Video features

Latest video content from the Chief Investment Office

![]()

header.search.error

Latest video content from the Chief Investment Office

On Thursday, 5 February at 1:00 p.m. ET, join our upcoming livestream with Ulrike Hoffmann-Burchardi, Chief Investment Officer Americas and Global Head of Equities, and Leslie Falconio, Head of Taxable Fixed Income Strategy, where they will discuss CIO’s outlook for a broadening market rally, and the continued importance of high-quality fixed income in today’s evolving investment landscape. Hosted by Anthony Pastore, Head of Broadcast Communications, CIO Americas.

Watch the replay of the CIO House View monthly livestream for a conversation with Mark Haefele, GWM Chief Investment Officer, and David Lefkowitz, Head of US Equities, CIO Americas, hosted by Anthony Pastore, Head of Broadcast Communications, CIO Americas. Global equity markets have surged on the momentum of artificial intelligence, but investors now face a pivotal question: can AI drive economies to “escape velocity” and unlock a new era of growth, or will challenges like rising debt and persistent inflation slow progress? Our discussion will help you interpret the signals, seize opportunities, and build resilient portfolios for long-term success. For more insights, read CIO’s Year Ahead 2026 outlook.

Please note there won't be a CIO House View monthly livestream in January due to the New Year’s holiday. Yhe monthly series will resume on 5 February 2026 at 1:00 p.m. ET.

Watch the replay of the House View livestream, hosted by Nadia Lovell, Head of Global Equity Strategy & Management, featuring David Lefkowitz, CIO Head of US Equities, and Kurt Reiman, Head of Fixed Income. Markets have entered the fourth quarter near record highs, powered by strong corporate earnings, resilient consumer spending, and advances in artificial intelligence. While renewed US-China trade tensions have reminded investors that volatility can re-emerge, we believe a full-scale trade war remains unlikely.

Our experts discussed why we’ve upgraded US equities to Attractive, supported by robust AI momentum, a more accommodative policy backdrop, and a strong US growth outlook. They shared our latest S&P 500 earnings forecasts, highlighted sector preferences—including financials, technology, and health care—and examined fixed income opportunities as the Fed pivots and yield curves shift. Plus, they introduced our new report, “From sea to shining sea: The transcontinental railroad,” launching a series in honor of America’s 250th birthday and celebrating the nation’s spirit of enterprise.

The Fed’s decision to lower rates by 25 basis points at its September meeting was driven by signs of labor market weakness and subdued inflation pressures. Historically, rate cuts outside of recessions have supported equity market performance. However, we remain vigilant regarding potential economic uncertainties and inflation risks.

We discussed the economic outlook, the impact of the recent Federal Reserve rate cut, and practical strategies for deploying cash in today’s market. The session featured Leslie Falconio, Head of Taxable Fixed Income Strategy, CIO Americas, and Jason Draho, Head of Asset Allocation, CIO Americas, with host Anthony Pastore, Head of Broadcast Communications, CIO Americas.

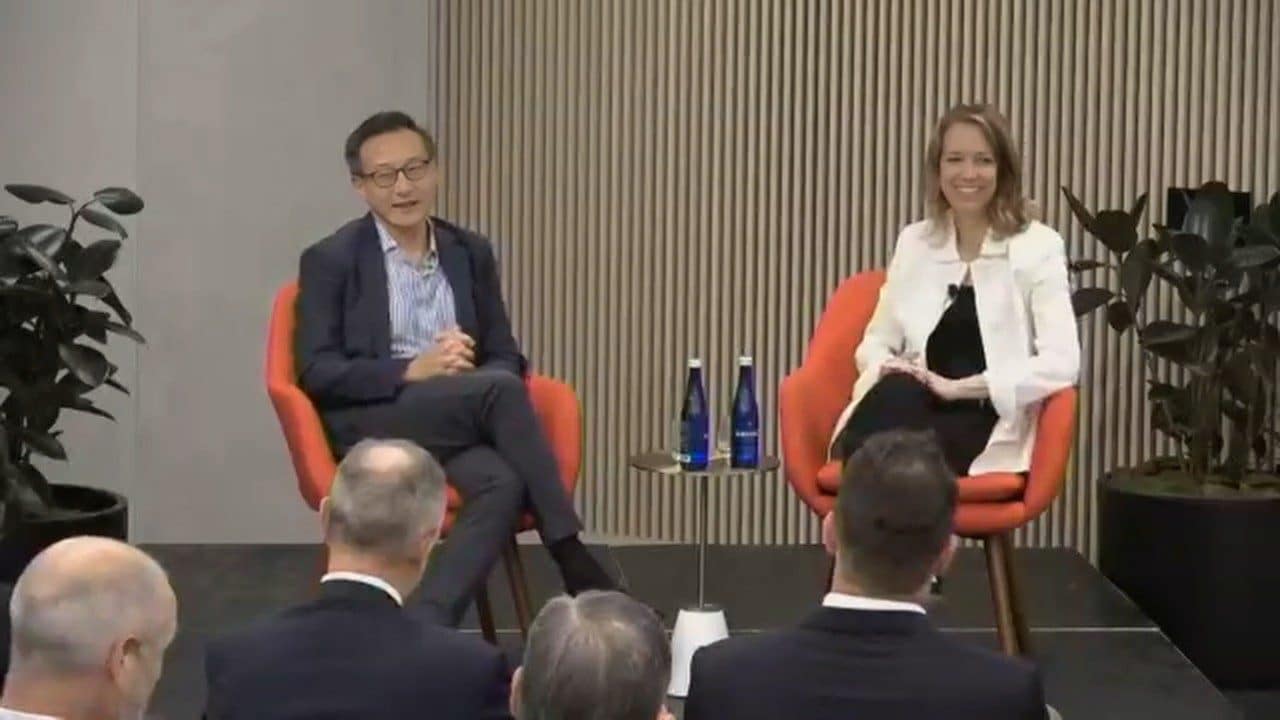

A special edition fireside chat with Joe Tsai, Chairman of Alibaba, a global leader in e-commerce and artificial intelligence. Following introductory remarks from Mike Ebert, Head IB Americas at UBS, Ulrike Hoffmann-Burchardi, Chief Investment Officer Americas and Global Head of Equities, moderates a conversation, delving into topics like the future of AI and the dynamics of the China Tech market.

Explore more artificial intelligence content from CIO at ubs.com/ai-hub