Emerging market review and outlook – equities and fixed income

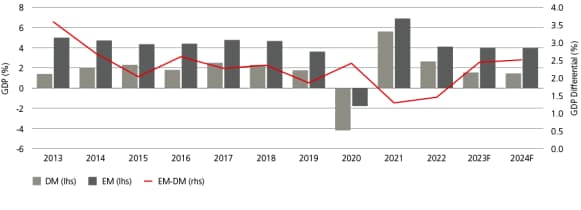

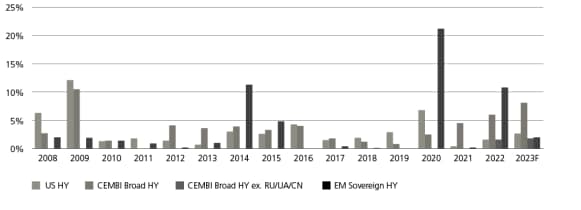

Overall emerging market growth is likely to be lower going into the new year, but we believe active management could continue to build a compelling emerging market case for global investors.