With still robust AI demand amid an uptick in adoption and monetization, CIO maintains their positive view on the AI growth story. (UBS)

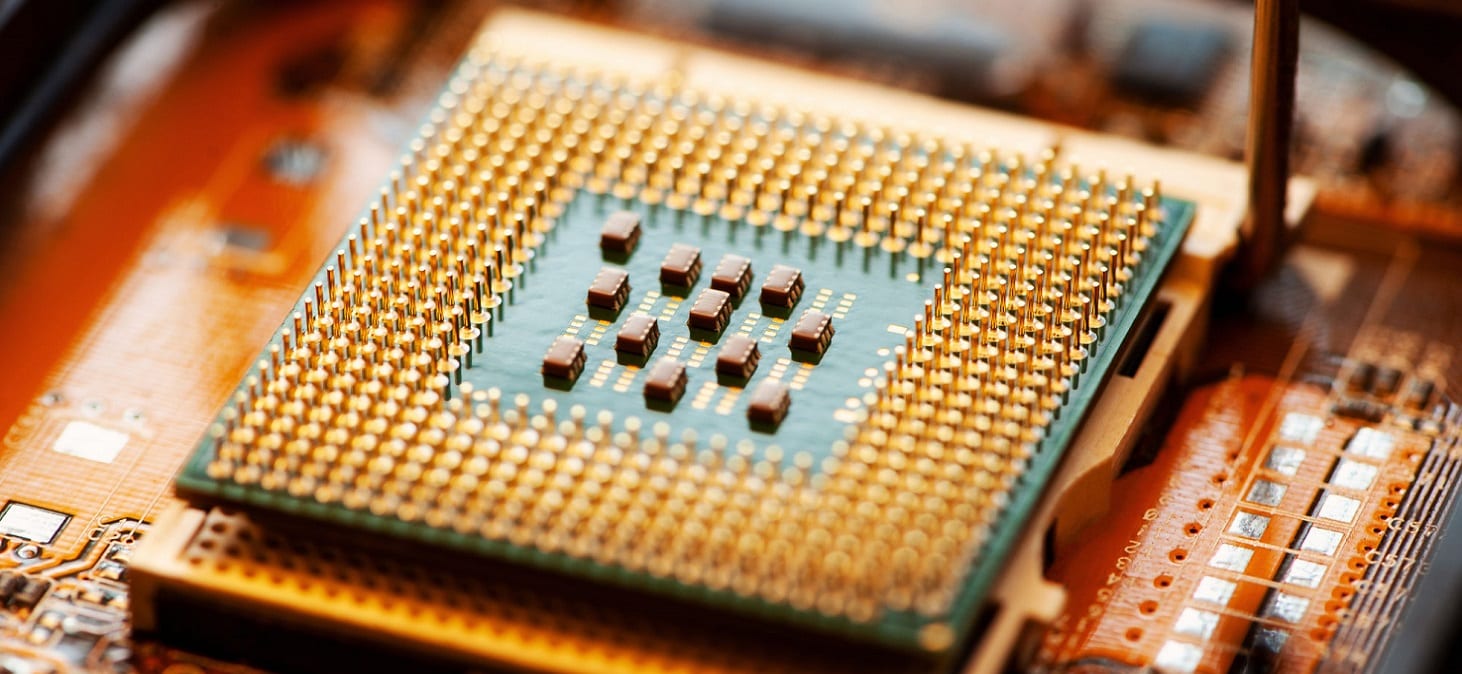

The number of Chinese companies that the US would add to a trade restriction list is said to be fewer than in earlier drafts, according to the report, and the focus of the latest curbs is on Chinese companies that make semiconductor manufacturing equipment rather than fabrication facilities that make the chips themselves.

It remains to be seen what details are included when the new rules are released, and we expect volatility in the broader semiconductor and tech sectors to pick up in the near term, especially as President-elect Donald Trump’s tariffs loom. But we also continue to believe that solid fundamentals should provide support for quality semiconductor companies with exposure to the AI growth story.

Investors are likely to refocus on fundamentals once details emerge. In both 2022 and 2023, semiconductor-related firms experienced sharp corrections in October due to uncertainty around export controls, with the Philadelphia Semiconductor Index falling around 15-20% from peak to trough. However, chip stocks rebounded over the next few months as the impact appeared manageable. Any broad-based implications of the new restrictions remain unclear at this stage, but we believe investors will look beyond the headlines and assess the company-specific impact once details become available.

Trump’s tariffs should have limited impact on AI’s growth story. Trump earlier this week began outlining his tariff plans, threatening levies of 25% on Canadian and Mexican goods and 10% on Chinese imports “above any additional tariffs.” While the latest threats targeted non-trade issues, the tech sector could be affected if the Trump administration decides to raise the effective tariff rate on Chinese imports substantially and introduce universal tariffs on tech imports. In 2018, tech stocks saw a roughly 25% correction from peak to trough amid trade worries. However, we think several tech segments may get tariff relief or exemptions, and the AI supply chain has low dependence on China.

Big tech’s commitment to AI spending should continue to support semi companies exposed to the secular AI trend. Recent earnings from big tech firms continue to underscore their willingness to invest in the technology, with 50% growth in their combined spending this year to USD 222bn and with likely another 20% increase to USD 267bn in 2025. This should continue to be a tailwind for the semiconductor sector. Within semis, we would tilt exposure to AI logic chips first, followed by quality foundry companies where earnings growth should remain strong. Memory companies are more exposed to US restrictions, while chip manufacturing equipment makers are likely the most vulnerable in the near term, given their higher revenue exposure to China.

So, with still robust AI demand amid an uptick in adoption and monetization, we maintain our positive view on the AI growth story. Investors should be prepared for heightened volatility, and consider utilizing structured strategies to build up long-term allocation if their AI exposure is insufficient. Investors with high exposure can consider capital preservation strategies.

Main contributors – Solita Marcelli, Mark Haefele, Sundeep Gantori, Daisy Tseng, Vincent Heaney, Julian Wee

Original report - Markets brace for volatility amid potential US chip restrictions, 29 November 2024.