Interest rate cuts driving momentum

Interest rate cuts driving momentum

Swiss economy performs solidly in a turbulent global environment

The macroeconomic environment in recent years has been anything but calm. The pandemic and the resulting economic slump were followed by inflation, interest rate hikes, and the associated fears of recession as well as geopolitical upheaval. The resulting uncertainty is als o reflected in economic sentiment . The Purchasing Manager Index (PMI) has been continuously below the growth threshold of 50 points for manufacturing since January 2023. Germany is one of Switzerland’s most important trading partners and the weakness of its industry is impacting the Swiss manufacturing sector. With a range of values between 43 and 57 points since the start of 2023, the PMI for services paints a somewhat less gloomy picture than the manufacturing index, but its high volatility still reflects the increased uncertainty.

After moderate annual growth of 0.7% in 2023, and 0.5% in the first quarter of 2024, the Swiss economy was able to record slightly above-average growth of 0.7% in the second quarter despite the lack of tailwind from abroad. Growth was boosted by strong expansion in the chemical and pharmaceutical industry. However, the labor market is not fully in line with the growth numbers in the economy. Following the significant employment growth of 77,200 full-time equivalents (FTEs) in 2023, employment growth in the first half of 2024 was relatively moderate at 26,900 FTEs. Similarly, the unemployment rate has risen from 2.2% in January to 2.5% in September. Overall, growth of 1.4% is expected for 2024, which represents a significant improvement compared to last year though still below the trend growth rate of 1.6%.

Low inflation allows the Swiss National Bank to lower interest rates

In contrast to other European countries and the US, inflation in Switzerland has remained within the target range of the Swiss National Bank (SNB) of 0-2% for more than a year now. Furthermore, over the third quarter of 2024, inflationary pressure in Switzerland fell further. Imported goods in particular have had a deflationary effect since November 2023. However, the year-on-year rate of change for domestic goods also no longer exceeded the 2% mark in 2024. Accordingly, the SNB lowered its interest rate by another 25 basis points to 1% in September. With the strengthening of the Swiss franc and the easing of energy prices, the SNB also revised its conditional inflation forecast significantly downward in the September meeting. This means that two further interest rate cuts of 25 basis points each are currently expected in December 2024 and March 2025.

Risk premiums back above long-term average

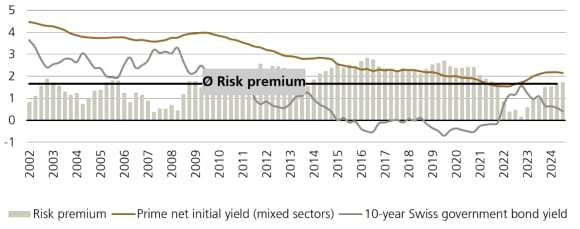

Swiss real estate investment lost some of its attractiveness in the past two years, but investor sentiment has improved considerably again in 2024, thanks, at least in part, to the normalization of the risk premium. At around 175 basis points, the risk premium for direct real estate investments is back just above the level of the long-term average since 3Q24 (see Figure 1). In addition to the significant decline in yields on Swiss Confederation bonds, the corrections in real estate yields over the past 24 months has been a contributing factor. Compared to the low point in the first half of 2022, prime yields in the residential segment have risen by a total of 65 basis points and prime yields in the retail segment have also risen by 53 basis points. The comparatively low corrections in the retail segment can be explained by the lower yield compression in this segment during the pandemic due to the boom in online retail.

Figure 1: Risk premium back to long-term average. Yield on 10-year Swiss Confederation bond, net initial yield on prime real estate and resulting risk premium (%)

Source: Wüest Partner; Swiss National Bank; UBS Asset Management, last data point: 3Q24, November 2024.

Residential properties, on the other hand, experienced strong yield compression during this period, which resulted in a somewhat stronger correction after the interest rate turnaround. In the case of office properties, the change in conditions in the capital markets was amplified by structural shifts that are putting additional pressure on the segment. As a result, office properties worldwide have suffered the sharpest corrections in the past two years. With an increase of 70 basis points, office yields in Switzerland also experienced the most significant correction, although ‒ by international comparison ‒ this remains very moderate. Over the course of this year, yields across all segments have stabilized and have even started to come down slightly in the third quarter of 2024.

The resulting brightening in sentiment becomes clear when comparing this year’s capital market transactions with those of the past two years. With CHF 3.6 billion of raised capital (debt and equity), total capital market transactions in 2024 exceeded the total of last year by 76% at the beginning of November.

Population growth continues to drive demand

Population growth continues to drive demand

Demand for rental apartments remains high

The fundamentals of the Swiss housing market remain very positive. Following the record figure in 2023, net immigration is down year-on-year at just over 58,000 between January and September 2024, but remains at a high level. As a result, demand for rental apartments continues to rise sharply, while the increase in supply, with 38,000 residential units approved for construction over the past 12 months, is only slowly recovering from very low levels. This means that the vacancy rate has fallen further from 1.15% in the previous year to 1.08% at present.

The decline was once again driven by rental apartments, where the vacancy rate fell by 8.6%, while 9.5% more owner-occupied units were recorded (see Figure 2).

Figure 2: Vacancy rate continues to fall. Vacant apartments ‒ total (left axis); in % of stock (right axis)

Source: Federal Statistical Office, last data point: June 2024, September 2024.

As a result, the ongoing shortage is driving rents up further: according to Wüest Partner, asking rents rose by 6.4% across Switzerland in 2Q24. Growth remained strong in the third quarter as well at 3.8% year-on-year, despite the already strong increase of 3.9% in the same quarter of the previous year.

Last year, two increases in the mortgage reference interest rate of 25 basis points each in June and December 2023, also led to an increase in existing rents in the rental apartment market. As the reference interest rate is based on the volume-weighted average interest rate of the outstanding mortgage receivables of Swiss banks, no further increase in the reference interest rate is expected due to the recent fall in mortgage interest rates. However, due to the high proportion of fixed-rate mortgages, the interest rate level for part of the total mortgage portfolio continues to rise or at least remain stable (depending on the term and time of refinancing) despite the rate cuts.

This means that changes, such as the current fall in interest rates, are reflected in the reference interest rate with a certain time lag.

Population growth also supports commercial markets – despite structural challenges

In addition to the turnaround in interest rates, the commercial real estate market continues to be affected by the ongoing uncertainty regarding future space requirements in light of hybrid working models and the growth of online shopping. On top of that came little dynamic from the economy, to which the commercial segment is inherently more sensitive than the housing market. Despite these adverse circumstances, the commercial segments of the Swiss real estate market are relatively robust.

Employment growth is having a stabilizing effect on the office space market. At 26,900+ full-time equivalents, growth slowed somewhat in the first half of 2024 but remained positive. It also helps that, according to CBRE, Swiss companies have an above-average office presence by international standards. As a result, vacancies in Swiss office locations remain largely stable. Demand for office space in prime locations in particular remains high. As secondary properties are in an increasingly difficult situation in the wake of space consolidation, the result is a polarization of the rental market.

This is reflected in the varying development of rents: while prime rents have risen by 4.1% since the start of the pandemic, average rents have fallen by 5%. The situation on the retail market is similar: according to Wüest Partner, rents for retail space fell by another 0.3% in 3Q24 quarter on quarter. By contrast, rents in prime locations, which are also supported by the return of tourists, have risen significantly, particularly in Zurich.

The Red Thread – Private Markets

Our semi-annual insights into private markets

Our semi-annual insights into private markets