Double take on China: policy support

Many believed Beijing has not been doing enough to support China’s slowing economy. Does the surprise round of easing measures in September change things?

![]()

header.search.error

Many believed Beijing has not been doing enough to support China’s slowing economy. Does the surprise round of easing measures in September change things?

The state and outlook of China’s economy have been burdened by persistently weak domestic demand this year. But Chinese policymakers had been reluctant to pull out all the stimulus stops, until now.

A languishing economy in many ways is forcing Beijing’s hand. There is new urgency in the surprise policy pivot in September: the broad set of supportive measures are more comprehensive in scope and could have a more immediate and material impact than previous efforts. Policymakers are taking action sooner than we had expected, but is this round of policy moves enough to revive consumer and business confidence and shake the property market out of its doldrums?

To answer that question, we do a double take on the various government efforts this year.

Extreme caution turns into anemic demand

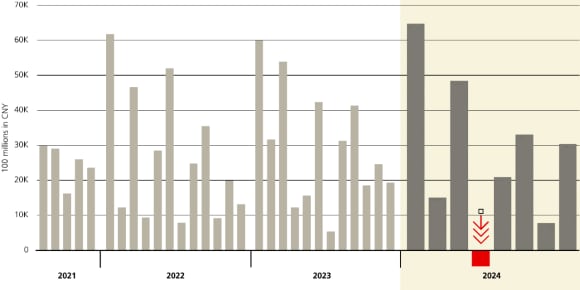

One telling barometer on the flagging demand and sluggish economy is the total social financing (TSF), also known as aggregate financing. It measures credit and liquidity in the economy, and it declined in March for the first time since 2005. While the gauge rebounded feebly in the months after, on an overall basis it contracted sharply this year after a strong 2023.

Total social financing (TSF)

A similar measure on credit lent to the real economy yielded similar results: new bank loans contracted for the first time in almost two decades. Short-term household loans turned negative for the third time this year in July, while longer-term household loans (mostly mortgages) went up marginally. Meanwhile, corporate loans more than halved from a year ago.

Chinese consumers and businesses are reluctant to borrow in an uncertain environment, not to mention spend or invest for the future. Although discretionary spending on entertainment and travel is solid, continued weakness in big-ticket purchases pushed overall retail sales to a new post-pandemic low in June.

A change in policy thinking

To shake up the stubbornly conservative attitude, policy support and pledges on commitment to stabilize growth have already picked up in intensity in the past few months, but markets remained unconvinced – that is until the September pivot.

As it turns out, the flurry of surprise interest rate cuts in June was just the beginning: benchmark interest rates were cut broadly and further in September after the US rate-cutting cycle began, giving the People’s Bank of China (PBOC) more policy room.

While in line with market expectations and largely priced in by markets already, the latest cuts to the banks’ reserve requirement ratio (RRR), mortgage rates and the seven-day reverse repo rate increase the common equity tier 1 (CET1) capital for banks, encouraging more lending to the real economy.

More importantly, the new tools to support liquidity in capital markets are a positive surprise and represent a change in policy thinking and approach. A swap facility for securities firms, funds and insurance companies together with a relending facility for listed companies will provide RMB 800 billion in total direct funding support to encourage stock purchases and buybacks. On top of that capital boost, a state market stabilization fund was also discussed. Not only could these measures lift the downcast market sentiment, they could also be a signal for more easing to come.

A drawn out property market crisis

Since last year, a number of measures have been implemented to lighten the load of homebuyers, including lower rates for new mortgages, reduced downpayment requirements as well as the removal of purchase restrictions. Still, housing sales and prices dropped to new lows in recent months as the sector’s troubles are more entrenched than initially expected.

In the September round the government went further. Minimum downpayment for second homes was brought down to the same level as for first homes. Rates for existing mortgages were reduced, narrowing the gap between new and existing home loans. The affordable housing program set up in June – for state-owned enterprises (SOEs) to turn unsold and excess inventory into low-income housing rentals – also received a boost via a rate cut to its relending loan facility. However, the stringent criteria on what qualifies for the program is more limiting than funding itself in our view.

On one hand, the government is ensuring the delivery of pre-sold apartments; and on the other hand, it is making sure the oversupply of unsold homes is reduced. That said, until we see price improvement in Tier 1 and 2 cities – a closely followed metric that is considered the first step to a sector recovery – more needs to be done to rebalance supply and demand, and we don’t see sentiment to improving substantially. We believe the fundamentals of the property market will take longer to unwind; the sector is unlikely to materially recover so long as income prospects and job availability remain uncertain.

Special treasury bonds to support scientific innovation and economic growth

While the issuance of the RMB 1 trillion ultralong special treasury bonds (alongside RMB 1.9 trillion special-purpose local government bonds) in May is a significant step, this type of ultra-long bonds are rarely used and are intended to be a steady source of funding for long-term, high quality infrastructure projects. These bonds can help offset some of the drag from weak private demand, but the impact on broad credit growth is expected to be gradual.

Perhaps more remarkable is the RMB 300 billion allocation of the special treasury bond proceeds to expanding an existing trade-in and equipment upgrade program. It covers a wide range of equipment and consumer goods, and although the projected spend represents only a small part of the retail economy, directly linking the bond program with consumption is without precedent in China.

It’s all relative?

To get a sense of scale, looking at efforts of other countries in supporting economic growth provides an interesting reference. During the global financial crisis, US purchases of mortgage and treasury debt for the first round of US quantitative easing (QE1) peaked at RMB 14.9 trillion. China’s bond issuance at RMB 2.9 trillion is roughly a fifth of that, but its stimulus package at RMB 4 trillion in 2008 – widely considered massive – only amounted to slightly more than a fourth of the US spend.

It is of course not entirely fair to compare China with the US, given the fundamental differences in policies and the makeup of the economy. The bond package is in fact less than what was put forth in 2008, even if one throws in the latest liquidity facilities, and it is still not enough in our view. What else can the government do to prevent a prolonged economic slump and cement recovery momentum?

One option is to help households refinance mortgage debt. Household debt in China is quite large relative to income, so once households started paying off debt, they have less to spend, particularly among lower-income and more indebted households. While the cuts to new and existing mortgage loans will put more money back in households, there is no guarantee that the money would be spent rather than saved.

Yet another option would be direct consumption vouchers. While there are several small-scale province-level trial efforts – e.g., Anhui province has issued discounts and subsidies for spending at restaurants and shopping for home appliances and cars – the central government so far has resisted similar measures at the national level, questioning their impact and effectiveness.

More is more

Taken together, the comprehensive package of policy stimulus exceeds market expectations. In the long term, we are still looking forward to measures that target households, whether through social welfare spending or direct consumption support, in the country’s push for a more sustainable, high quality development focused on consumption. We would also like to see policies that target businesses and help reestablish confidence among entrepreneurs. We believe they can be more effective to put an end to the downward spiral of consumer and business sentiment than those targeting investment and infrastructure.

To be sure, markets are reacting euphorically in the short term to the stronger set of policies amid subdued expectations and overly bearish market sentiment. After a four-month steady decline following a short-lived spring rally, the Shanghai Stock Exchange (SSE) Composite Index was near a multiyear low before the PBOC announcement kicked off a dramatic rebound (as of 27 September 2024).

However, a sustained market rally – not to mention a sustained economic recovery – would be dependent on the follow-through of the announced measures as well as the potential for coordinated fiscal stimulus. It will inevitably take time for the various support measures to work, but at the same time we are hopeful as the policy direction is clearer now.