UBS Multi Asset Strategy Tactical Rotation Index

The UBS Multi Asset Strategy Tactical Rotation Index (the “Index” or the “UBS-MASTR Index”) aims to provide a diversified and global exposure to equities, bonds and commodities, using an alternative-data- driven growth momentum signal.

Each asset class features its own investment mechanism. Equities use an intraday rebalancing methodology seeking to quickly react to changes in equity markets. Bonds use a dynamic weighting mechanism which is designed to adapt to various rates environments. In addition, a diversified commodity alpha strategy is used as a potential source of uncorrelated returns.

The Index targets a volatility of 6% with the goal of providing smooth and stable returns over the long run.

Ticker:

UBSMASTR Index

Previous day closing level:

Single-day % change

Watch the short video on UBS-MASTR

Global multi asset exposure

Global Equities

Global Equities

Exposure to the US, European and Japanese equity markets through the S&P 500®, Euro Stoxx 50® and Topix 100® futures.

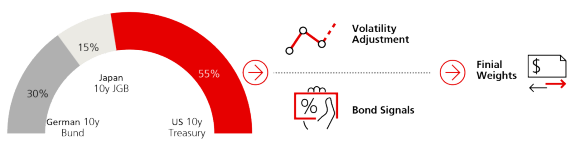

Global Bonds

Global Bonds

Exposure to the US, European and Japanese bond markets through 10Y US Treasuries, 10Y German Bunds and 10Y Japanese Government Bonds futures.

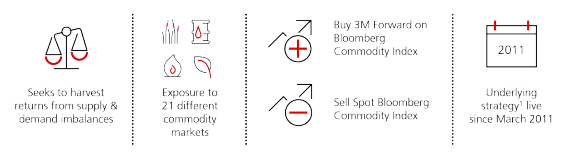

Commodities

Commodities

Exposure to commodities market (excluding precious metals) aiming to harvest supply/demand imbalances across 22 commodities.

Multi layer volatility control

To target a volatility around 6% over the long term, the Index applies a multi-layer risk control that measures:

- The volatility of the index sub-components and their correlations

- The realized volatility of the final index itself

Step one: Volatility of the sub-components

Step one: Volatility of the sub-components

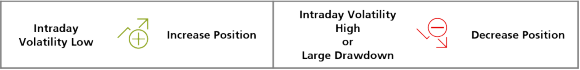

- Recent volatility of the sub-components is measured daily for Bonds and Commodities, and measured intraday for Equities.

- Each sub-component is designed to target a certain realized volatility.

Step two: Volatility of the final Index

Step two: Volatility of the final Index

- Realized volatility of the Index itself is measured daily over multiple lookback windows.

- Both short-term and long-term volatility measures are used to determine the final leverage and aim to keep the final Index realized volatility in line with its 6% target over the long term.

Performance statistics

UBSMASTR

| YTD | 1y | 3y | 5y | 10y | All | |||||||

Annualized Return (except YTD) | -3.31% | -3.31% | 0.62% | 0.74% | 4.98% | 8.18% | |||||||

Volatility | 6.09% | 6.09% | 5.79% | 5.74% | 5.64% | 5.61% | |||||||

Return/Risk | -0.54 | -0.54 | 0.11 | 0.13 | 0.88 | 1.46 |

Resources

Download our useful resources, updated monthly.

Download our useful resources, updated monthly.

Selected risk considerations

- The Index is not guaranteed to succeed at meeting its objectives.

- The Index relies on a risk control methodology and could underperform indices that do not have a risk control overlay.

- The intraday rebalancing of the Index can lead to underperformance when markets exhibit non-trending behavior. For example, if equities included in the index experience a sharp decline followed by a sharp recovery within the same day, the intraday drawdown control mechanism may cause the Index to underperform similar indices that do not have such an intraday drawdown control mechanism.

- There is a potential for the underlying data to incorrectly Nowcast the key economic indicators and subsequently incorrectly determine the state of economic growth, which might then negatively impact the Index allocations and the Index performance.

- The Index has exposure to global equities, commodity and global bonds markets which may be volatile and decline in value.