The forces of investor demand and stricter regulation, monitoring and disclosure are driving an acceleration of ESG awareness in China. But just how sustainable are companies in China?

Sustainability considerations are growing in importance for both companies and investors in China with performance being derived from a company’s environmental, social and governance (ESG) metrics. A core aspect of sustainability also involves assessing the quality of a company’s management and its ability to orient the business away from material risks, toward opportunities. These issues continue to form an important part of our strategy when investing in China.

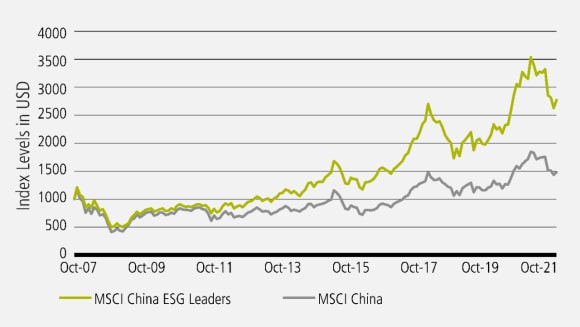

This approach matters because we believe that industry leaders with a good ESG profile will eventually deliver in terms of long-term performance. Looking at historical data shows that, in China at least, a portfolio based on the MSCI, but weighted toward ESG can deliver stronger performance than the standard MSCI China benchmark respectively.

MSCI China ESG Leaders vs MSCI China

MSCI China ESG Leaders vs MSCI China

Chinese companies are sometimes considered laggards in sustainability, but from our experience these lower scores are often less due to actual performance differences and more a reflection of lower levels of disclosure of traditional sustainability metrics.

This is also where our ‘boots on the ground’ research process and quality assessment can help us to go beyond what an ESG database may provide.

Is healthcare ripe for expansion?

Is healthcare ripe for expansion?

When thinking about healthcare in China, we believe there are compelling opportunities as Chinese healthcare expenditure has continued to grow and is expected to expand by double digits amid an aging population. China is already the second-largest healthcare market globally.

While we see investment opportunities, we believe there is still a lot of room for improvement in ESG disclosure. Among the top 60 companies in the market and the Hong Kong stock market, only 74% of healthcare stocks by market cap published ESG reports in 2020 (vs. 94% and 93% for the financial and property sectors)1. However, we think inadequate disclosure indicates unfamiliarity towards ESG criteria rather than low awareness.

Emphasizing ESG

Emphasizing ESG

Companies are increasingly recognizing the need for improved disclosure regarding ESG and during our engagement with one major pharmaceutical company, the company revealed plans to publish an ESG report within the company’s annual report next year. A chief compliance officer was hired in early 2020, and, supported by a compliance team of more than 20 members, is said to be in the midst of institutionalizing various policies including whistle blowing, anti-corruption and bribery.

In our engagements with Chinese companies, we have found that they are increasingly open to taking steps to improve their ESG profiles.

Another example includes a food manufacturer in China where our ESG risk dashboard flagged certain risks around disclosure. The SI research team identified food quality and safety, energy and water intensity topics as financially material risks to the business, requiring further information from the company on how they manage these risks, considering the lack of detailed disclosure.

Additionally, health and nutrition were areas identified where the company could excel. The investment team participated in three engagements with the company aiming to evaluate the strength of ESG risk management practices and to encourage greater transparency. The investment team, in collaboration with other investors, through the Access to Nutrition Index, led an engagement with the company to discuss health and nutrition opportunities. As of early 2021, the company no longer flags on our ESG risk dashboard and we continue to engage with the company.

Green bonds growth

Green bonds growth

Within China fixed income, sustainable investing is increasingly a major factor. Under the banner of “common prosperity,” the central government has outlined a commitment to aligning aspects of ESG to drive China’s long-term growth model.

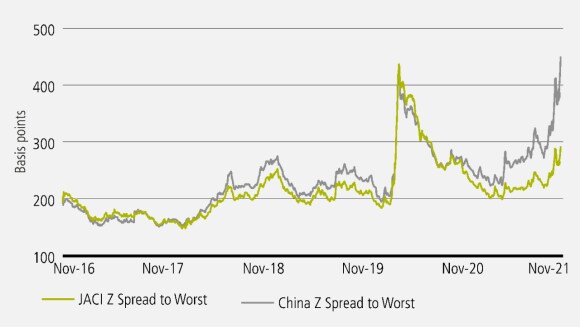

While aspects of this transition have presented short-term volatility in Chinese credit markets relative to the overall Asia market (see chart) for example tightening in property markets to reign in price, policy changes in education and labor reforms around low-income workers, we believe these changes will be healthy for the further development of the economy and fixed income markets.

J.P. Morgan Asia Credit Index (‘JACI’) vs JACI China Z Spread to Worst

J.P. Morgan Asia Credit Index (‘JACI’) vs JACI China Z Spread to Worst

In terms of environmental policy, China’s commitment to become carbon neutral by 2060 is a potential driver of expansionary capex spending; the expected implementation of the People’s Bank of China’s (PBOC) “green lending facility” and standardization in the banking sector around green lending should improve the efficiency of capital deployment in the economy.

Looking at social policies, the focus on home affordability, educational accessibility and healthcare are paramount in avoiding the potential demographic crisis emerging from the one-child policy. Despite Chinese issuers’ relatively lower-rated ESG profiles (driven by the sovereign risk rating, weaker disclosures and entrenched boards) we expect top-down policy to be an incremental driver for improvements.

Further, we expect both USD and CNY fixed income markets to continue to grow given the April 2021 update to the China Green Bond Endorsed Projects Catalogue and the work being undertaken by China and the EU to assess Common Ground Taxonomy.

Related

Emerging markets, Asia & China

Emerging markets, Asia & China

Authoritative views and insights on investing opportunities in some of the world’s most dynamic economies

PDF

Investment outlook 2022

Investment outlook 2022

As we work towards building a more sustainable future and continue to face global supply chain and inflation challenges, what role will asset managers play, and how will this reshape the economy?

Was this article helpful?

Please enable javascript in your browser and retry.

The feedback component cannot be displayed.

Nicole Fröhlich

Head of Fixed Income Research

Nicole Froehlich is Head of Fixed Income Research leading a global group of over 30 research professionals including Investment Grade, High Yield, Emerging market and securitized credit as well as Money Market debt analysts.

Geoffrey Wong

Head of Emerging Markets and Asia Pacific Equities

Geoffrey Wong is Head of Emerging Markets and Asia-Pacific Equities with overall responsibility for all Emerging Markets, Asian, Japanese and Australian equity teams, strategies and research. Geoffrey is also responsible for research, portfolio management and construction for Emerging Market Strategies.

Cui Cui

Equities Research Analyst, China Healthcare

Cui is a member of the Global Emerging Markets and Asia Pacific Equities team and is responsible for investment analysis of China/Hong Kong equities, specificized in healthcare sector.

Read more

-

-

UBS Art Collection commission: 'Ermatingen mountain' by Ugo Rondinone

Watch as Ugo Rondinone’s monumental 'ermatingen mountain' is installed at Wolfsberg – UBS Center for Education and Dialogue

-

Yin Xiuzhen: ‘Each piece of clothing brings with it the wearer’s spirit’

The continually inventive Chinese contemporary artist Yin Xiuzhen provides insight into her use of worn clothes as an artistic material and her views on sustainability.

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.