With AI demand remaining robust and the technology likely to disrupt and transform industries in the years to come, CIO thinks it is important for investors to ensure they’re sufficiently invested. (UBS)

Shares of the chipmaker rose 3.5% on Tuesday, lifting its market capitalization to over USD 3.3tr, more than those of Microsoft and Apple. Since its latest quarterly results on 22 May, NVIDIA has risen over 30%, while the Nasdaq is up 6.7%. US markets were closed on 19 June for the Juneteenth National Independence Day holiday.

Without taking any single-name views, we continue to believe AI offers significant opportunities for growth, with potential value creation likely amounting to trillions of dollars. But the global tech sector is not cheap, and the various parts of the AI value chain may benefit at different stages as the technology continues to develop. We see several approaches investors can consider today.

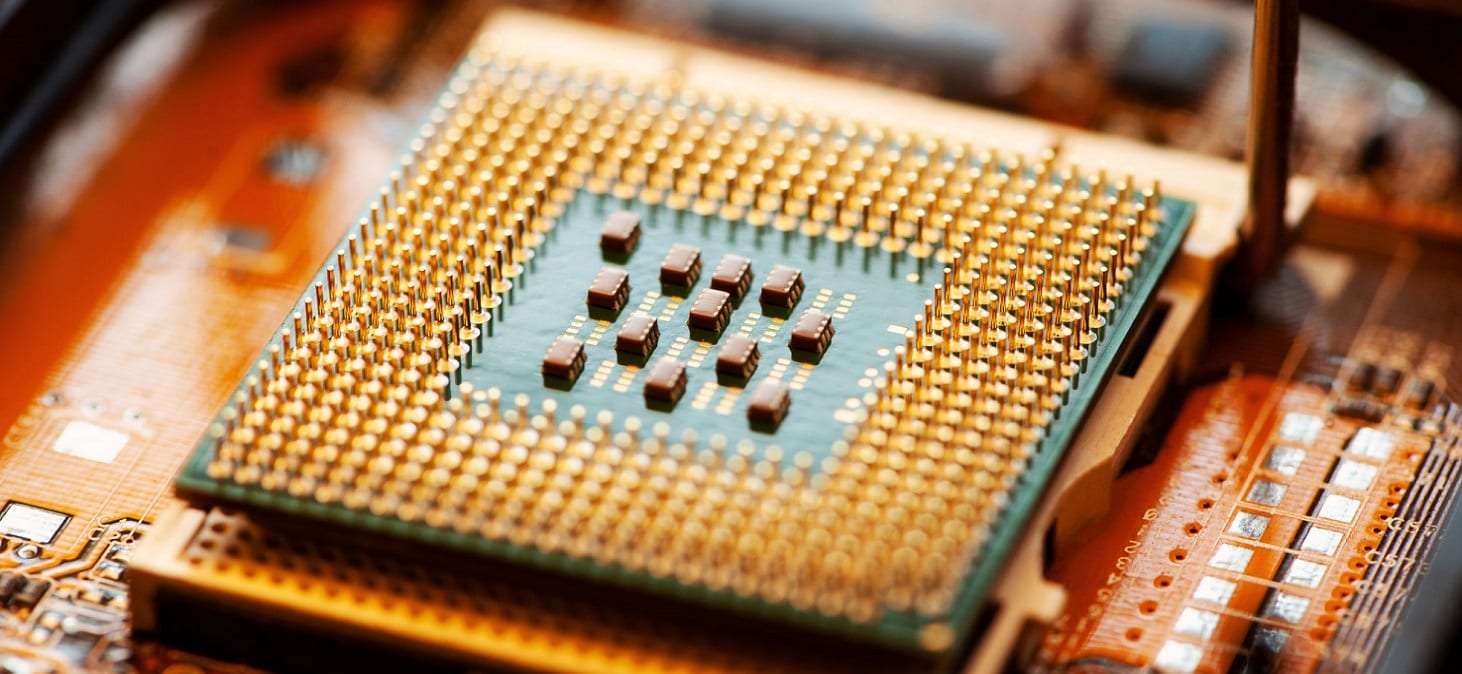

Look for AI enablers. Like past technology cycles, significant investment in the underlying infrastructure is required in the early phase. This means companies that provide the backbone for AI development, ranging from semiconductor production to chip design, cloud and data centers, and companies involved in power supply are currently well-placed given visible earnings growth profiles and strong competitive positioning. While US lawmakers have introduced a new bipartisan bill seeking to ban chipmakers from buying Chinese-made chip equipment for use in the US, robust AI-linked demand remains the biggest driver for the segment. We expect USD 331 billion in annual capital expenditure for the enabling layer by 2027.

Big tech companies are at the forefront of AI growth. AI investment has been led by financially strong companies, with high-quality earnings, strong profitability, and healthy cash flows. This financial stability reduces the risk of speculative bubbles, in our view, and it means that megacaps are core to the AI story. We expect the AI market to be dominated by an oligopoly of vertically integrated “foundries” and monolithic players along the value chain, covering chips, cloud computing, and generative AI models and applications.

Consider structured investments for defensive positioning. Options or structures with capital preservation features can be an effective way to position for potential gains in AI-related names, while managing sentiment, valuation, and idiosyncratic risks. Such strategies at an index level can also help investors mitigate potential macro and geopolitical risks.

With AI demand remaining robust and the technology likely to disrupt and transform industries in the years to come, we think it is important for investors to ensure they’re sufficiently invested. In fact, given the size of some of the largest AI companies, investors may consider weightings more akin to those of certain country equity markets than to those of other companies

Main contributors: Solita Marcelli, Mark Haefele, Daisy Tseng, Thomas Wacker, Dean Turner, Sundeep Gantori, and Kevin Dennean

Original report - Investing in AI as the rally continues, 20 June 2024.