Eligibility

If you’re an existing UBS Digital Banking client with one-to-sign authority, you’ll be automatically enrolled for account transfers. Otherwise, please contact your client advisor for more information.

Yes, you can perform an account transfer on UBS Mobile Banking.

No. You can only perform an account transfer through your client advisor or via UBS Digital Banking.

Placing account transfer orders

You can transfer funds across your UBS accounts in Singapore and Hong Kong*. You can perform an immediate account transfer, a future-dated transfer or a standing order.

*Conditions apply.

- Log into Digital Banking and select “Menu”.

- Select “Account Transfers”, followed by “Account Transfers”.

- Select “Acct. transfer”.

- Choose the debit and credit accounts for your transfer.

- Input the amount and select the currency.

- Choose the execution day. Select “Same-day” for immediate transfer, “Future order” for transfer on a specific date, or “Standing order” for recurring transfer. You may add your “Reason of transfer” and “Personal note”, or request the credit/debit advice.

- On the “Check” page, select “Edit” to edit the entry or “Transfer” to proceed.

A message will pop up to confirm that your order is created and accepted.

UBS Mobile Banking

To amend your transfer order:

1. Log in to mobile banking.

2. Select “Account Transfers”, followed by “Account Transfers”.

3. Under “Pending”, select “View all”. A list of all pending orders will be shown.

4. Choose your desired transfer order and select “Edit”.

5. Update the transfer order details.

A message will pop up to confirm that your order is successfully amended.

To cancel your transfer order:

- Log in to mobile banking.

- Select “Account Transfers”, followed by “Account Transfers”.

- Under “Pending”, select “View all”. A list of all pending orders will be shown.

- Choose your desired transfer order and select “More”.

- A pop-up menu will appear. Select “Delete”.

UBS E-Banking

1. Log in to UBS E-Banking.

2. On the menu, select “Account transfers”, followed by “Account transfers overview”.

3. Select the transfer order that you wish to amend, cancel or interrupt.

4. Click the end of the row to expand the menu and view options to “Edit”, “Delete” or “Interrupt”(for standing orders only).

To amend a pending order:

5. Edit your transfer details.

6. Select “Next” to proceed.

7. A message will pop up to confirm that your amended order is successfully submitted.

To cancel a pending order:

5. On the “Account transfers overview” homepage, select the transfer order to cancel.

6. Select “Delete” to continue.

7. A pop-up will appear for your confirmation to delete order.

8. Select “Delete”.

A message will pop up to confirm that your order is successfully deleted.

Please note that transfer orders can only be amended, canceled, or interrupted when:

- The transfer status is fully approved, and

- The original transfer order is created by the same person performing the amendment or cancellation.

Once a transfer has been successfully executed, you will be alerted via SMS or email. You will also receive a push notification if you have previously enabled these on UBS Digital Banking.

This function is currently not available on UBS Digital Banking. Please contact your client advisor for assistance.

The earliest value date that can be selected is the current date.

The minimum amount for transfers is 0.01 (of the receiving currency). The maximum amount is limited to the available balance on your account including credit.

No. The account transfer will be rejected if you do not have sufficient available balance, assuming there is no credit available as well.

For transfers that are in the same currency or performed within the same booking centers (such as Hong Kong to Hong Kong or Singapore to Singapore), the account transfer is executed immediately.

For transfers that are in FX or performed across booking centers (such as Hong Kong to Singapore or vice versa), they are executed as a SWIFT payment. This means that payments made before the currency cutoff time are executed on the same day. Otherwise, the transfer will be executed on the next business day.

Please call the UBS emergency hotline as soon as possible:

Note that you may experience restricted access to your UBS accounts while investigations are ongoing. Please contact your client advisor for assistance.

Fees and charges

No, you can make account transfers with no additional fees.

If the account transfer is made across different currencies, an indicative FX rate will be displayed.

After submitting your order, the actual rate will be shown on the confirmation page:

- Go to “Asset View”.

- Select “Credit and Debit Advices”.

You can check your transfer statuses after submitting the transfer orders.

UBS Mobile Banking

1. Log in to mobile banking and select “Menu”.

2. Select “Account Transfers”, followed by “Account Transfers”.

3. Choose a status. Select “To Do” to view transfers that require an action from you, “Pending” for transfers that are scheduled to be executed, or “Executed” for successful transfers.

4. If you wish to export your transfer statement to PDF, choose the specific transfer, review it, and select “Export as PDF”.

UBS E-Banking

1. Log in to e-banking.

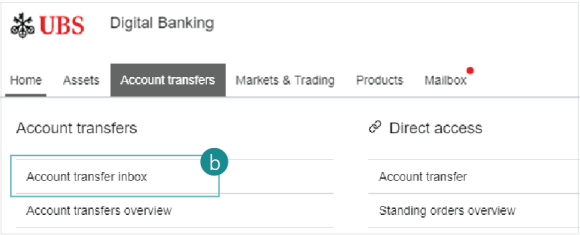

2a. On the menu, select “Account transfers”, followed by “Account transfers overview” to view all orders*.

*Except non-executed orders and orders with missing approval.

2b. To review all non-executed orders and orders with missing approval, select “Account transfers”, then select “Account transfer inbox” on the homepage.

3. A list of all transfer orders will be displayed according to their transfer status.

There are three possible scenarios that may result in a transfer being rejected:

- insufficient funds

- account is blocked (commonly due to document deficiency)

- restricted currency

For assistance, please call the UBS Digital Banking hotline.

Please call the UBS Digital Banking hotline if you need assistance.

The hotline operating hours are from 7am-8pm (Monday to Friday) and 9am-5pm (Saturday).

Alternatively, you may send an email to sh-econtactasia@ubs.com.

We’re here to help

We’re here to help

UBS Digital Banking hotline

Available from Monday - Friday: 7am - 8pm; Saturday: 9am - 5pm