The design and craft behind energy storage

The world is using more electricity, and more of it is coming from solar and wind. The need for batteries is now.

![]()

header.search.error

The world is using more electricity, and more of it is coming from solar and wind. The need for batteries is now.

One look at the enigmatic Mesa Laboratory and you could never forget it. Situated in the outskirts of Boulder, Colorado and designed by the much celebrated architect I. M. Pei for the US National Center for Atmospheric Research (NCAR) in the 1960s, the research center focuses on meteorology and climate sciences with environmental and societal impact. This breakout building of concrete and geometric shapes changed the course of the career for Pei, who went on to design his more famous works including The Louvre Pyramid in Paris and Bank of China Tower in Hong Kong.

Elsewhere in Colorado, our portfolio manager Ken-Ichi Hino is mulling over the design of a very different type of building: energy storage. Because renewable energy like solar and wind power is intermittent and unpredictable, batteries are needed to save up power when there is an oversupply and to release what is stored when there is high demand. To our Energy Storage team (part of the UBS Real Estate and Private Markets Infrastructure team), the design of a battery project is critical, and it takes engineering and economical craft and might to get it right. I. M. Pei once quipped, “No one combines art and functionality like an architect”; perhaps it can be said that energy storage combines climate technology with functionality like nothing else.

The need for energy storage

The world is using more electricity, and more of it is coming from solar and wind. With continued electric vehicle adoption and rapid AI proliferation across industries driving up demand, energy storage makes for a perfect complement to solar and wind and is critical in balancing a renewables-heavy grid.

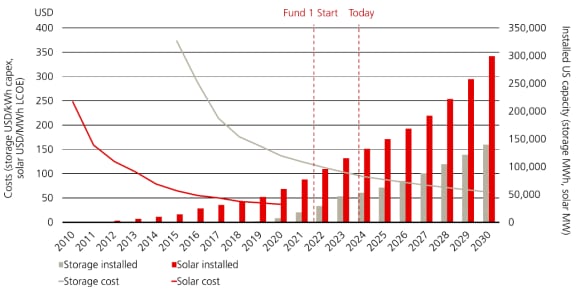

Transition towards decarbonization will span decades, but now is an interesting time for energy storage. Battery technologies are scaling quickly, making energy storage commercially lucrative in more and more markets. The overall energy storage market is projected to grow more than 35% annually through the end of this decade. In the US alone, it is expected to grow 20 times over from 2020 to 2030.1 The path solar has taken in its growth to where it is today is one we believe storage will follow.

Costs vs. market size for energy storage and solar power

That said, investing in energy storage is a craft and requires weaving together deep market, technical and operational expertise. From the right location to the right design, from a reliable supply chain agreement to a capital efficient financing structure, every step is crucial to delivering a successful energy storage project. Barriers to entry are high and business models have not fully come to form, creating a market opportunity that can only be maximized by a few. Since economics are highly attractive in certain markets, energy storage could potentially offer higher returns than traditional infrastructure.

Craft in project assessment

Before breaking ground on the Mesa Laboratory, Pei hiked through and camped on the Table Mesa, to better understand the build site and its relationship with the Flatirons’ sandstone cliffs in the backdrop. “There in the Colorado mountains, I tried to listen to the silence... The investigation of the place became a kind of religious experience for me,” said Pei. He also took the time to drive around Colorado and nearby states, ultimately taking inspiration from cliff dwellings of the Ancestral Puebloans in Mesa Verde National Park. Carved into the rock face, the ancient village made of stone and earth made it clear for Pei: the architecture could only work if it exists in harmony with its natural surroundings.

The same level of fervor goes into energy storage, and the early assessment and planning decisions are just as integral. Together with our multidisciplinary team of renewables industry veterans and energy storage specialists, Ken-Ichi and I have managed development of close to one gigawatt of energy storage projects at UBS alone. Take our portfolio of current projects across the Electric Reliability Council of Texas (ERCOT) region as an example. We had identified this emerging opportunity using financial analysis, pinpointing high value locations close to high demand centers with promising transmission characteristics, and controlling for risks in constructability and natural disaster exposure. When the market had matured enough in 2021, we were ready to move quickly in sifting through development projects and acquired six projects with a total potential output of 930 megawatts in high value locations.

As part of the value-maximization strategy we secured projects at the beginning of their life cycle, taking advantage of good locations. Our team’s credibility in the industry brought us bilateral opportunities, avoiding auction processes or sales that were widely marketed, and before traditional infrastructure investors stepped in.

Craft in design and operation

Battery projects need to be optimized across multiple variables, and therefore the alignment of the size and duration of the battery with the specific market and its price characteristics is a key part of a project’s path to commercial operation. Will the operation be sustainable and profitable? Is it capital efficient? These are the type of questions we ask ourselves, and the answers along the way inform our design and configuration for a project. The design needs to be precise; it must work on both the technical and economical level.

For the Texas projects, the ability for us to make those design decisions and control project elements is unique. We take an integrated approach to design, procure and construct energy storage projects; in many ways we are more like managers running an operating company than traditional fund managers. We put together a team of engineers, battery and equipment suppliers, EPC (engineering, procurement, construction) contractors and support staff, and a lot of work goes into making sure the different pieces support the overall successful execution and operation of the project. Not to mention the complexity in the supply framework agreement, offtake insurance contracts and capital financing structure, the devil is in the details for this type of projects. The system must match our long-term operational strategy, ensuring sustainable value over time.

The obsession with details is also evident with building the Mesa Laboratory; one example was a then-new technique called bush hammering. Purposefully combing the dry concrete with bush hammers creates vertical ridges and grooves, giving the building exterior a softer, more textured corduroy-like appearance. And to match the Flatirons in color and tone, the same sandstone along with a local pinkish aggregate were blended into the poured concrete of the building as part of a rock treatment process.

In the end, the first four Texan projects located in Lamesa, Nevada, Alvin and Crosby with a total output of 730 megawatts will be operational by end of this year. Together they will make up one of the five largest fleets of operating energy storage projects in Texas.2

Connected with craft

I. M. Pei said that building the Mesa Laboratory made him feel more connected to the ground, to nature. “You can’t dominate nature; you join it. How can you dominate nature?” Working in harmony with sandstones and mountains was nuanced and easier said than done, but hard work and dedication to his craft got Pei there. We try to do the same with the sun and the wind; energy storage will help pave the way for decarbonization.