Better mid-term outlook but long-term challenges

Better mid-term outlook but long-term challenges

For years, Germany's business model was: the Americans protect us for free, the Russians sell us cheap gas and the Chinese buy our overpriced cars. None of that works anymore.

Oliver Welke, a German comedian

Start of a cycle, but granularity needed

Around six months ago, in our last publication, we wrote about the start of a new investment cycle in Europe. We highlighted the improvement in inflation and interest rates, in resilient purchasing manager indices (PMIs), especially for services, and how investors should act as athletes before the race begins: “train hard, win easy.” Prepare and get outsized returns.

Since then, nothing has happened that would change our minds regarding the mid-term outlook. On the contrary, we increasingly see data points that confirm our former opinion that we are at the start of a new real estate cycle.

Top down, inflation has continued to improve. Annual eurozone inflation came in at 2.0% in October, in line with the inflation target of the European Central Bank (ECB). Across the Channel, the Lady of Threadneedle Street: Bank of England (BoE), and the ECB, are already cutting interest rates thanks to falling inflation. Now at 2.3%, it indicates a largely positive outlook. We expect policy rates in the eurozone to hit 2.0% by June next year and that the BoE will deliver 75bps rate cuts by September 2025, down to 4.0%. Thanks to lower inflation and policy rates, we also continue to expect interest rates to largely trade sideways or lower on the long end of the curve, with the German Bund around 2.25% and the UK gilt around 3.5% in a year’s time.

The economy in the eurozone is holding up. Annual real economic growth came in at 0.9% in 3Q24, up from 0.6% in 2Q24 and 0.5% in 1Q24. Services are clearly the driving force, with the PMI survey results for that part of the economy above 50 (indicating growth) for nine consecutive months. But manufacturing PMI values have been below 50 (indicating a slump) since summer of 2022, hamstrung by high energy prices.

The headline economic picture is clearly positive from the marginal-improvements point of view. Not robust, but positive. But granularity matters. And when we look at the more country-level developments within Europe, we can see a diverging picture.

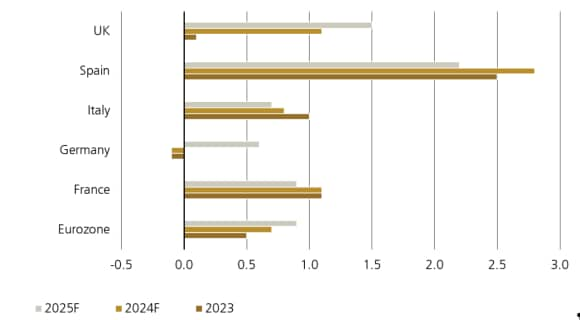

We expect economic growth in the region to stay adequate over the mid-term, i.e. until year end 2025 (see Figure 1). Clearly, Spain is set to outperform other key economies in the region while Germany acts as a drag. Germany has, in fact, been going through structural difficulties for quite some time now. Gross domestic product is all but flat since 2019 and industrial production, having peaked in 2017, has contracted by ~15% since then. That contraction is double as much as the contraction in industrial output in Italy over the same period. When we look at industrial production’s most recent development, a notable gap is developing between Spain and Italy on the one hand, and Germany on the other.

Figure 1: Annual real GDP growth (%)

Structural challenges

We must have more than granularity in mind. Structural developments matter, especially in the long run – and the long run is the appropriate time horizon for real estate investors to consider, given the nature of the asset class.

Europe faces a fundamental, long-term challenge: not enough competitiveness. Welke’s previously quoted quip, focusing on Germany, may be blunt but Mario Draghi stated the same opinion, in a frank, yet more bureaucratic tone, in his recent report on The Future of European Competitiveness. Draghi does not mince his words and some of the issues he points out are:

- Europe has strong innovation capacity, thanks to e.g., top-quality universities, but regulatory, financial and training barriers cause its companies and industries to struggle to turn this into successes within the global competitive landscape. As an example, many European entrepreneurs relocate abroad, first and foremost to the US, where they have a friendlier environment to grow over the long term.

- The energy crisis in Europe, driven mainly by the drop in Russian gas imports after the war in Ukraine, kept energy prices high, directly undermining European competitiveness. The drop in industrial output is a clear consequence of this.

- Europe’s defense industry is fragmented, therefore not large enough to benefit from economies of scale. Given the new global geopolitical environment, there are doubts floating around NATO’s ability or willingness to respond in case of an attack on one of its members, particularly in eastern Europe.

- A fragmented defense industry, which impacts strategic autonomy, exposes Europe to political and economic coercion from unfriendly actors. This may cause lower or more volatile economic growth, especially over the long run, impacting access to raw resources and intermediate inputs – think of periodic hiccups in the supply chain during the COVID-19 pandemic.

Draghi proposes solutions for these issues, including: reforming pension plan regulations for more flexibility in investing pensions into real capital investments; simplifying research and development frameworks; adding to clean-energy investments; channeling defense procurement to European firms; and policies intended to secure access to critical material and outputs, including pharmaceuticals.

How can real estate investors respond?

The lack of competitiveness that Europe faces is nothing new, but it is increasingly being discussed due to notable geopolitical events. The Draghi report highlights this specifically and depicts how the relative labor productivity of Europe has suffered against the US over the last two decades. But policy changes are more likely to surface now in comparison to the past. Thus, real estate investors should consider how they can benefit from these structural challenges.

First, the Draghi report specifically highlights the need for changes in the pharmaceutical supply chain. According to him, the industry is “a sector of geostrategic importance.” For example, in the life sciences real estate sector in Europe where the current stock (e.g., labs and manufacturing sites) is short given high demand, geopolitical forces continue to drive regionalization of pharmaceutical R&D further exasperating this shortage of stock. We’ve covered this topic in more detail in a separate publication.

Second, increased focus on clean energy and autonomy in this area in general will have clear implications for real estate investors. Heating and cooling constitutes around half of total energy consumption in Europe , of which 40% goes to industry and the rest to buildings.1 That means ca. 30% of energy consumption in Europe goes to heating and cooling of residential and commercial real estate.

The investment needed in procuring energy (e.g., solar panels) and retaining it (insulation) onsite is clear. The installation of heat pumps, solar panels and other energy-generating features should be considered more by real estate investors to entice tenants looking for lower energy costs. This is particularly significant given the gap in energy costs between Europe and its key competitors: the US and China. There may also be opportunities for real estate investors in installation of electric vehicle recharging points, including in shopping centers, last-mile logistics locations, apartment complexes and offices.

Third, logistics and manufacturing real estate is a clear winner in case of increased focus on regionalizing defense contracts. Europe spent EUR 240 billion on defense in 2022 – and would spend ca. EUR 80 billion more assuming all countries spent close to 2% of their GDP on defense.2 Between June 2022 and June 2023, EUR 75 billion was spent on defense procurement, i.e. material, nearly 80% of which went to suppliers outside the region, mainly in the US.3 Therefore, if procurement is around a third of total defense spending, European defense procurement could be close to EUR 100 billion a year. This is based on the assumption that defense spending accounts for ca. 2% of nations’ GDP or ca. 50% higher than it currently is (EUR 75 billion).

Clearly, if regional procurement increases, European defense contractors will likely need to expand their manufacturing capabilities, which may include a larger real estate footprint. The demand for warehouses capable of facilitating the necessary changes in defense supply chains is likely to increase as well. This would come on top of any changes focused on e.g., securing the supply of critical raw materials and inputs in e.g., electricity generation and distribution, water supply and protection, sewage and waste management and other critical industries that would need to be shielded from unfriendly actors in a new geopolitical world.

So to summarize, the competitiveness of Europe has been under pressure since the beginning of this century. A credible set of structural improvements, which is taken seriously by the European Commission that says it “sets the stage for a new era of sustainable growth,” has been formulated.4 If executed, the improvements could affect the long-term development of the region for the better. Real estate investors must heed this development and be ready to benefit from the structural changes that are likely coming. Changes are only inconvenient for those who do not prepare for them.

Capital markets are coming back

Following the improved short- and mid-term outlook, European commercial real estate markets are beginning to see an increase in investment volumes. This is selective, however, and it is mainly markets where valuations have been updated to reflect market pricing, and where leasing market fundamentals are positive enough to encourage investors to price higher rent-driven capital values a few years down the line where the recovery is the strongest. Smaller, and perhaps somewhat more niche markets, are also improving relatively fast but from a lower base than larger, liquid markets.

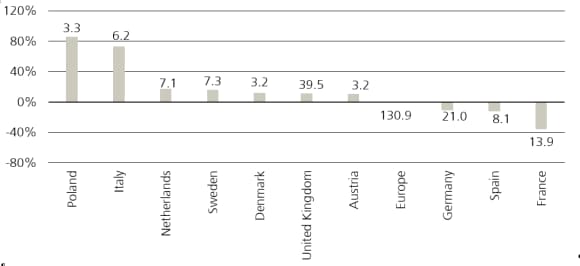

Figure 2: Annual change (%) in year-to-date (YTD) commercial real estate investment. Bars represent YTD inv. volume (EUR billion)

Source: MSCI, 3Q24.

The above overview on the country and sector level shows that Poland and Italy lead the pack in terms of investment volume improvement if we look at YTD volume compared to the same period last year (see Figure 2). However, investment volumes are low, only EUR 3.3 billion in Poland, and so the relative movement can easily be outsized. More descriptive is perhaps the fact that Europe’s largest commercial real estate market, and the 3rd largest one in the world according to MSCI, i.e. the UK, is seeing its YTD investment volume increase by a low double-digit number in relative terms, hitting EUR 39.4 billion in the first three quarters of 2024.

The total European YTD investment volume, EUR 130.9 billion, is however down 1% YoY, as Germany, Spain and France continue to see pressures on investment volume. One reason: those markets’ valuations are somewhat less up-do-date than valuations in the UK, so investors are not keen on stepping into those markets yet.

Figure 3: European YTD real estate investment volume by sector and YoY change

Title | Title | EUR bn. | EUR bn. | YoY | YoY |

|---|---|---|---|---|---|

Title | Office | EUR bn. | 28.6 | YoY | -17% |

Title | Industrial | EUR bn. | 28.1 | YoY | 12% |

Title | Retail | EUR bn. | 21.6 | YoY | -9% |

Title | Hotel | EUR bn. | 15.4 | YoY | 55% |

Title | Apartment | EUR bn. | 27.4 | YoY | 7% |

Title | Senior housing & care | EUR bn. | 2.8 | YoY | -40% |

Title | Dev site | EUR bn. | 7.0 | YoY | -18% |

Title | Europe total, all sectors | EUR bn. | 130.9 | YoY | -1% |

Looking at the sector breakdown (see Figure 3), we see that investment volumes in hotels are 55% higher YTD than last year. Amongst the major sectors, offices are well behind with a 17% contraction in investment volume, outperforming only senior housing which is a much smaller sector easily affected by single deals. There is no surprise that the investment volumes in the industrial and residential sectors is improving given the leasing market fundamentals of those sectors. But leasing markets dynamics may be surprising given news headlines.

Leasing markets: prime offices are outperforming

There has been much ink spilled on the troubles of offices. It is true that low-quality offices are struggling, and vacancy rates are close to all-time highs in that part of the sector. As an example, low-quality offices in Central London are close to 30% vacant according to data from MSCI.

But high-quality offices are in demand, driven by tenants’ preference to offer their employees an attractive working environment. It’s also important to remember that while weekly occupancy rates (i.e. how occupied are let office spaces due to people coming into the office rather than working from home) are widely lower than the ca. 70% mark they were at before the pandemic, the increase in occupancy rates over the week are notable. Note that we are specifically talking about Europe here.

According to Savills, Madrid offices are steadying around 65% occupancy level while the West End market in London is hovering around 60% over the last year or so. Other markets, such as Paris, Warsaw and Prague are largely flattening around the 55% mark. This is a stark difference to the US, where occupancy is only 30-35% in some markets, see e.g., Los Angeles, New York and San Francisco.5 European offices are not facing the same problems that American offices do.

Therefore, while we expect that European office occupiers will continue to optimize their office footprint in the semesters to come – measures include e.g., more desk sharing and concentration of office locations into fewer buildings to reach scale and better information flow between teams – we are fairly confident about the prospects of high-quality, well-located offices.

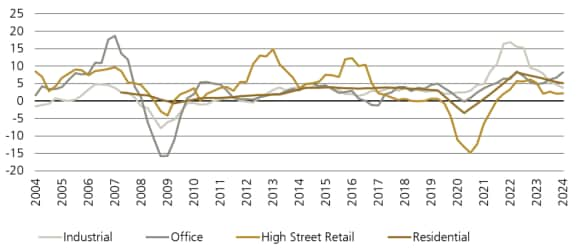

This should not come as a surprise: prime rental growth for European offices is currently outperforming other sectors as there’s a relative shortage of high-quality offices despite total office take-up, on the high-level, being ca. 25-30% lower than pre-pandemic levels. Prime office rents in Europe are up 8.2% on an annual basis as of September, with residential (all-property quality) rents rising ca. 5% over the same time. Prime industrial and high street retail assets are both seeing their rents rise by 3.7% and 2.3%, respectively (see Figure 4).

Figure 4: Europe, annual rental growth by sector (%)

Source: CBRE; Green Street; UBS Asset Management, 3Q24.

On the whole, we are looking at positive rental growth across most markets, with the trickiest segment being low-quality offices. In the UK specifically, we expect all-office rental growth to be close to 2.0% p.a. over the next three years, while industrial and residential markets should see closer to ~3.5% p.a. growth over the same period. But we also expect selected prime offices to see higher per annum growth e.g., ca. 4.5% and 3.5% in the City and West End markets by year-end 2027.

Elsewhere on the continent, prime offices are also expected to deliver positive rental growth, but the range is vast with e.g., Rome and Berlin seeing only ~1.0% p.a. growth over the next three years but Munich, Madrid and central Amsterdam closer to ~3-4% p.a. Industrial rental growth is more even, with most markets around ~2.5-3.0%, somewhat trailing the UK industrial segment.

Residential is outperforming other sectors in many cities, with market rental growth expected to be close to ~4-5% in Warsaw, Berlin and Barcelona but ~3-4% in e.g. Munich, Amsterdam and Dublin.

Overall, the market rental growth outlook is largely positive, driven by relative shortages of space in e.g., the residential and prime office segments. And importantly, prime rental growth should be higher than inflation in most markets, something that has generally been rather rare since we faced the spike in inflation in 2022. Therefore, we expect rental growth to largely contribute to positive total returns in the coming years. But the mere fact that yields have stabilized at a relatively high level is in many cases enough to make the case for real estate, given higher income returns.

The total return outlook has markedly improved

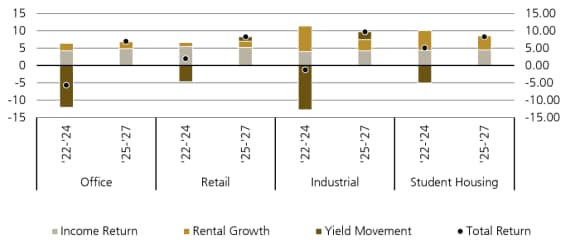

We’ve previously focused on the fact that inflation has come down markedly, and with it, interest rates. And as that happens, the yield spreads (risk premiums) between property yields and local government bond rates rise: yields stabilize and their impact on capital growth subsides. Add in a relatively healthy outlook for rental growth, and we end up with a total return outlook that is often close to high single-digit numbers per annum over the next three years for multiple markets.

The UK serves as an excellent example of how the tide has turned in terms of the contribution to total returns due to changes in yields. The graph below depicts the all-property outlook for each sector over the period 2025-2027 compared to what we expect to be the case for the period 2022-2024 (see Figure 5). The key improvement is simple: the yield expansion is all but over – we highlighted this in May – and even turning around in selected markets, especially those where rental growth is healthy.

Figure 5: UK, p.a. total return and its composition over two different investment periods (%)

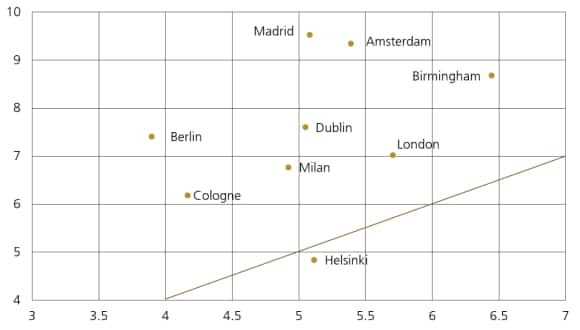

The picture is similar in continental Europe. As an example, when we consider our estimates of market-risk over a long-term (i.e. over the whole cycle) holding period in European residential markets compared to what we believe will be the actual gross returns over the next three years, we get the following picture (see Figure 6).

The residential market in Europe is famously low-yielding, one key reason being how relatively stable its capital values are, i.e. it is relatively low risk. However, there are clear pressures in the sector when it comes to rental growth, which is likely to drive positive returns within the sector despite various regulations slowing rents down. But the sheer lack of space in the sector, due to structural under-construction for years, has generated an investment opportunity in the sector today that looks like it may generate healthy risk-adjusted returns in the coming few years.

Figure 6: Europe residential markets, est. required return vs. est. forecasted returns over the next 3 years

To summarize, the outlook for European real estate markets has markedly improved, be it in absolute terms (example in Figure 5) or on a risk-adjusted basis (example in Figure 6).

The improved mid-term outlook is, however, somewhat burdened by a long-term challenging environment where Europe needs to find its place anew in a world where geopolitics have shifted. But investors that prepare for such a structural change are those that will be able to benefit from it in order to generate attractive risk-adjusted returns from their portfolios. For the basis of investments is not to avoid all risks but to take calculated, fruitful risks ‒ and Europe’s commercial real estate markets are ripe.

The Red Thread – Private Markets

Our semi-annual insights into private markets

Our semi-annual insights into private markets