Article

Overcoming the carbon investment conundrum

Rethinking emission metrics for a progressive approach to climate investing.

![]()

header.search.error

Article

Rethinking emission metrics for a progressive approach to climate investing.

Organizations like Doctors Without Borders (Médecins Sans Frontières, MSF) operate where they are most desperately needed, often in countries that score poorly on health, democracy, and economic opportunity. Despite these tough conditions they make a difference by working for change - even though it often means starting from a low base.

It may seem puerile to compare MSF’s heroic efforts to the actions of investors operating from the safety and comfort of air-conditioned offices. Still, the organization’s mindset of actively seeking out and engaging with problem areas can also be applied to investors with impact ambitions. MSF demonstrates the importance of addressing challenges at their core.

High-emission industries are vital organs of society

Currently, most climate-related capital is invested in exclusion-based and low-carbon strategies, which avoids making investments in the worst emitters. While there are valid investment arguments for avoiding high-risk businesses with significant transformation challenges and stranded assets, it is essential to recognize the potential for making a difference by actively investing in and engaging with high-emissions companies.

Bill Gates' breakdown of the global carbon footprint into various categories highlights that the industries that are most to blame for damaging the climate also keep society functioning:

How much greenhouse gas is emitted by the things we do? | How much greenhouse gas is emitted by the things we do? | ||

|---|---|---|---|

Making things (cement, steel, plastic) | 31% | ||

Plugging in (electricity) | 27% | ||

Growing things (plants, animals) | 19% | ||

Getting around (planes, trucks, cargo ships) | 16% | ||

Keep things warm and cool (heating, cooling, refrigeration) | 7% | ||

We can strive to do more with less, but we cannot end these activities. They will continue to play a critical role in our lives and our economy. Therefore, it makes sense for impact-oriented investors to not exclude companies in these industries but rather support an acceleration of their decarbonization.

Also, it is often the case that the higher the risk, the higher the potential reward. Companies that successfully transition are likely to deliver attractive investment returns. In many ways it resembles traditional turnaround investing. This is an area where the investment and impact theses should be closely intertwined.

Measure what matters: change

While advocating engagement rather than divestment is nothing new, investment strategies fully embracing this approach are still rare. One of the reasons is the emission metrics used by investors. Today, the most common metric is weighted average carbon intensity (WACI), capturing an investment portfolios’ exposure to investee companies’ current emission intensity. WACI disincentivizes investments in companies with high emissions regardless of their importance to society.

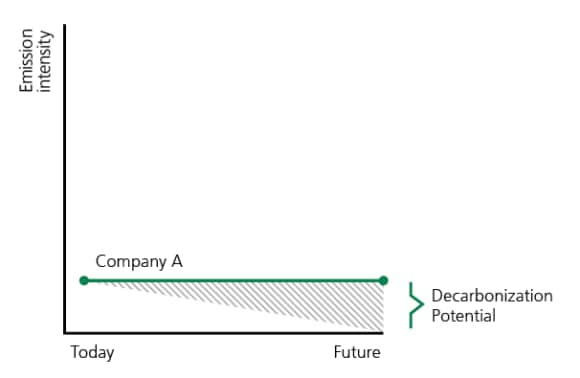

The focus on WACI, coupled with the complexity of measuring sustainability outcomes and impact, has created a misalignment of metrics that hinders the progress of transition investing. High-emission companies may score worst on this metric, but they also represent the most important opportunity for change. Transition investing requires a new mindset, and a move towards measuring the rate of change in real economy emissions. This is further detailed in a recent Institute white paper (figure 1).

Metrics measuring change rather than the current state

By rethinking and reengineering the field of climate investing we can pave the way for a new wave of investors who actively contribute to solving the climate crisis. Transition investing requires measuring success, holding investors accountable for financial and sustainability outcomes, and embracing a more nuanced and progressive approach.

Conclusion

MSF are willing to go to difficult places and support the ones most in needed. Investors are not tasked with saving lives, but they can apply the same mindset of addressing challenges at their core. Instead of divesting, the climate crisis can be addressed by engaging with companies in need of change. It requires a change in mindset and metrics applied by sustainability focused investors. Also, change represents opportunities, and while the risks are high, this is true for high emission industries. Therefore, supporting investee companies' transitions aligns with investors fiduciary responsibilities to deliver financial returns.

Given ever increased scrutiny of sustainable investing, aligning metrics with desired outcomes is critical. We need metrics that hold investors accountable for their ability to support and drive change in the real economy.

The author is grateful for feedback from: Nalini Tarakeshwar, Richard Mylles, Jackie Bauer, Mike Ryan, Richard Morrow.

For further information, please read our thought leadership disclaimer