One-stop solution for investing in China

UBS China Allocation Opportunity Fund

Please read the important information of the fund before proceeding

Please read the important information of the fund before proceeding

UBS (Lux) Key Selection SICAV –China Allocation Opportunity (USD)

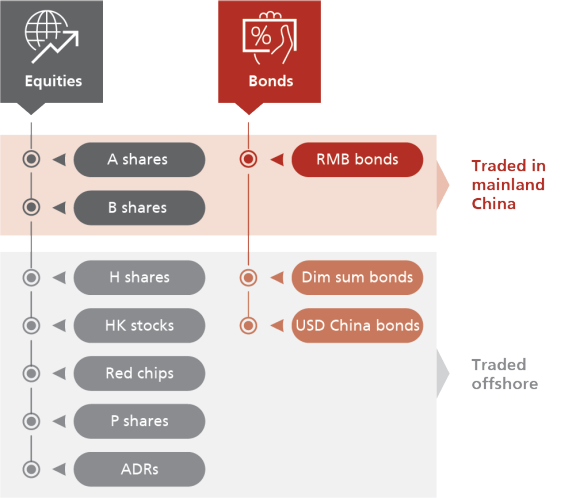

1. Under normal circumstances, the Fund expects to invest up to 65% of its net asset value in equities and equity rights and up to65% of its net asset value in bonds and claims (i.e. secured obligations such as bank loans and other debt instruments) of companies domiciled or chiefly active in China. The Fund may also invest up to 65% of its net asset value in securities traded on the onshore China securities market. These include Chinese A shares ("A shares") as well as RMB-denominated fixed-income instruments traded on the Chinese interbank bond market ("CIBM") or the exchange-traded bond market ("Chinese onshore bonds"). The Fund may invest up to 100% of its net asset value in equities and bonds issued or traded offshore outside the PRC.

Capture China's growth opportunity through a risk-aware approach

Capture China's growth opportunity through a risk-aware approach

China offers numerous investment opportunities, yet is complex. A multi asset portfolio can navigate through market cycles and capture opportunities in different asset classes.

Fund features

Fund features

1. One-stop solution

A unique multi-asset China fund that balances between asset classes and onshore as well as off shore assets.

A multi-asset strategy has historically been much less volatile than most pure equity strategies, which may make it suitable for investors who would like to capture China's growth story, but who would like an easier ride. Additionally, allocating to China fixed income means exposure to the higher nominal yields.

2. Dynamic asset allocation

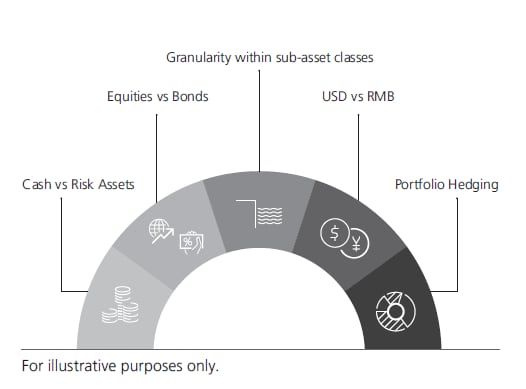

Five levers to steer asset allocation to serve as a diversifier to achieve a strong risk-adjusted return profile.

Active asset allocation matters when investing in China. Here's why.

- Chinese stocks are relatively volatile. A risk-aware balanced investment approach allows investors to access Chinese growth and income with less volatility of the equity markets.

- there is limited diversification benefit between Chinese bonds and equities. Hence, dynamically moving in and out of risk assets in different market environments helps to achieve better risk-adjusted returns.

Make an inquiry

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.