | 1.59x | ESG-Integration funds | 1.40x | Impact funds | 1.09x |

Quartile ranking | 3rd Quartile | Non-ESG funds | 1.15x | ESG-Integration funds | 1.18x | Impact funds | 0.90x |

Key observations

For pension funds and other institutional investors, the performance discrepancy between ESG-integrating and impact funds offers a compelling reason to prioritize ESG-integrating funds over impact funds, at least from a return-oriented perspective.

SFDR and its 2025 revisions – uncertainty on the horizon

The Sustainable Finance Disclosure Regulation (SFDR), which divides funds into Article 6, Article 8, and Article 9 categories, has reshaped the way European investors assess sustainability. Article 8 funds can have a promotion characteristic or seek to invest a portion of the portfolio in sustainable investments, whereas Article 9 funds mainly focus on sustainable investing and achieving an environmental or societal impact. However, it’s important to note that the SFDR framework is under revision, with major changes expected by 2025. This revision leaves a considerable amount of uncertainty:

For institutional investors, particularly those with global portfolios, this creates an additional layer of complexity. Whilst many non-European private equity funds may brand themselves as impact, they might not adhere to the same rigorous SFDR standards, making it harder to compare them directly with European funds.

Impact funds – growing in number but it's still early days

Based on our findings and experience, whilst we do see a growing number of impact private equity funds being launched every year, in our view it’s still too early to judge whether these funds represent a good investment or not.

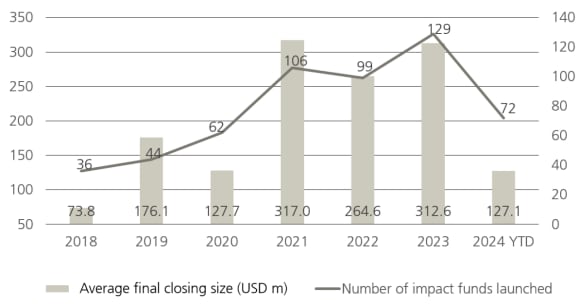

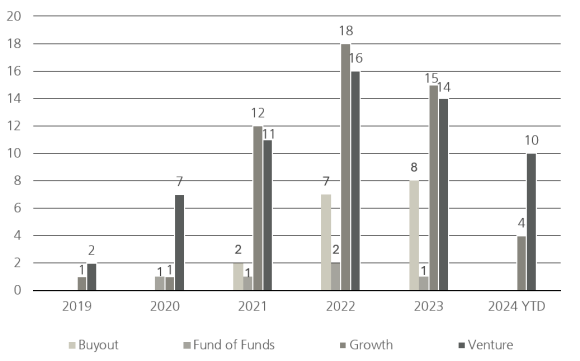

As shown in Figure 3, in recent vintage years, worldwide, the number of funds labelling1 themselves as impact has grown from 36 in 2018, to 129 funds in 2023. As of September 2024, so far 72 private equity funds in vintage 2024 have labelled themselves as impact and we expect this upward trend to continue. That being said, the average size2 of these impact funds ranges from USD 73‒317 million, with many impact funds failing to exceed USD 150 million in client commitments.

The sectors in which the companies in the portfolios of these impact funds are also an aspect to be considered. Many sectors such as Agritech and climate-tech are unproven, and it remains to be seen if companies in these sectors can be exited by these impact funds in coming years and still return exit multiples similar to other sectors favored by private equity.

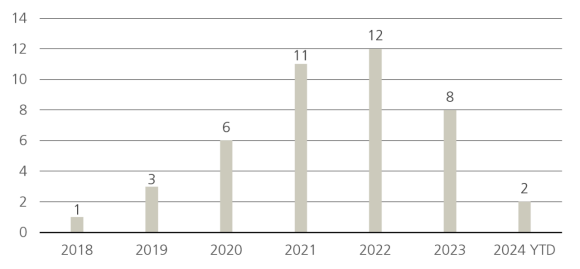

The Agritech sector is a good example of this. If we look at all funds which have (i) labelled themselves as impact, and (ii) drill down a level further to include those funds which are stated to have Agritech firms in their portfolio, then we see that the vast majority of such funds have only been launched in the last three to four years. According to Preqin, historically speaking, since 2018 only 43 impact funds in total have been launched that include Agritech in their portfolio, of which 90.8% of said funds were launched in the vintages 2020‒2024 (see Figure 4). In our view, this indicates that the vast majority of these impact funds are very young and their portfolio companies are still within the J-curve.

In our view, at this point in time it’s simply too early to tell whether these impact funds will turn out to be ‘good’ investments. Many impact funds are typically small, sub-scale venture capital funds, investing in companies operating in sectors that are largely unproven such as agtech and climate-tech, and realistically we’ll need another 5‒10 years in order to adequately judge this.

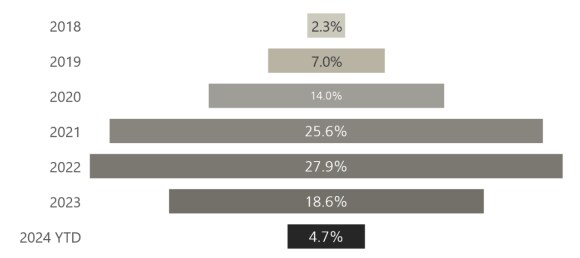

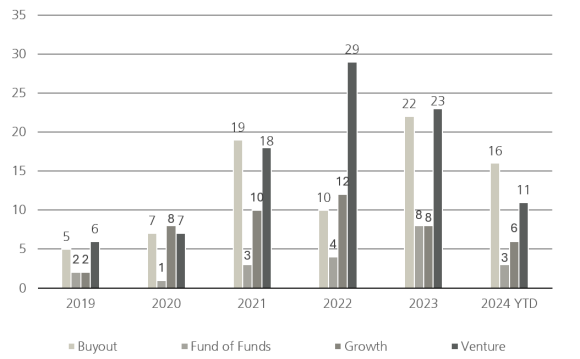

The growing trend in SFDR fund launches

As sustainable investing gains momentum, the number of Article 8 and Article 9 private equity funds launched each year has increased. The following tables break down the number of funds launched per vintage year based on fund strategy.

Summary:

Similarities between ESG integration and Sharia investing

One underexplored area is the alignment between ESG integration investing and Sharia-compliant investments. Both strategies share common exclusion criteria:

For institutional investors, especially those with a global or multi-faith clientele, considering Sharia-compliant funds alongside ESG funds could offer another ethical investment option, diversifying the portfolio while adhering to strict Sharia ethical criteria.

Final thoughts: A balanced approach for institutional investors

For institutional investors, particularly pension funds, the growing demand for sustainable and impact investing presents both an opportunity and a challenge. ESG-integrating funds offer a balanced approach, considering ESG factors, while maintaining competitive financial returns. The more stringent impact funds, whilst seeking to achieve a greater level of environmental or societal impact, may not always meet the financial return targets of a pension fund. Given the relatively small investment universe of impact funds, it may be impractical to shift a large portion of the portfolio toward impact-focused investments. This is mainly due to the typical lifespan (ca. 10-15 years) of private equity funds. Furthermore, such statistical comparisons must be viewed with caution, due to the relatively small sample size of impact and ESG-integration funds listed in such databases and the potential for self-reporting bias.

In the view of the writers of this article, institutional investors wishing to satisfy both financial obligations and the increasing demand for sustainable investing, may be best served by adopting a balanced approach to portfolio construction by:

The views and opinions expressed in this article are those of the authors and do not reflect the views of UBS or the UBS Framework on sustainability.

Want more insights?

Subscribe to receive the latest private markets perspectives and insights across all sectors directly to your inbox.