International Pension Gap Index

Will your pension be enough to finance the life you’re used to living?

![]()

header.search.error

Will your pension be enough to finance the life you’re used to living?

In many countries, mandatory pension schemes alone can’t maintain your accustomed lifestyle in retirement.

Private savings are often crucial to covering expenses in old age.

Retirement planning can help you assess how much you need to save.

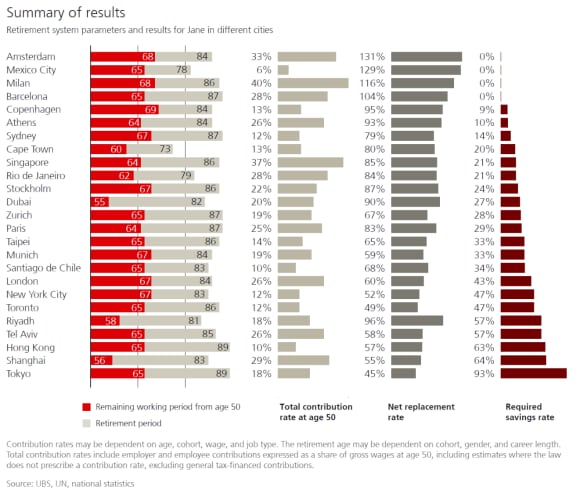

The UBS International Pension Gap Index benchmarks 25 retirement systems around the world. It does so based on the voluntary savings a fictional 50-year-old woman (Jane) needs – in addition to benefits from mandatory pension schemes – to maintain her accustomed lifestyle in old age.

The report reveals a pension gap in many retirement systems. This is a shortfall between expected retirement income and the expenses required to maintain your accustomed standard of living. When that’s the case, private savings and investments can help to close this gap.

Mind the gap

Pension gaps are influenced by various factors, including life expectancy, retirement age and the benefits that mandatory pension schemes intend to deliver. It’s key that you understand the pension schemes you’re enrolled in and the level of benefits you can reasonably expect from them. You also need to factor in the inherent uncertainty related to pension reforms.

Far from being reckless, investing savings in view of retirement can help workers maintain their accustomed lifestyle in old age.

Women tend to pause their careers and work part-time more often than men. As a result, they often experience lower wage growth, accumulate fewer retirement benefits and save less during their working lives. Women also tend to outlive men. This all means that women’s savings needs are usually higher than those of men.

From planning your finances to providing individual solutions, we focus on helping you get more out of life and your wealth.