Asia credit market on the recovery path

Key factors driving the Asia credit market’s resurgence and our promising outlook for 2025

![]()

header.search.error

Key factors driving the Asia credit market’s resurgence and our promising outlook for 2025

Despite the still sluggish market sentiment and valuations, a more diversified Asia credit market potentially presents a unique and attractive investment opportunity. In particular, high yield is in a turnaround that could provide a boost to the broader market.

The Asia credit market is poised for continued recovery in 2025, with the Asian high yield market, in particular, showing significant signs of resilience and growth. Following a challenging period marked by defaults and sector concentration, the market has rebounded strongly, presenting possible new opportunities for investors.

A turning point for the Asian high yield market

Similar to other markets that have faced prolonged periods of distress and oversold conditions, the Asian high yield market has made a remarkable recovery, returning a robust +15.2% in US dollar terms, as represented by the J.P. Morgan Non-Investment Grade Index (JACI HY) in 2024. This resurgence surprised many market participants after the tough years of 2021-2023 (which were mainly due to the major default wave in China's real estate sector).

We view 2024 as a pivotal year for the Asian high yield market, and believe the turnaround will continue to bring attractive investment opportunities in 2025. Three key observations reinforce our confidence in the market's return to normalcy:

We are optimistic that these factors will continue to support the positive momentum in the Asian high yield market.

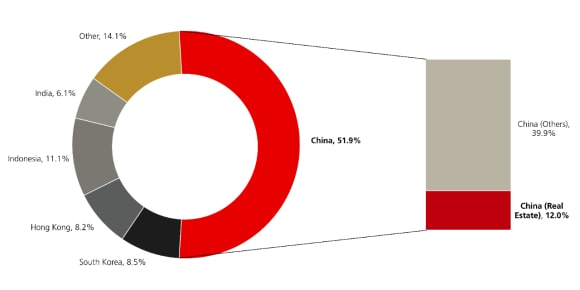

Five years ago, China's real estate sector represented 38% of the Asian high yield market. Today, this figure has decreased to 7.0% because many Chinese property developers had defaulted and were dropped from the index.

As a result, the Asian high yield market has become much more diversified in terms of both countries and sectors. This diversification could prove beneficial to investors seeking higher yields and lower risk. Not only has the risk of investing in real estate been reduced; the broader risk of investing in China has decreased significantly as well.

The China real estate sector is made up of state-owned enterprise (SOE) property developers (2.5% of the high yield market) and private property developers (4.5%) as of December 2024. Most of the private property developers have not defaulted and remain operational. Additionally, the rest of the China high yield risk is distributed among 4.9% in industrial companies and 10.0% in financial institutions, primarily large Chinese banks' additional tier 1 bonds (AT1s).

January 2020

December 2024

Over the past two years, the return and volatility profile of the Asian high yield market has become less correlated with China real estate. There were even instances when the correlation turned negative, as shown in the rolling correlation chart below (Figure 2). The correlations between China's real estate sector and other major Asian high yield sectors, like those in India and Indonesia, have also similarly weakened. This is a noteworthy shift in market dynamics. Moreover, we have observed distinct performance divergences between the China real estate sector and other key sectors. This further indicates that the Asian high yield market has gradually returned to normalcy, no longer being skewed by the dominance of a single sector.

After four years of market adjustments, the default cycle for China real estate is nearly over. Outside of the China real estate sector, other distressed issuers such as those in Sri Lanka have successfully restructured their debt and issued new GDP-linked bonds using a more sustainable debt structure, while Pakistani issuers secured adequate financing in 2024.

Our bottom-up analysis suggests a positive outlook for the future. We forecast a 2.0% default ratio for the Asian high yield market in 2025 on a market value basis. This is driven by the Chinese real estate sector, given a significant number of issuers are already trading at distressed levels. Furthermore, we anticipate that credit loss expectations to be close to zero, as most potential default candidates are already trading at distressed dollar prices close to their potential recovery values.

Currently, with China continuing to implement stimulus measures and most other Asian economies successfully recovering from the impact of the pandemic, credit fundamentals of the Asian high yield market are in excellent shape. This low expected default ratio in 2025 will serve as a strong fundamental factor that could drive Asian high yield spreads even tighter.

Despite the market structure becoming more diversified and the Asian default cycle nearing an end, market sentiment and valuations are still lagging. This scenario could present an attractive investment opportunity in Asian high yield for the upcoming year.

As of the end of December 2024, the blended spread in the Asian high yield market stands at 521 basis points. This is notably wider than the historical normal range of 300-500 basis points observed before COVID and offers a significant spread pick-up over both US and European high yield markets. We believe the low expected default ratio in 2025 will drive Asian high yield spreads to tighten, possibly returning to historical norms.

Furthermore, the valuation dispersions across different sectors present potentially attractive credit alpha opportunities for active managers in 2025. This creates a fertile ground for those looking to capitalize on the unique dynamics within the Asian high yield market.

High yield credit market: Spreads

Spreads | Spreads | Asia HY | Asia HY | US HY | US HY | EUR HY | EUR HY |

|---|---|---|---|---|---|---|---|

Spreads | Latest | Asia HY | 534 | US HY | 261 | EUR HY | 294 |

Spreads | MTD Change | Asia HY | 13 | US HY | -26 | EUR HY | -15 |

Spreads | YTD Change | Asia HY | 13 | US HY | -26 | EUR HY | -15 |

Spreads | All-time wide | Asia HY | 1517 | US HY | 1100 | EUR HY | 904 |

Spreads | All-time tight | Asia HY | 412 | US HY | 253 | EUR HY | 219 |

Spreads | Current percentile | Asia HY | 29% | US HY | 1% | EUR HY | 13% |

High yield credit market: Yields

Yields | Yields | Asia HY | Asia HY | US HY | US HY | EUR HY | EUR HY |

|---|---|---|---|---|---|---|---|

Yields | Latest | Asia HY | 10.56% | US HY | 7.20% | EUR HY | 6.02% |

Yields | MTD Change | Asia HY | 0.28% | US HY | -0.29% | EUR HY | -0.01% |

Yields | YTD Change | Asia HY | 0.28% | US HY | -0.29% | EUR HY | -0.01% |

The broader Asian credit market, with a market cap exceeding USD 1 trillion, is dominated by approximately 85% investment grade-rated bonds and about 15% high-yield rated bonds. Similar to the Asian high yield market, as the market structure diversifies, the Asian default cycle is almost over. However, despite this progress, market sentiment and valuations still lag behind.

This situation presents a unique and attractive investment opportunity in the Asian credit market, especially for investors with lower risk tolerance. Given the current market conditions, investors could consider diversifying investment portfolios and leveraging the potential this market offers.

January 2020

December 2024

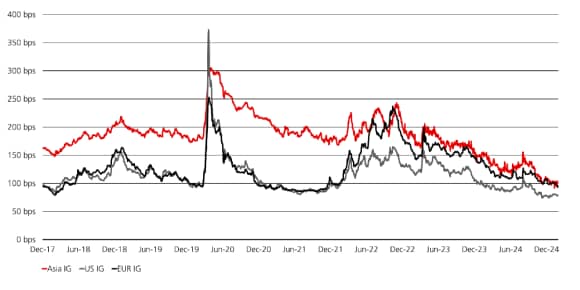

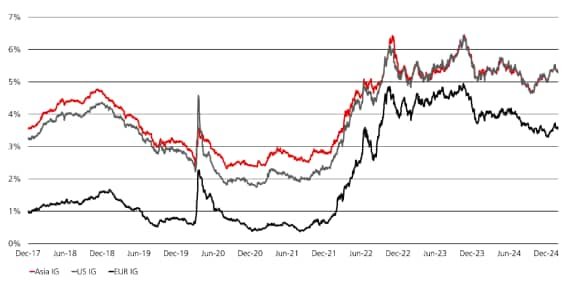

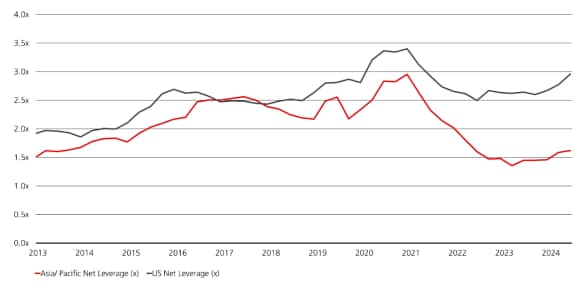

As a major segment of the Asian credit market, the Asian Investment Grade market offers an attractive spread pick-up of approximately 30 basis points. Additionally, it boasts a lower leverage ratio and a higher average credit rating compared to the US investment grade market. This combination of factors makes it an attractive investment option in our view.

Another noteworthy aspect of the Asian Investment Grade market is its average duration of 4.7 years, which is shorter than both the US and European investment grade universes. This shorter duration can be advantageous from a risk management perspective.

Taking into account both valuation and risk, we believe that the Asian Investment Grade market will continue to generate better risk-adjusted returns in 2025. It presents a unique opportunity for investors to achieve investment goals while effectively managing risk.

Investment grade credit market: Spreads

Spreads | Spreads | Asia IG | Asia IG | US IG | US IG | EUR IG | EUR IG |

|---|---|---|---|---|---|---|---|

Spreads | Latest | Asia IG | 102 | US IG | 79 | EUR IG | 91 |

Spreads | MTD Change | Asia IG | -1 | US IG | -1 | EUR IG | -10 |

Spreads | YTD Change | Asia IG | -1 | US IG | -1 | EUR IG | -10 |

Spreads | All-time wide | Asia IG | 314 | US IG | 373 | EUR IG | 253 |

Spreads | All-time tight | Asia IG | 92 | US IG | 74 | EUR IG | 79 |

Spreads | Current percentile | Asia IG | 1% | US IG | 1% | EUR IG | 9% |

Investment grade credit market: Yields

Yields | Yields | Asia IG | Asia IG | US IG | US IG | EUR IG | EUR IG |

|---|---|---|---|---|---|---|---|

Yields | Latest | Asia IG | 5.30% | US IG | 5.30% | EUR IG | 3.42% |

Yields | MTD Change | Asia IG | -0.01% | US IG | -0.03% | EUR IG | -0.06% |

Yields | YTD Change | Asia IG | -0.01% | US IG | -0.03% | EUR IG | -0.06% |

Net leverage: Asia Investment Grade (IG) vs US IG

Net leverage: Asia IG vs US IG

Average Credit Rating

(Upward migration for EM VS downward move for US credit)

The Asian Investment Grade segment, which currently encompasses over 400 different issuers, presents a significant opportunity for active managers to achieve alpha through diligent credit selection. The secondary market is notably liquid, providing ample opportunities for trading. Additionally, primary market activity remains robust, and we anticipate continued strength well into 2025.

We believe a potential trade war would have minimal impact on Asian credit. Few Greater China US dollar denominated bond issuers export to the US, limiting exposure. An analysis of the 2018-19 trade war cycle indicates that the overall impact on Chinese exports was relatively minor. This resilience can be attributed to China's competitive manufacturing capabilities and robust supply chain, which were instrumental in mitigating any potential adverse effects.

Thus, tariffs are expected to have a minimal impact on credit spreads in China. China’s external position is very strong, and credit spreads are driven by ratings based on medium-term credit and macro credit fundamentals rather than tariffs. Moreover, US tariff announcements are seemingly used as leverage and negotiation tools for more favorable terms rather than the salvo to a full-blown trade war, latter of which could have a detrimental impact on the US economy and progress on keeping inflation in check . This reinforces our positive outlook on Asian credit.

All in all, the Asia credit market is well on its recovery path this year, as the transformation of the high yield segment uplifts the broader market. Despite the still sluggish market sentiment and valuations, our outlook is positive, rooted in the market’s demonstrated resilience and growth potential. We believe Asian credit potentially offers a unique and attractive investment opportunity.