General

A Lombard loan is a loan secured by assets such as cash and capital market instruments, such as equities, bonds or fund units. These assets are deposited with the lender and are taken as collateral for your loan. A Lombard loan may be used for reinvestments in products and services, such as securities, or for liquidity needs.

When used for reinvestment, a Lombard loan may create a leverage effect that may enhance the return on your investment, but this also implies a higher risk of loss. A Lombard loan can also be used for liquidity needs, for example to purchase goods or services.

Risks in a nutshell

- The leverage effect may not only result in higher chances of profits, but it also implies higher risks of loss. Unforeseeable market movements may cause a negative leverage effect.

- If the value of the collateral falls below a certain limit, UBS may ask you to repay the loan or provide additional assets as collateral.

- Insufficient funds to pay interest or repay the loan when due may lead to the sale of your securities at an inopportune point in time.

- Currency and interest rate fluctuations may also have an impact on the return of your investment.

For further information regarding risks associated with Lombard loans, please refer to your agreement for Lombard loans with UBS or contact your client advisor.

Risk-mitigating measures

- Diversification: Generally, a broadly diversified portfolio reduces the risk that the value of your collateral becomes insufficient to cover your Lombard loan. This means that investments are spread over various securities, countries, sectors, currencies and asset classes.

- Keeping a buffer: Lombard-related risks can be mitigated by not making full use of your maximum lending value and keeping a buffer in case the lending value of your assets deteriorates.

- Providing additional cash or liquid assets: By providing cash or other liquid assets as additional collateral, you can increase the overall lending value of your assets or you can use it to repay loans in full or in part. You may also consider transferring liquid assets (such as readily marketable securities) from another bank to UBS to serve as additional collateral in agreement with your client advisor.

- Portfolio rebalancing: By selling securities with a lower lending value at a high market price and investing the proceeds into securities with a higher lending value, you can increase the lending value of your assets.

- Closing trading positions: You can close open trading positions to reduce margin requirements booked against the lending value of your collateral.

Managing your Lombard loans

You cannot request a new loan in UBS Digital Banking. Please contact your client advisor for assistance.

The information related to Lombard loans in UBS Digital Banking, such as lending values, credit usage, available credit amount as well as the information displayed in the remaining lending value chart are based on previous closing prices, unless indicated otherwise. For real-time values, please reach out to your client advisor.

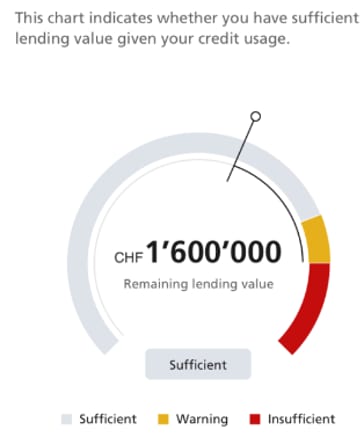

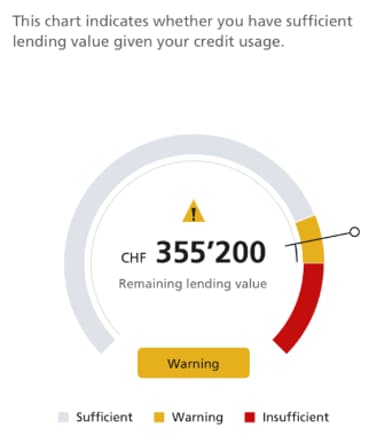

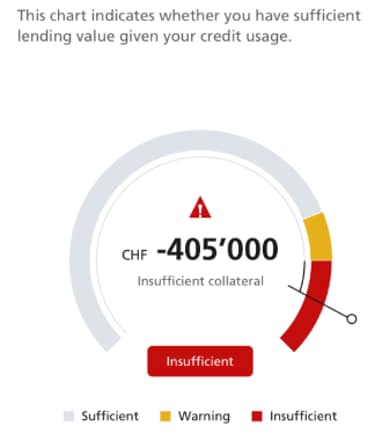

Lombard loans represent certain risks. With the remaining lending value chart, we aim to help you manage these risks by giving you an indication whether your lending value is sufficient to cover your credit usage. This is reflected by the following three statuses: "Sufficient", "Warning" and "Insufficient". The remaining lending value chart isbased on previous closing prices of the collateral. For real-time values, please reach out to your client advisor. If you are providing collateral to a third party, please be aware that this chart only reflects your own situation and takes into account the collateral you have provided to third parties. However, it does not inform you about the recipients' status and their remaining lending value.

"Sufficient"

The lending value of your collateral covers your credit usage. However, as market changes may occur suddenly, you should keep an eye on price movements of your collateral.

"Warning"

Your current credit usage is close to the lending value of your collateral. If the difference between the two decreases further, your collateral may no longer be sufficient to cover your credit usage and you will have to remediate the situation. You should closely follow market developments. Furthermore, you can improve your status by:

- providing additional collateral

- rebalancing your portfolio to increase your lending value, e.g., by selling assets with low lending values and buying others with higher lending values

- reducing credit usage

- If you require further assistance, your client advisor is happy to help.

"Insufficient"

Your collateral is no longer sufficient to cover your credit usage. You should get in touch with your client advisor and resolve the situation at the earliest opportunity. You can remediate the "Insufficient" status by:

- providing additional collateral

- rebalancing your portfolio to increase your lending value, e.g., by selling assets with low lending values and buying others with higher lending values

- reducing credit usage

- Whilst such measures are taken, further deteriorations of market prices may necessitate additional measures. It is important that your client advisor is able to reach you easily in order to discuss any requirements for further action. If UBS issues a margin call and you fail to comply, UBS may take such action as deemed fit, which includes closing out derivative trades and/or selling collateral without any further notification.

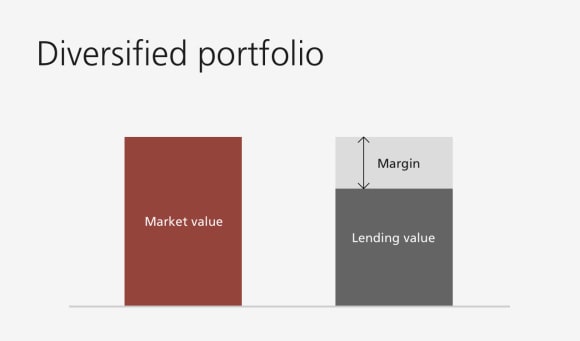

Lending value and market value

When you take out a Lombard loan, your assets serve as collateral. To determine the lending value of your collateral, UBS defines and deducts a margin from the market value of each eligible asset. The amount deducted depends on the type of assets, their market or nominal value and their risk profile. The resulting lending value normally represents the maximum amount you can potentially borrow. Your total lending value changes with the market movements as well as adjustments in your portfolio, e.g., when you buy or sell assets. The lending value will always be lower than the market value of your collateral to absorb possible value decreases (for example, due to market volatility). UBS decides which assets are acceptable as collateral and reserves the right to adjust the lending values at any time.

The market value of your assets is determined by the financial markets around the world. As securities are subject to fluctuations in value, Lombard loans are not granted on 100% of their market value. UBS therefore deducts a security margin from the market value of your assets to calculate their current lending value – indicating how much you are able to borrow. This is why the lending value is always lower than the market value of your assets. The security margin is set in UBS's sole discretion and subject to change at any time.

As the market value of your portfolio fluctuates, so does the lending value. Additionally, the lending value of your collateral may change at UBS's discretion. Therefore, we always recommend that you avoid drawing the maximum available credit amount and retain a buffer in case the value of your assets decreases.

The lending value of your assets depends on their market value and the security margin. We recommend choosing securities with high average daily trading volume and low volatility as these factors may influence the security margin. The security margin for bonds is generally lower than for equities. Within equities, blue-chip stocks have a smaller security margin than small cap stocks. This will result in a smaller security margin deducted from the market value and therefore a higher lending value.

Reserved lending value consists of amounts that are reserved to cover potential credit card usages or to serve as additional coverage for mortgages. Please note that the reserved lending value is applicable only to certain UBS locations.

Credit limit

In principle, the credit limit is the maximum amount you can potentially borrow under your credit facilities, subject to your current lending value. Despite this, if your lending value is lower than your credit limit, then your available credit is limited to the lending value instead of your credit limit. Please refer to FAQ "What is my available credit?" for more details and examples. The credit limit is granted for each client individually and is indicative and non-binding. Please note that it can be adjusted by UBS at any time.

In case you would like to adjust your credit limit, please contact your client advisor.

Your available credit is the maximum amount you can potentially borrow at a given point in time based on your (i) lending value, (ii) credit limit and (iii) credit usage. It is calculated as the difference between your credit limit and your credit usage. However, if your lending value is lower than your credit limit, then your available credit is the difference between your lending value and your credit usage. The available credit amount is indicative and non-binding and may not necessarily correspond to your risk profile.

Example 1: The credit limit is lower than the lending value

Let's assume a client has a credit limit of USD 1 million and a total lending value of USD 1.2 million. With a current credit usage of USD 600,000, the available credit amount is USD 400,000.

Example 2: The lending value is lower than the credit limit

In this case, let's assume a client has a credit limit of USD 1 million and a total lending value of USD 800,000. With a current credit usage of USD 600,000, the available credit amount is USD 200,000.

In addition to your main credit limit, you might also have product-specific limits that further cap the credit usage for certain products. For example, a cash loan limit will determine the maximum cash amount you can take out provided your lending value is sufficient.

You can request a change to all your credit limits through your client advisor. UBS will assess your request before increasing or reducing your credit limit.

Credit usage

Your credit usage is the total amount you have currently borrowed under your credit facilities with UBS. It may include cash loans, trading exposures, guarantees issued by UBS as well as other liabilities. You can see more details by clicking on "Credit usage". Please note that mortgage products are not reflected in the Lombard loan information in UBS Digital Banking.

The information about your Lombard loan positions is located under "Assets" in UBS E-Banking and UBS Mobile Banking.

Legal disclaimer:

The information in the help is intended for information purposes only and does not constitute any of the following: (i) a recommendation to request a Lombard loan or an offer or a solicitation of an offer for a Lombard loan; or (ii) a recommendation, an offer or a solicitation of an offer to buy or sell investment products or other products, irrespective of whether these products are acquired with own capital or financed with a Lombard loan.

Tax treatment depends on the personal situation of each client and may be subject to changes in the future. In all cases, clients are advised to obtain the necessary customized advice on the tax consequences of a Lombard loan from an independent advisor. Before acquiring investment products or other products with the funds provided by a Lombard loan, you should obtain relevant professional advice. Please note that UBS reserves the right to alter its services, products and prices at any time without prior notice.

Certain products and services are subject to legal restrictions and therefore cannot be offered worldwide on an unrestricted basis.

We’re here to help

We’re here to help

UBS Digital Banking hotline

Available from Monday - Friday: 7am - 8pm; Saturday: 9am - 5pm