Macro monthly

Navigating the US debt drama

Negotiations are likely to conclude with a last-minute deal to raise the debt ceiling. We expect continued US economic resilience.

![]()

header.search.error

Macro monthly

Negotiations are likely to conclude with a last-minute deal to raise the debt ceiling. We expect continued US economic resilience.

Highlights

Macro updates

Keeping you up-to-date with markets

As negotiations over raising the US debt ceiling twist and turn, we have three core convictions on their evolution and endgame. The risk of a default on US Treasury obligations is extremely low. A compromise agreement by early June is more likely than not. But volatility is poised to increase in the near term, as markets are likely to price in some risk of a disruptive outcome between now and then.

Discussions had taken a positive turn in mid-May as US President Joe Biden expressed a willingness for deficit reduction via spending cuts and the group of negotiators slimmed to key Republicans and the White House. However, both sides are incentivized to drag out talks to make a deal appear difficult to demonstrate to their respective camps that they negotiated for the best outcome possible. The situation will remain fluid, but we expect more negative headlines than positive ones until such time that a resolution is at hand.

Once left-tail risks linked to a failure to raise the debt ceiling are behind us, we will be back to a world in which economic activity and earnings are likely to remain more resilient than many expect.

Down to the wire

In our view, a deal is unlikely to be reached until just before or shortly after the June 1 ’X-date’ (when the US government is in danger of completely running out of money) as identified by Treasury Secretary Janet Yellen. It has become more likely that, before the government receives tax payments on June 15, the US federal government will be unable to meet all of its spending commitments within roughly a week of the X-date. It is also possible that Congress passes a short-term extension to raise the debt limit and provide more time to negotiate, and we find ourselves replaying this situation in several weeks.

We believe there is a basic framework for a deal taking shape. The most important component is likely to be a multi-year cap on the level and/or growth rate of federal government discretionary spending beginning this October in exchange for lifting the debt ceiling through the 2024 US elections. Reclaiming unspent COVID-19 relief funds from states and energy infrastructure permitting reforms are also likely to be part of any deal.

Reductions in spending relative to the prior baseline will amount to a drag on growth, but one that is surmountable for an economy that is still displaying nominal strength. Any fiscal drag is likely to be less negative for economic activity compared to the fiscal consolidation that resulted from the 2011 debt ceiling agreement.

What happens past the X-date?

Should Democrats and Republicans fail to reach an agreement past the X-date, there are larger downside risks to growth. The US government would immediately need to limit spending to its revenue-generating capabilities. Conscious that a default on Treasury obligations would risk a financial calamity, we strongly expect the Treasury would prioritize making principal and interest payments on the debt over other obligations. Indeed, Federal Open Market Committee (FOMC) conference call transcripts from prior debt ceiling episodes in 2011 and 2013 state that this was the gameplan.

A prioritization of debt payments means that other obligations would not be met. The ensuing drop-off in spending and substantial hit to consumer confidence would be an increasingly negative drag on economic activity the longer the standoff lasts. In our view, any potential period in which the US government is unable to meet all of its obligations is likely to be short-lived. Whether due to market angst or public outcry, lawmakers would feel pressure to reach a compromise.

A failure to raise the debt ceiling, even without a sovereign default, would be negative for risk assets and positive for longer-term US government bonds given the hit to economic growth. The impact on the US dollar would likely be bifurcated, with weakness against traditional safe havens like the Japanese yen, but stronger against growth sensitive currencies.

What if there is a default on Treasuries?

We think there are very low odds that the US government defaults on one of its debt obligations. In the very unlikely event that were to arise, risks to the financial system would be significant. The most severe financial distress occurs not when assets that are known to be risky suffer, but rather when assets that are widely believed to be safe fail. It is very likely that the negative ramifications are not possible to fully identify ex ante, but may include ratings downgrades of the United States, forced selling of US Treasuries, faults in funding markets and broader systemic stress.

In our view, it is more likely that President Biden acts unilaterally to continue paying the US’s debt obligations (citing the 14th Amendment, which states “the validity of the public debt … shall not be questioned”) than it is that the Treasury ceases making principal or interest payments. This maneuver would be drastic and legally dubious, but put Republicans in the optically unfavorable position of trying to get the courts to enforce a US default.

In a worst-case scenario, we are operating under the principle that the Federal Reserve is prepared to act decisively to maintain market functioning should the creditworthiness of Treasuries be thrust into question. Financial stability considerations will be paramount, even though monetary policymakers do not want to be seen as shielding Congress from the consequences of failing to raise the debt ceiling.

The transcript of the 2013 Federal Reserve meeting on the debt ceiling, indicates that then Governor, now Chair Jerome Powell is willing to accept “loathsome” options such as buying defaulted US Treasury securities or swapping unblemished Treasury securities on the Fed’s balance sheet for defaulted ones, if necessary.

Asset allocation

We believe the macroeconomic landscape will become more supportive of risk once this large potential headwind is behind us, and believe a deal will be struck by early June. Any meaningful pullbacks in the stock market linked to concerns about whether a debt ceiling agreement will be reached or if the US government will not service its debt obligations may be an attractive point to increase equity exposure, in our view.

Corporations have retained pricing power amid a slowing in economic growth – and nominal activity is still high and has room to decelerate further without triggering recession fears. The aggregate amount that US companies exceeded expectations increased for both the top and bottom lines during the most recent reporting period. The resilience of nominal activity and margins suggest that downside to earnings is limited outside of recession, which we do not believe is imminent. Core inflationary pressures are also poised to decelerate, in our view, and may give scope for the Federal Reserve to not only skip hiking rates at its June meeting, but go on a more extended pause.

Ahead of debt ceiling talks, our relative value positioning in equities and foreign exchange became somewhat more defensive, in line with our belief that there will be some unease in markets along the way to an eventual deal. We are prepared to be nimble to take advantage of opportunities that arise across asset classes if debt ceiling headlines drive market dislocations in the days to come.

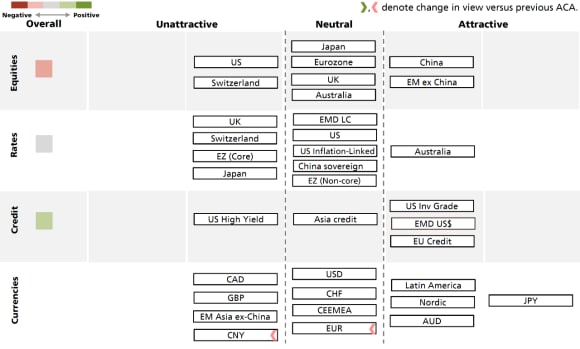

The chart below shows the views of our Asset Allocation team on overall asset class attractiveness as of 23 May 2023. The colored squares on the left provide our overall signal for global equities, rates, and credit. The rest of the ratings pertain to the relative attractiveness of certain regions within the asset classes of equities, rates, credit and currencies. Because the ACA does not include all asset classes, the net overall signal may be somewhat negative or positive.

Asset Class | Asset Class | Overall/ relative signal | Overall/ relative signal | UBS Asset Management’s viewpoint | UBS Asset Management’s viewpoint |

|---|---|---|---|---|---|

Asset Class | Global Equities | Overall/ relative signal | Light Red | UBS Asset Management’s viewpoint |

|

Asset Class | US Equities | Overall/ relative signal | Light Red | UBS Asset Management’s viewpoint |

|

Asset Class | Ex-US Developed Market Equities | Overall/ relative signal | Light Grey | UBS Asset Management’s viewpoint |

|

Asset Class | Emerging Markets Equities (ex. China) | Overall/ relative signal | Light Green | UBS Asset Management’s viewpoint |

|

Asset Class | China Equities | Overall/ relative signal | Light Green | UBS Asset Management’s viewpoint |

|

Asset Class | Global Duration | Overall/ relative signal | Light Grey | UBS Asset Management’s viewpoint |

|

Asset Class | US Bonds | Overall/ relative signal | Light Grey | UBS Asset Management’s viewpoint |

|

Asset Class | Ex-US DM Bonds | Overall/ relative signal | Light Red | UBS Asset Management’s viewpoint |

|

Asset Class | US IG Corporate Debt | Overall/ relative signal | Light Green | UBS Asset Management’s viewpoint |

|

Asset Class | US HY Corporate Debt | Overall/ relative signal | Light Red | UBS Asset Management’s viewpoint |

|

Asset Class | Emerging Markets Debt | Overall/ relative signal | Light Green | UBS Asset Management’s viewpoint |

|

Asset Class | China Sovereign | Overall/ relative signal | Light Grey | UBS Asset Management’s viewpoint |

|

Asset Class | Currency | Overall/ relative signal |

| UBS Asset Management’s viewpoint |

|